For the last few years, the sovereign debt crisis in Europe has caused equity investors to flee the continent. Today, that exodus has set up an attractive opportunity for value investors.

By the end of September, European stocks were trading at a 16% discount to global equities based on price/book value, well below their average of the last 24 years. On price/forward earnings, the euro area discount is about 13%—not as provocative but still worthy of attention.

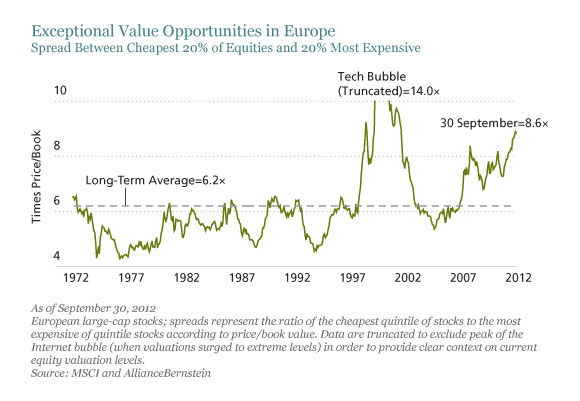

For value investors, the opportunity looks especially compelling. Spreads between the cheapest and most expensive euro-area stocks are wider than at any time in the last four decades except the tech bubble in 2000. The chart below shows the gap between the cheapest 20% and most expensive 20% of the stocks in the MSCI Europe index. In the past, when valuations have moved back towards their long-run average levels and this spread has narrowed, attractively valued stocks have outperformed strongly. Wide valuation spreads can be found in almost every sector, which means you don’t have to concentrate holdings in specific areas (such as cyclically sensitive stocks) in order to position a portfolio for a value recovery.

What’s more, the quality of attractively valued stocks in Europe might surprise you. While we remain wary of troubled companies in so-called peripheral countries, when you exclude Greece, Italy, Spain and Portugal, our research shows that the cheapest quintile (20%) of non-financial stocks has a net debt to equity ratio of 70%. That’s 32% lower than its 30-year average. For these stocks, free cash flow is also surprisingly strong, ranking in the top quintile of the last three decades.

Equity investors in Europe have long been waiting for something to spark a sustainable stock-market recovery. Today I think it’s easier to see the catalysts for a potential rebound. The threat of a sovereign debt default has been alleviated by recent European Central Bank moves, along with the progress (albeit slow) made at various European Union summits in recent months. And with more than €1 trillion deployed to support bank liquidity, the euro-area banking system is also looking much more secure.

Of course, structural reform is the trickiest part. But given that we’ve seen significant progress on the first two components of reviving confidence, I think that further progress on structural reform in the periphery may be catalysts for a recovery in equities. Against this backdrop, I think the time is right to hunt for attractively valued opportunities with strong underlying fundamentals.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.