Finding Growth in an Uncertain Environment

How to Identify Quality Growth Companies with Stronger Fundamentals

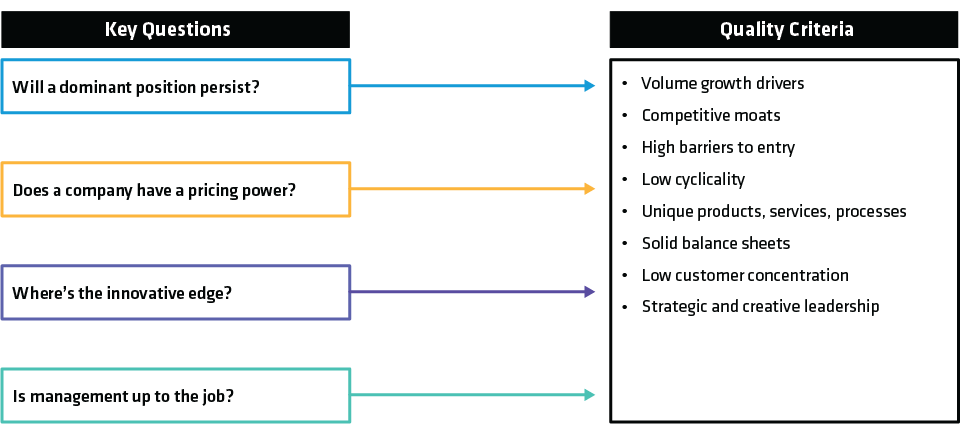

Investors searching for growth will find that a clearly defined focus on high-quality businesses capable of delivering dependable earnings and cash flows is essential to support long-term equity return potential.