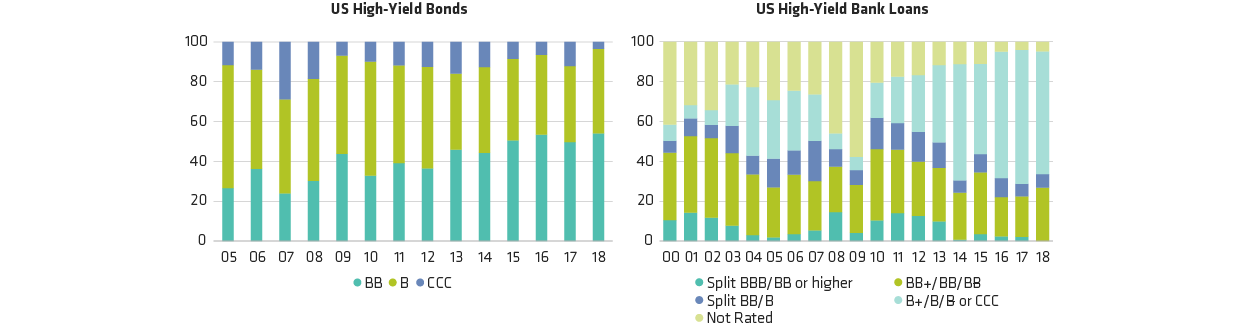

As Display 2 also illustrates, we’ve seen the opposite trend in the high-yield bank-loan market. There, M&A and LBO activity is on the rise—largely because investors who see floating-rate loans as a remedy for rising rates are buying first and asking credit questions later. This is allowing companies to borrow without offering the types of lender protections typical in the high-yield market. It also makes loans less effective against rising rates.

Warning Sign No. 3: A Wave of High-Yield Defaults

Put simply, we’re not seeing anything that resembles a surge in defaults. Default volume ticked higher in the first quarter to 2.21%, with a single issuer (iHeartCommunications) accounting for more than half of the total.

Despite worries about inflation, the Fed is still signaling that it will hike rates gradually, and the global economy remains strong. If you’re betting that growth will continue this year and inflation will stay under control, you shouldn’t expect a wave of defaults any time soon. We expect a slight year-over-year rise, but for the rate to remain below average.

Today’s low default rates suggest high-yield bonds may not be as expensive as they first appear. As of mid-May, the yield to worst for the broad market—the lowest likely return you should get barring significant defaults—was hovering around 6.3%. For the global market, it was 6.1%. Few other assets can provide that type of income potential; those that can usually come with higher risk.

Don’t Ditch; Diversify.

None of this means that there won’t be rough patches ahead for high-yield bonds and other risk assets. With central banks slowly shifting out of the quantitative-easing era, markets are likely to remain volatile.

Our advice for surviving and continuing to profit in these conditions: Use a global, multi-sector strategy that mixes high-yield bonds with other income generators, such as emerging-market bonds and US securitized assets. And be selective. No matter the sector, a set-it-and-forget-it approach isn’t the way to go. But shunning high-yield bonds—one of the highest potential income generators out there—isn’t an option either.