As fixed-income markets have started to recover following the massive selloff and liquidity crunch in March, credit risk-transfer securities (CRTs)―agency mortgage securities not guaranteed by Fannie Mae and Freddie Mac―have been slower to do so. Investors are wondering: Where do CRTs go from here?

To answer this question, we believe it’s important to look at the reasons for CRTs’ larger underperformance in March. Initially, the drawdown was driven by concerns about housing-market fundamentals, as investors feared that unemployment caused by the economic lockdown to slow the spread of COVID-19 would lead to a spike in mortgage delinquencies and defaults.

The selloff was exacerbated by the fact that many investors—such as mortgage REITs and hedge funds—who were attracted by CRTs’ strong underlying quality had levered their exposure. As bond prices fell and the repo markets came under pressure, these investors became subject to margin calls, forcing them to sell. This created a perfect storm for CRTs.

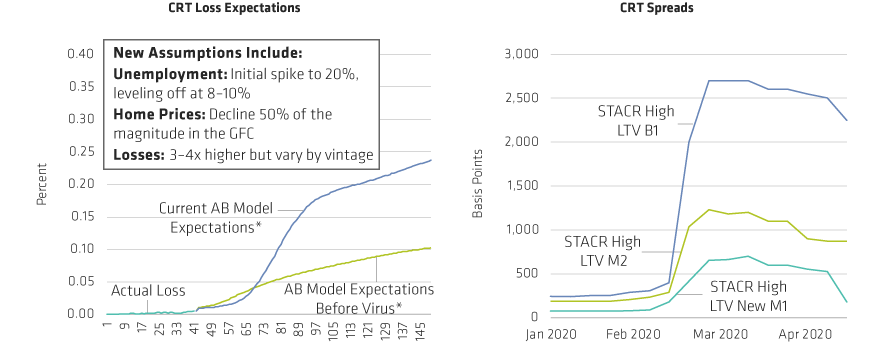

While CRT prices have started to recover, spreads are still multiple times their pre-crisis levels, more than compensating investors for increased risk associated with COVID-19. The current environment is certain to impact many of the mortgage borrowers and to increase the credit risk in the underlying mortgage pools. However, there are many reasons why we continue to favour this sector. In fact, CRTs continue to offer solid fundamentals at a time when corporate credit metrics look stretched.

Before diving deeper into the fundamental picture, it is helpful to understand how CRTs are structured.

WHAT ARE CRTs

CRTs are typically issued by government-sponsored housing agencies Fannie Mae and Freddie Mac. Like typical agency bonds, CRTs pool thousands of different mortgages into a single security, and investors receive regular payments based on the performance of the underlying loans. But there’s a key difference: CRTs carry no government guarantee. Investors could absorb losses if a large number of the loans default.

CRTs are issued in tranches. Lower-tiered bonds absorb losses first, followed by higher-rated tranches if losses are more severe (with the most senior tranches receiving prepayments first). GSEs retain a share of the risk for each security they issue—that’s why the securities are referred to as risk-sharing bonds.

The underlying mortgages are the same ones included in the agency mortgage pass-through pools, with strong-credit borrowers that conform to the GSE’s standards.

HOUSING MARKET IS ON SOLID FOOTING

One of the key fundamentals supporting our outlook for CRTs is that the underwriting standards are much higher than those that prevailed before 2008. For example, most borrowers in CRT pools have FICO scores above 750. At the peak of the housing boom, there was a much higher preponderance of borrowers in the 600‒700 bracket. FICO scores are borrower credit-risk scores that range from 300 to 850, with scores above 650 indicating a very good credit history.

Another positive effect flowing from the improved underwriting standards has been the sharp drop in risk-layering, which is the inclusion of multiple high-risk metrics―such as poor loan-to-value ratios together with low FICO scores and high debt-to-income ratios―in individual loans.

The practice was responsible for the large credit losses on many underlying loans in non-agency securities during the housing crisis. CRTs typically do not layer risk, and the decline in the practice has helped to improve the quality of the overall market of which CRTs are a part.

Finally, the housing market today is supported by very strong technicals. Compared to the state of the housing market before the 2008 crash, inventory levels today are very tight (Display), as we have not seen speculative building.