-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Alternative Risk Premia

Why Diversify Beyond Style?

30 May 2019

2 min read

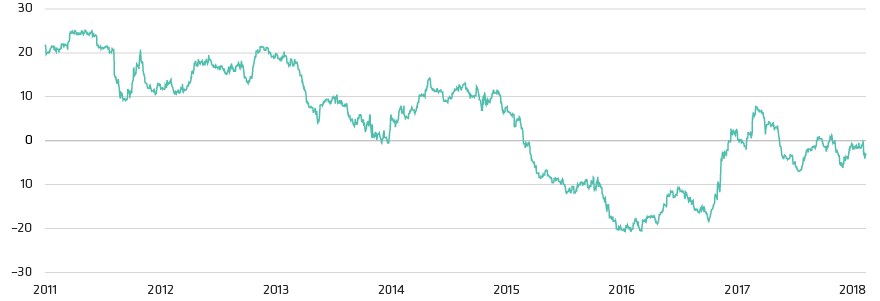

Event-Driven Has Exhibited Low Correlations with Style Premia

12-Month Roll Correlation

Historical analyses do not guarantee future results.

Through 31 December 2018

Source: AllianceBernstein (AB)

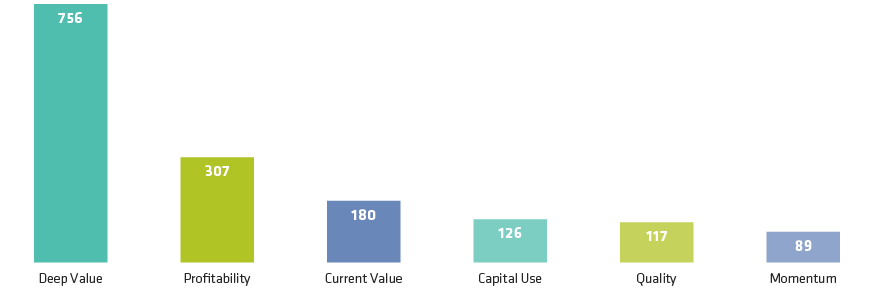

Style Premia Pay off over Extended Periods

Theme Time Horizon Exposure Half-Life (Days)

Historical analyses do not guarantee future results.

As of 31 December 2018

Source: AllianceBernstein (AB)

About the Author