High-yield bonds have had a good run. But with interest rates rising, has the market run out of road? Don’t bet on it. The sector usually motors ahead when rates rise. And when it does decline, it rebounds rapidly.

Unlike many other types of bonds, high-yield bonds aren’t particularly sensitive to rising interest rates. That’s because rates usually rise as the economy expands, which leads to higher corporate profits and increased consumer spending. That’s good news for high-yield issuers and usually leads to lower default rates.

It also helps that the US Federal Reserve is raising rates at a measured pace. During its last tightening campaign, which took two years to complete, US high yield produced annualized returns near 8%.

What explains this performance? Simply this: higher yields eventually lead to higher returns. This goes for all bonds, but it’s especially important in high-yield bonds because the average life of a high-yield bond is just four or five years. Maturities, tenders and calls mean that the typical high-yield portfolio returns roughly 20% of its value every year in cash, allowing investors to reinvest the money in newer—and higher-yielding—bonds.

The End of QE: A New Risk?

Of course, the Fed isn’t just raising rates. It’s also about to begin quantitative easing (QE) in reverse. Over the next several years, it will shrink its massive balance sheet—swelled by its post–financial crisis asset purchases—by more than a trillion dollars. This, along with its rate hikes, will tighten conditions further. And the Fed probably won’t be alone. The European Central Bank may begin tapering its own monthly bond purchases this year and could end them in 2018.

We expect balance-sheet reduction to proceed gradually, and we don’t think it will be disruptive. But this is uncharted territory, and investors are understandably concerned about what it will mean for markets and economic growth. It’s certainly possible that high-yield bonds and other risk assets could hit a rough patch.

High Yield: The Comeback Kid

Thankfully, high-yield sell-offs tend to be short-lived. Those who stay invested tend to recoup their losses quickly. Over the past two decades, high yield has recovered most big drawdowns—losses of more than 5%—in less than a year.

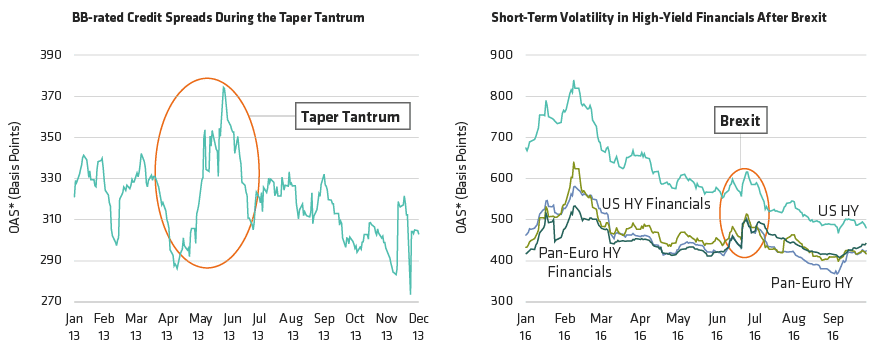

If you’re not a trader with a short time horizon, a brief downturn shouldn’t be a big concern. In fact, it might be an opportunity to acquire assets at attractive prices. During the 2013 taper tantrum, prices on BB-rated bonds fell, and credit spreads—the extra yield offered over comparable government debt—widened. By year-end, they’d more than recouped their losses. Last year, Brexit presented a similar opportunity in high-yield financials (Display).