-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

US Banks Look Better than Fed Stress Tests Suggest

14 July 2020

4 min read

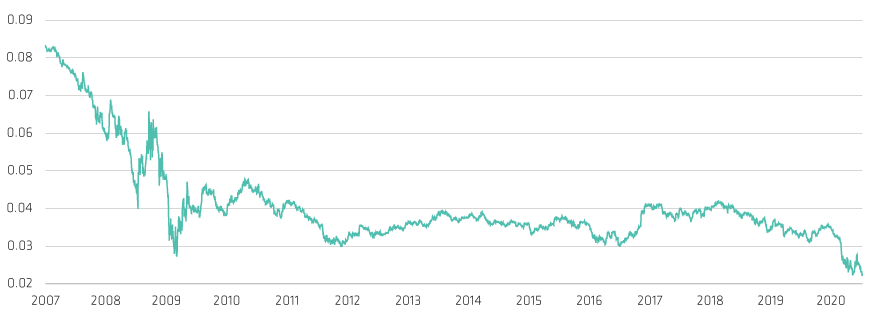

Bank Stock Prices Are at Record Lows Relative to the S&P 500

KBW Bank Index Relative to S&P 500

Past performance and current analysis do not guarantee future results.

Through June 30, 2020

Source: Bloomberg and AllianceBernstein (AB)

Bank Prices Already More than Reflect Relative Estimate Revisions

Past performance and current analysis do not guarantee future results.

As of June 30, 2020

Banks represented by KBW Bank Index

Source: Bloomberg and AllianceBernstein (AB)

About the Author