It seems that rumors of the death of long-term equity investing have been greatly exaggerated.

That the rumors exist is hardly surprising. There are still significant risks facing the market, the 2000s were an underwhelming decade, and investors still feel the pain of the 2008–2009 selloff and the effects of the volatility that followed it. Stocks have made plenty of headway since that low point, though, and based on our assessment the prospects seem bright.

But if there are better times ahead for stocks, how many investors will be around to see them?

Individual and institutional investors have been cutting exposure to equities and other risk assets for years. This de-risking took place as stock valuations were declining. For example, the price-to-earnings ratio of the S&P 500 Index at the beginning of the 2000s was about 30; now, it’s 15. There were many reasons for the equity downsizing, but the bottom line is that investors were shedding stocks as stocks were actually getting cheaper.

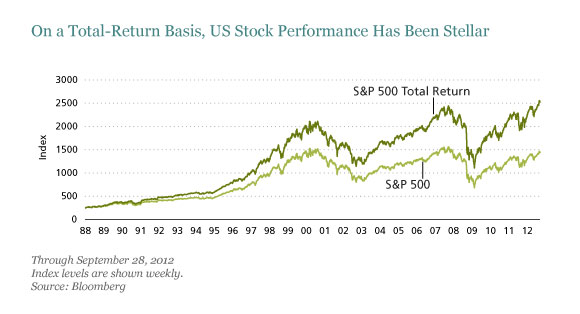

These investors haven’t taken part in the post-crisis rebound—as long-term buy-and-hold investors have. Including 2012, US equity markets have risen for four straight years. As seen in the display below, the S&P 500 Index even reached an all-time high in August 2012. It wasn’t the better-known S&P 500 price index that set the mark, but the total-return version that includes dividend payments and their reinvestment. In other words, a benchmark that’s more relevant to long-term investing reached an all-time high. There didn’t seem to be much mention of this in the financial media, which remained preoccupied with macro and political concerns.

Despite the lack of attention, it seems hard to fathom that buy and hold is dead.

These days, the idea that stocks represent ownership in real companies might seem quaint to investors looking for a path to near-term gains. Over the years, holding periods for individual stocks have shortened dramatically. One reason for this short-term perspective might be the arm’s-length relationship of investing in stocks through broader, diversified strategies. With potentially hundreds of companies in a portfolio, it can be easier to look at individual stocks as mere ticker symbols.

It may be time for this mind-set to change. We feel strongly that professional investors should focus much more closely on analyzing companies as going concerns and much less on forecasting macro trends that might make stocks generally rise or fall. If investors do their homework and pay reasonable prices for solid businesses, we believe that a buy-and-hold strategy can be very effective.

And it might be necessary. Institutions that have pulled back from equity exposure could find it hard to meet their spending obligations without turning back to stocks. We think the attractiveness of the US equity market merits their attention. S&P 500 companies are earning more than ever, and paying record dividends that are growing faster than earnings. On top of this, American blue-chip companies seem in very strong shape financially, with historically high cash levels and borrowing rates near all-time lows.

In our opinion, it’s only a matter of time before the investment professionals who allocate institutional money reevaluate historically low equity exposure and hurdle rates, and rediscover equities to some extent. We hope individual investors will be ahead of that trend, or at least not far behind it—investing with active managers who buy stocks based on the business fundamentals they represent.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.