-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Earnings Surprises...Are You Kidding Me?

11 September 2015

4 min read

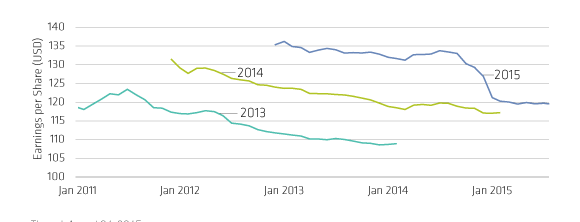

Recent Forecasts Show a Distinct Pattern

Consensus S&P 500 EPS Estimates

Through August 31, 2015

Source: Factset, S&P and AB

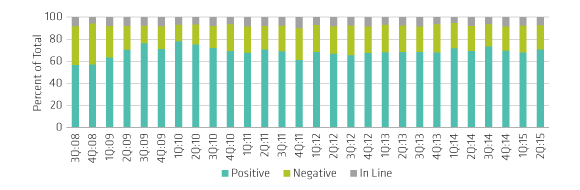

Upsdie Surprises have Become the Norm

Breakdown of S&P 500 Quarterly Earnings Surprises

Through June 30, 2015

Index constituents rebalnce every calendar year-end

Source: FactSet,S&P and AB

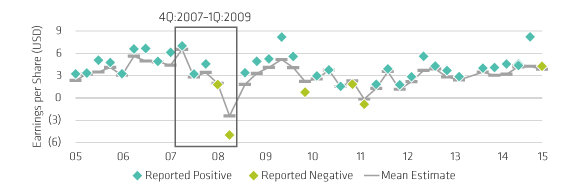

Surprises often Obscure What's Really Goind On

Goldman Sachs Consensus EPS Estimates and Surprises

Through July 16, 2015

Source: FactSet, S&P, company reports and AB

About the Authors