The one-two punch of public health disaster and macroeconomic shock has dealt many nonprofits a staggering blow. With revenues plummeting and fundraising events shelved, some are even facing an existential crisis. Can they raise sufficient funds to sustain their missions—which are arguably more vital than ever before?

Fortunately, many charitably inclined donors stand ready to extend a lifeline. But while they are eager to help, some wrestle with where to begin. Whether you’re determined to provide at-risk children with nutritious meals—or healthcare workers with personal protective equipment—here’s a quick guide to filling today’s most urgent needs.

Accelerating Philanthropic Aid

Most charities run very lean organizations. This means they tend to be staff-light, often counting on volunteers to drive fundraising and other operational tasks. But as volunteers shelter at home and formal fundraising events dry up, nonprofits stand at a severe disadvantage. Here are three ways to provide immediate support:

1) Lean into the Need: Continue to give to the charities and causes that are close to your heart. Many of them offer online grant access, but if they don’t, consider reaching out for the best way to send a gift. If you want to fund organizations on the front lines, you’ll find a list of national resources at Charity Navigator, FEMA, and the Center for Disaster Philanthropy. Alternatively, you can donate directly to organizations like the CDC Foundation. Many community foundations are in touch with local nonprofits and social services who need resources. The Council of Foundations compiled a list of community foundations that are supporting regional responses.

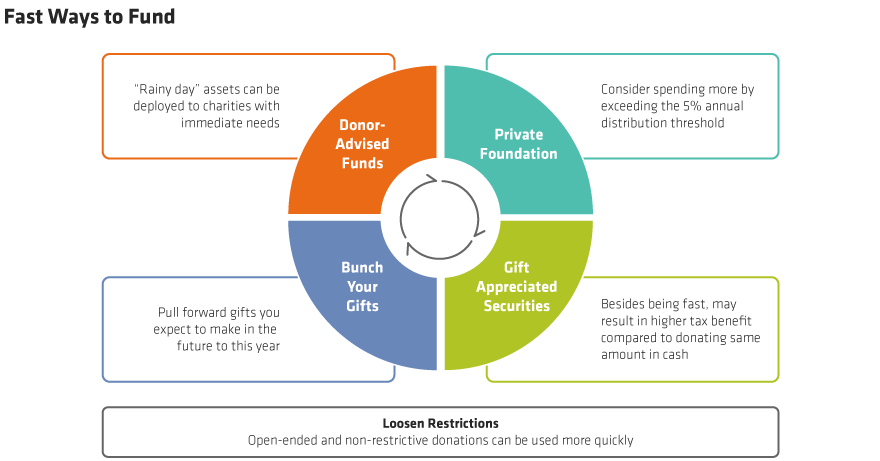

2) Figure Out Funding: Once you determine where to give, it’s time to structure your gift. With time of the essence, consider the following:

- Dip into Your Donor-Advised Fund (DAF)—Among the many benefits of DAFs is the ability to house assets for future grantmaking. Think of it as a type of “rainy-day fund.” During times of stress, DAFs can quickly fund organizations with immediate needs.

- Increase Private Foundation Spending—While foundations are required to distribute a minimum of 5% annually, they can spend more. Some are increasing disbursements for a point in time (such as during this crisis), while others are revisiting their spending policy altogether. Those with a goal of perpetuity should consult an advisor regarding the impact of shifting time horizons. You may be surprised to learn that upping your spending and shortening your time horizon can yield greater impact overall. And don’t forget to revisit the foundation’s investment policy statement for guidance and to make any necessary changes.

- Bunch Your Gifts—Donors can pull forward assets they expect to gift in the future into this year. This strategy, called bunching, also enables you to receive a tax benefit by pushing itemized deductions above the higher standard deduction.

- Gift Highly Appreciated Assets—despite the recent market sell-off, many portfolios still contain highly appreciated securities, which confer a larger tax benefit compared to donating the same amount in cash. With many stocks now at depressed levels, individuals can repurchase the same holdings at attractive prices where appropriate.

3) Loosen Restrictions: While seemingly minor, this final step could be the linchpin in making a difference. Many donors add stipulations to their gifts, requesting that they’re used for a specific purpose, with certain recipients, or doled out in a unique way. It’s understandable that donors want to direct how their gifts are used. But such restrictions often increase the amount of time, effort, and often expertise required to process the gift, which holds up the use of the bequest. Nonprofits need resources now—open-ended and nonrestrictive donations go a long way in providing immediate relief.

Ready, Set, Give

Governments are stretched and won’t be able to meet the growing needs of all Americans. But private giving has historically filled the void—and we believe this time will be no different. Because in the heat of crisis, America’s spirit tends to shine brightest.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.