With US stocks facing multiple risks, it’s easy to lose sight of the positive trends that could help the market recover. In 2019, investors should search for select stocks with the right attributes to produce positive surprises in a potentially tricky market environment.

When 2018 began, investors were upbeat for good reason: GDP growth was expected to be the strongest since 2005. Corporate earnings were projected to grow by at least 20%. The president was bent on deregulation. Nobody worried about a recession. US stocks moved higher until the fourth quarter downturn dragged equity returns into negative territory for the year. It was the first time investors lost money in US stocks during a calendar year since 2008. And it was the first time in 70 years that a market rose by more than 10%, only to end the year in the red.

What Changed?

In the fourth quarter, real fears took center stage. Investors started worrying about the Federal Reserve tightening monetary policy, fallout from the escalating trade war with China, a partial government shutdown and maybe even a recession by late 2019. In 2019, US GDP growth and corporate earnings are likely to slow from robust levels in 2018. Memories of the bear market of 2008 suddenly seem vivid.

Caution is warranted and market conditions are complex. Yet we believe US equity markets could surprise skeptical investors in 2019. We’re not wearing rose-tinted glasses, but we are taking a cold look at the state of the US economy, expected corporate earnings growth, current valuations and history.

US Economy: Bright Spots amid Dangers

Let’s start with the economy. Much of the recent weakness has been caused by trade tensions. US efforts to renegotiate trade deals have caused weakness in developing countries, which Apple blamed for its historic earnings miss in early January. While there’s no guarantee that a US-China deal will be reached, there’s enough pain on both sides to suggest a deal is in the best interests of both countries. Positive resolution of the trade conflict would go a long way to firming up the growth outlook.

Beyond trade, the US economy looks resilient: Unemployment is under 4%, wages are growing at more than 3% annually and the workforce and workweek are expanding. Consumer spending advanced by 5.1% during the holiday season, according to MasterCard’s SpendingPulse. Since the US consumer drives about 70% of the economy, we think these promising trends provide important support for growth.

Earnings and Valuations

Corporate earnings are poised to slow after a spectacular 2018. US companies posted earnings growth of about 25% last year, according to S&P. Earnings growth is expected to drop significantly to below 10%. Yet with slower growth, we expect a wider dispersion of earnings, which provides fertile ground for investors to distinguish between winners and losers.

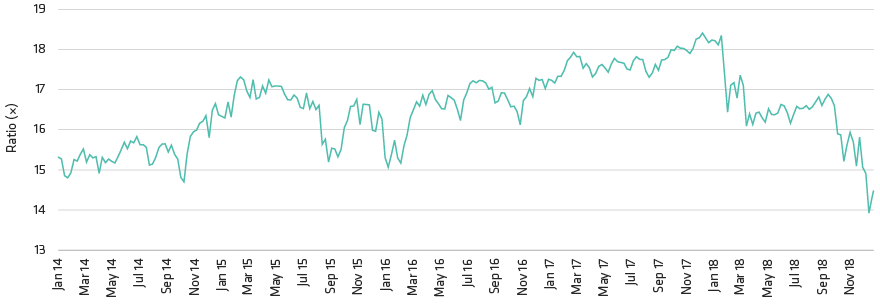

Stellar earnings growth combined with declining stock prices led to a severe contraction in the market’s price/forward earnings (P/FE) multiple. The S&P 500 traded at a relatively expensive 18 times expected earnings in early 2018 and started this year at about 14.5 times estimated 2019 earnings (Display). Stocks do look expensive based on other valuation metrics, such as price/sales and price/book value.