Tug-of-War: Inflation vs. Fundamentals

In many ways, the downturn was widely expected. In our view, equity markets are facing a tug-of-war between enthusiasm for good underlying economic conditions and earnings, and rising interest rates, which means more volatile market conditions are likely to persist.

The US wage report on February 2 appears to have been the epicenter of the downturn. Stronger-than-expected wage data reminded investors that inflation remains a real risk and fueled a rise in bond yields that began last September and accelerated in January. Many were already worried that rapidly rising interest rates would prompt a revaluation of equities.

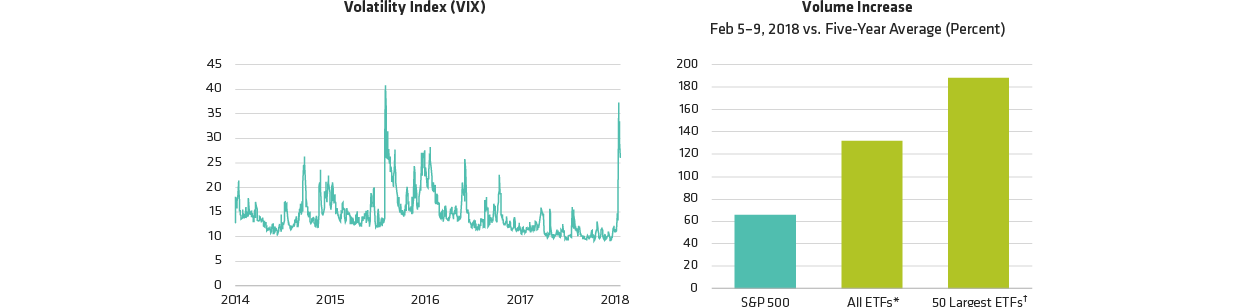

Technical forces also played a role. Rules-based investment strategies that are forced to sell stocks when volatility jumps may have amplified the losses. Nine of the 20 ETFs with the biggest volume increases were nontraditional funds that were betting on volatility to stay low or were shorting the entire market. Indeed, the sell-off has so far been largely indiscriminate, with share prices falling even for companies that have reported strong earnings.

Still, the macroeconomic environment remains resilient. Unemployment is low and global economic growth is solid. US tax reform is expected to fuel capital investments and consumer spending.

The current earnings season has started well: More than halfway through US earnings season, 74% of S&P 500 companies have beaten earnings expectations. Across the US, Europe and Japan, earnings have so far risen by around 15% on average. Earnings expectations for US companies have been revised up by 6.4% since the end of 2017, as measured by the Russell 3000 Index.

Context Matters

When markets are falling, it’s easy to lose sight of the bigger picture. Last year was an abnormally strong year for stocks. Developed markets rose in all 12 months of 2017—the only time this has happened in 48 years. Emerging-market stocks posted 11 months of gains, which occurred only once in the past 30 years. Investors remained bullish in January 2018, when all US-listed ETFs pulled in US$78 billion—their largest monthly inflows ever.

Until this week, US stocks hadn’t experienced a 10% downturn in 100 weeks, more than three times longer than the average since 1928.

Volatility has been extraordinarily low. These gains and market conditions were always unlikely to continue indefinitely.

Real Risks to Consider

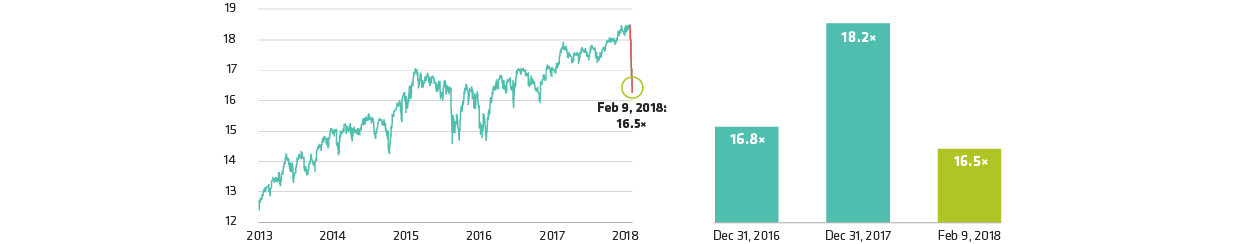

Valuations have been a persistent concern. At the start of the year, they were above historical averages, especially in the US. Now, the price/forward earnings ratio of S&P stocks has fallen to 16.5x, taking us back to 2016 levels (Display) as share prices dropped while earnings continued to rise.