Eurozone banks are watching the clock tick down on the European Central Bank’s (ECB’s) special support operations, which will start to lose effect from June 2019. Italian banks will be impacted the most. Investors should watch out for volatility—and pick their bank investments carefully.

Since 2014, the ECB has helped struggling banks across the eurozone with a novel support mechanism—but this has a limited term. Now that its expiry is in sight, rumours are starting about a possible extension of this scheme, which comes with a handy acronym: TLTRO.

Getting to Know TLTRO

Targeted longer-term refinancing operations (TLTRO) are a tool for the ECB to provide cheap finance to eurozone banks. They are designed to help lower banks’ marginal funding costs and encourage lending to firms and households in the euro area. A first series of TLTROs was announced on 5 June 2014 and a second series (TLTRO II—into which the remaining TLTRO I was rolled over) on 10 March 2016.

The TLTROs are “long-term” as they run for periods of up to four years. They are called targeted operations because the amount that banks can borrow from the ECB is linked to their loans to non-financial corporations and households. Also, in TLTRO II, the interest rate that the banks pay to the ECB depends on their lending patterns. Banks that issue more qualifying loans benefit from more attractive interest rates on their TLTRO II borrowings. And if they lend enough to the real economy, they can even receive interest by “paying” a negative rate, which can be as low as the ECB deposit facility rate (currently at –0.4%). *

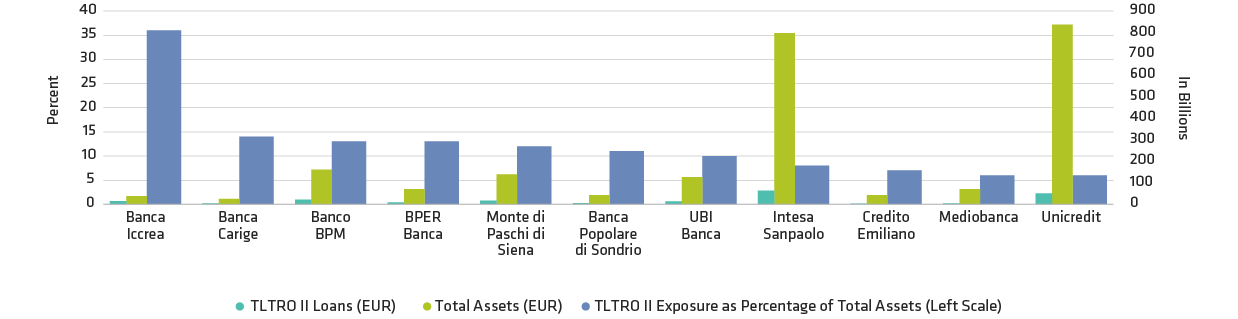

Although the TLTRO II tranches will not start to mature before June 2020, their benefit will disappear earlier. That’s because banks are not allowed to count any funding with less than one year to maturity for some regulatory measures of liquidity. As we approach June 2019, pressure will begin to build on the most exposed banks with the least ability to refinance on good terms in the open market.

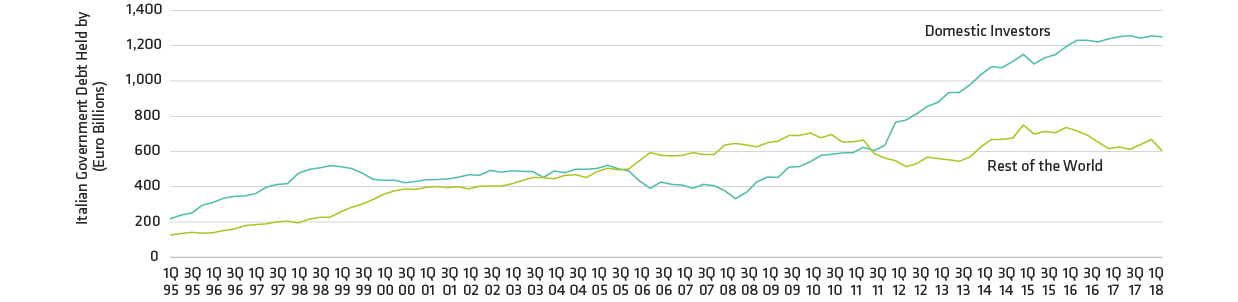

So, will the ECB launch TLTRO III? There’s already market speculation building that a new cycle is needed to provide unlimited liquidity to those banks that need it. Italian banks would benefit most, by avoiding a potential funding squeeze resulting from rising Italian Government Bond (BTP) yields.

Which Banks Need TLTRO III Most?