Defining Three Distinct Investor Personas

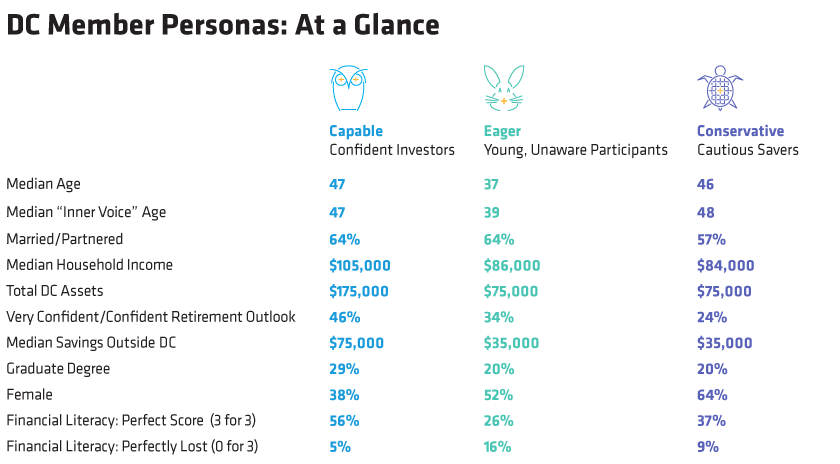

The three groups—of roughly equal proportions based on years of US surveys—have specific characteristics beyond demographics. Each persona reflects an investment style, learning preference, engagement level, risk profile and other qualities:

- Capable – Confident, knowledgeable investors who score highly on our financial literacy test and have higher plan account balances

- Eager – Younger members with greater enthusiasm and confidence but lower literacy scores, and—probably because they skew younger—lower account balances

- Conservative – Cautious, diligent savers with lower confidence and investing acumen, yet they may know (or need) more than they realise.

Stronger Engagement Requires Targeted Outreach

Broad-reaching plan communications are a good start, especially if the messaging is straightforward, uses storytelling visuals and always includes a call to action. But the path to better retirement planning engagement, and outcomes, also requires hands-on messaging.

To engage more deeply with plan members, connections need high-touch relevance, which is harder to achieve with a wider net. We believe that grouping members by these distinct investor personas can help plan sponsors discover better ways to connect with members—communicating and engaging with them on their own terms to foster better long-term results. The idea is to understand members first to provide more of what they find useful.

Generating retirement confidence and investment knowledge, for example, has been an ongoing challenge for sponsors. The pandemic exacerbated the problem in recent years, but the trend began well beforehand, and could explain why a growing number of members may one day regret not saving more.

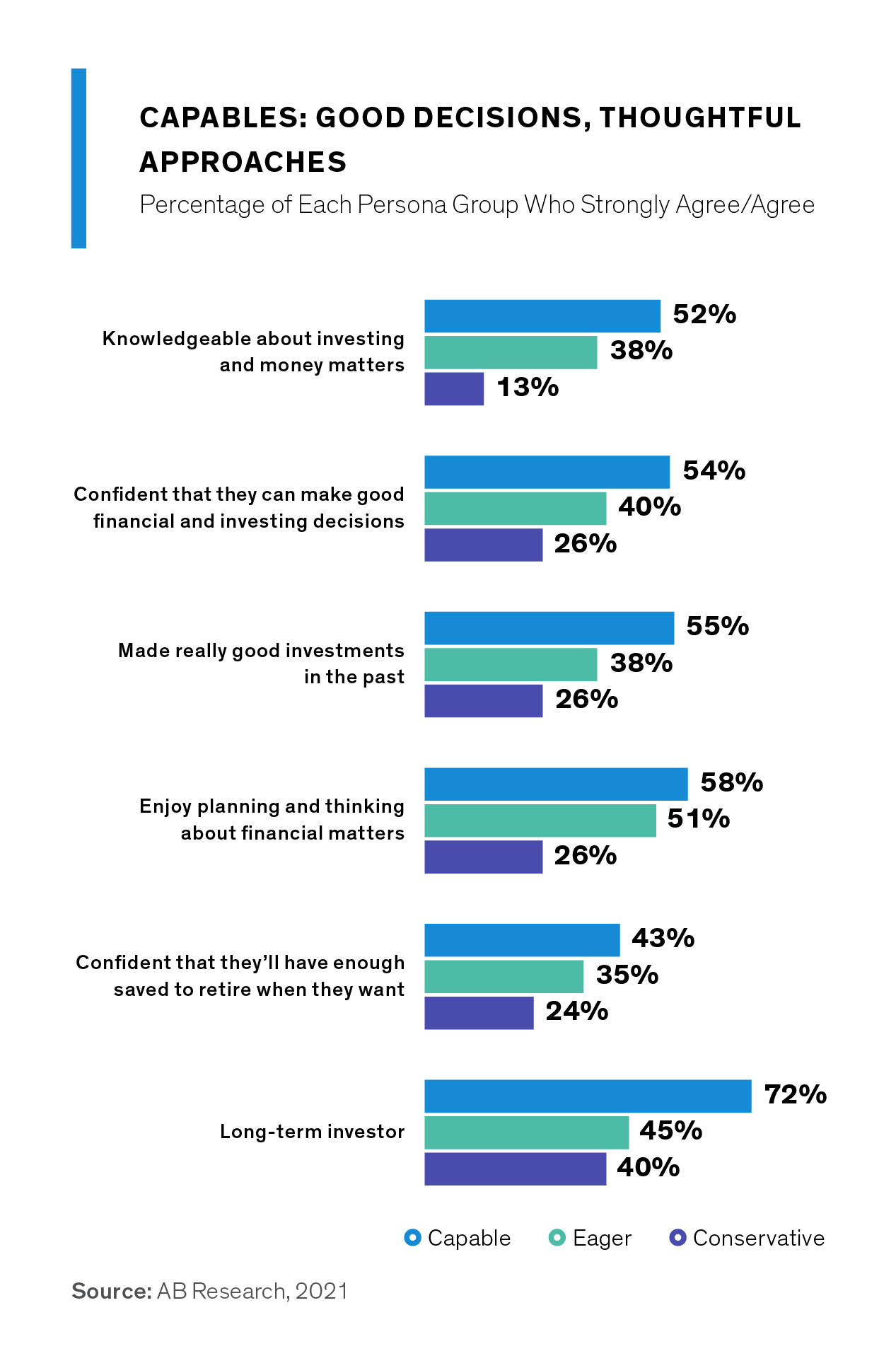

Even Capable Members Need Help

Compared with other personas, Capable members are long-term investors, financial planning enthusiasts and confident decision makers (Display). These members can be quite self-reliant, but they can still use plan sponsor help.

In the context of the UK, Capables are the type of members that may be invested in the self-select investment options, or at least the members for whom the self-select options may be of most interest. As well as making available a well-governed, suitable array of self-select investment options covering the full spectrum of asset classes and approaches, it is also important to provide clear documentation and communication of these options to empower Capable members.

Trustees and plan sponsors should also provide appropriate communications about the potential benefits and risks of the self-select fund range, and about the investment strategies these members could assign themselves. For example, many Capables may be too aggressively postured in their investment mix and need timely reminders of the potential downside to taking too much risk. Thought-provoking content about the risks and rewards of different investment types or perspectives on trending topics, like market volatility challenges or the long-term effects of inflation, can be helpful too.