Under current UK regulation,* DC governance bodies need to access transaction cost (and administration charges) data. This data should inform trustees’ value for money assessments, and be shared with members.

Sourcing, compiling and understanding the data can be laborious and complex. But should trustees simply resign themselves to more drudgery? AllianceBernstein’s (AB’s) David Porter suggests there is a smarter way to good governance.

The Regulations

The Financial Conduct Authority’s (FCA’s) 2018 Policy Statement and the Department for Work and Pensions’ (DWP’s) regulations are the first steps towards ensuring governance bodies get a better understanding of the underlying costs they are incurring on behalf of members. This is both an important and a substantial undertaking because, as we will see, transaction cost analysis is complex and multi-layered. That complexity creates a significant governance and cost burden – particularly if the underlying investment solution is unnecessarily complicated.

Two Example Approaches

To explain the complexities better, let’s contrast two approaches. Firstly, we examine a familiar lifestyle arrangement. Here, our example scheme uses several third-party managers, plus an administrator to oversee each members’ account and step them through the different phases of the lifestyle glide path.

For our second example, we turn to AB’s target-date fund (TDF) range. In this approach each member is invested in one fund from the AB range whose target date corresponds with their intended retirement window. This way, the member can use a single fund from a single provider, for the whole of their career lifetime. The administrator oversees the members’ accounts but isn’t responsible for the switching of the underlying funds, as they would be in lifestyle funds. Because each TDF has its own internally managed glide path, there is no need for the administrator to carry out any changes to the members’ asset mix, making it immediately more efficient to run, with fewer complicated moving parts to administer or reconcile.

OPTION 1

Doing Things the Hard Way

With the familiar lifestyle arrangement, the trustees themselves need to seek data from their administrator and all the individual third-party managers.

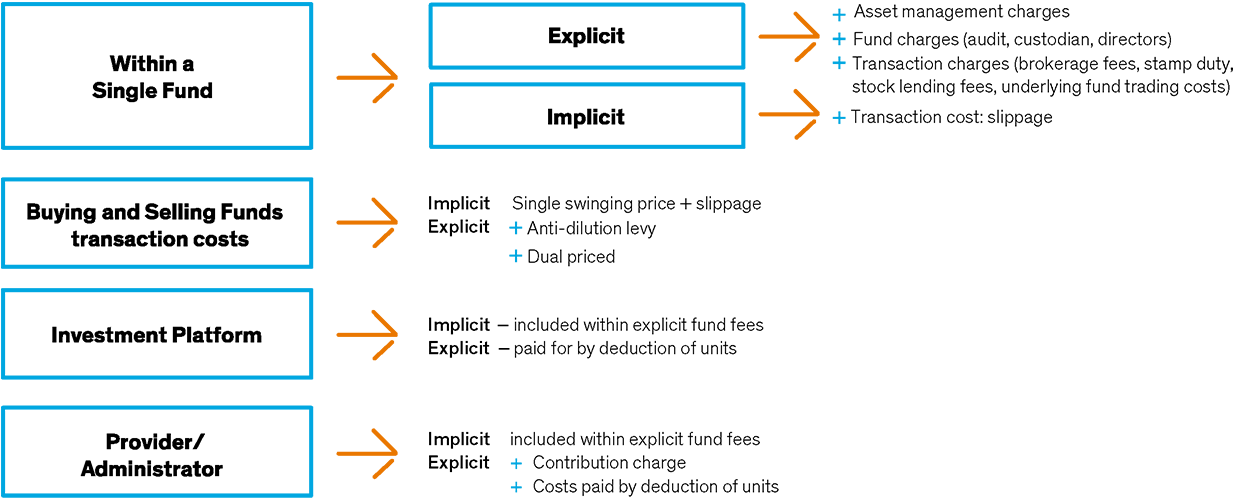

Each of the underlying managers’ funds will have its own range of explicit charges, which will include the asset management fee, fund charges (e.g. for audit, custody and directors) and transaction costs. Each manager will also account for the implicit costs of trading in each fund. The FCA has prescribed a specific approach to measuring transaction costs - the ‘slippage cost’ calculation methodology – and other regulatory and industry bodies have also provided guidance. However, this may be interpreted in different ways by the various third-party managers.

The trustees should also seek the data for costs in respect of buying and selling the managers’ pooled funds. This could be disclosed in any one of three different ways: a bid-offer spread; a single “swing” price in which the costs are apportioned to reflect the balance between buyers and sellers; and an anti-dilution levy, a single standard charge which can be triggered depending on the size of the trade.

Lastly, the trustees will need the provider/administrator charges data. Again, these will break down into different categories – implicit costs that are included in the fund fees, and explicit costs in terms of member charges or costs paid by deduction of units. Similarly, the breakdown could vary depending on the individual investment manager’s fund setup. As costs and charges data are typically based on historical averages and annualized computations, trustees will need to interpret the numbers with care and make various assumptions, based on historical comparators. At this stage, there is no universally agreed format for setting out the complete range of costs and charges. So the trustees could be faced with several data sets from the various managers, each compiled in different ways.

Because the lifestyle approach involves pre-determined asset strategy changes for each individual member’s account, the level of related member transactions could be substantial. This would generate not only corresponding fund management costs and charges, but also higher administration fees. Option 1 therefore involves high volumes of cost data that may not be directly comparable, and these are inflated by the multiple transaction and administration costs incurred by each member’s account as part of their lifestyle asset strategy. The trustees need to collate and interpret all this cost data to create an overview of their lifestyle costs in total.

Of course, if the trustees are investing via a platform and/or using blended funds, assessing transaction costs becomes even more complicated. For instance, it’s less clear which entity is responsible for aggregating the data – or even whether there is adequate data to disclose.