Pundits across the political spectrum say the health of the US economy and stock market hangs in the balance of this year’s presidential election. We found that when it comes to driving the stock market, politics actually takes a back seat.

At one extreme, investors on the right assert that four more years of the current administration will lead to a double-dip recession and a stock market crash. Investors on the left warn that proposals from the right are a rehash of the policies that led to the worst recession since the Great Depression.

But when you push aside the rhetoric, what are the actual facts?

It is certainly true that specific legislation matters for investors, especially for bottom-up portfolio managers. For example, the US ethanol policy, and the related 50 million acres of corn planted each year, could mean that a reduction in subsidies would meaningfully lower grain prices, potentially affecting agricultural companies. More directly, defense appropriations impact aircraft manufacturers.

But does party leadership drive stock-market returns? And—for the nervous investor pondering crucial asset-allocation decisions—should political affiliation lead your expectations for investment returns?

To answer this question, we looked at the empirical relationships between the party in the White House and the stock market, as well as the economy, over decades. We also examined tax rates and the stock market. While pundits can always find anecdotal episodes to support either side of the aisle, our research delivered an answer that’s completely nonpartisan.

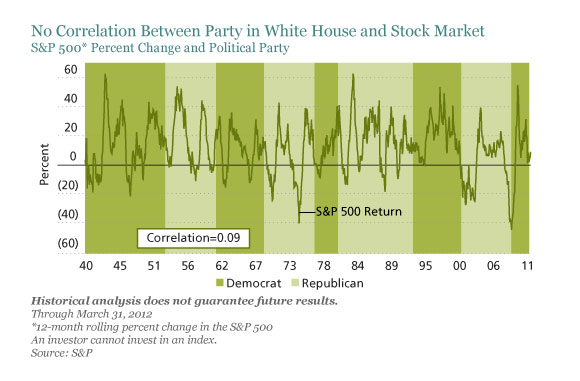

First, we asked if the party in the White House is related to either stock-market performance or economic growth. The evidence is surprising but clear: the stock market has risen and declined under both parties from 1939 to 2011, as the first display, below, shows. The correlation between political party and the S&P 500 is insignificant at +0.09. Similarly, the correlation between GDP growth and the White House is 0.25, a weak statistical relationship at best.

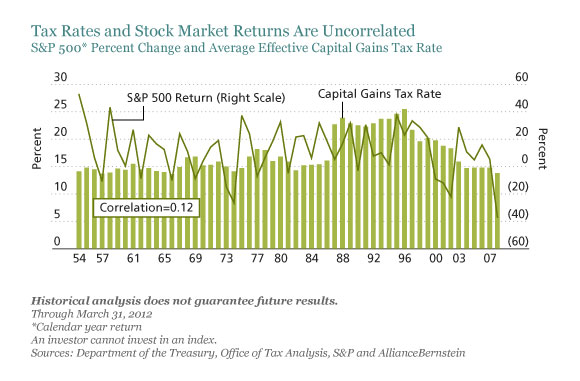

Then we examined the relationship between long-term capital gains tax rates and stock market returns, using the average effective capital gains tax rate and the annual performance of the S&P 500 Index from 1954 to 2008. Simply put, there is no visible relationship between the two series, as the second display, below, shows. The statistical correlation of 0.12 is not significant.

For example, the 1986 tax legislation increased effective capital gains tax rates from 16% to 22%. As a result, that year, capital gains as a percentage of GDP rose from 4.1% to 7.4%, but the following year the proportion fell to 3.1%—in line with the long-run average of 3.2%. We also examined the relationship between top marginal tax rates and the stock market from 1939 to 2011; the correlation was even weaker, at 0.06.

So, for investors broadly, it’s hard to identify any long-term linkage between political parties and the markets or tax legislation. That doesn’t mean policy is irrelevant: we do believe Washington matters for investors when there is a clear relationship between specific legislation and company earnings. But, as growth investors determined to identify differentiated companies with strong, lasting competitive advantages, we don’t think that election fever—and the prospects of victory for either candidate—should drive our stock selection.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.