Warnings about the fiscal cliff have saturated the US public debate. But consumers are still spending, even though they face huge potential tax hikes, while companies are being very cautious—even though they have relatively little to lose.

These trends provide some guidance on how the US economy may benefit if an agreement is reached—or how it may suffer if the economy goes over the cliff.

Fiscal uncertainty is not a new feature on the US economic landscape. In 1986, as the debate over President Reagan’s proposed tax reform dragged on for nine months, corporate spending declined. After the tax reform legislation was enacted in October 1986, business capital spending rebounded.

President Clinton faced a similar situation in 1993. Just after he was elected, Clinton proposed major deficit reduction legislation instead of an expected tax cut for the middle class. Talk of broad tax hikes led individuals and companies to defer investment and spending, and economic growth slowed.

The current debate has also added confusion and uncertainty. But the situation today is different because the behavioral response of consumers and companies isn’t aligned with the risks they face.

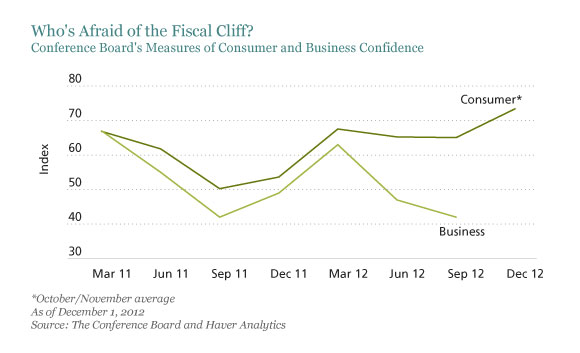

For example, individuals face the biggest risk because, without an agreement, a $536 billion tax hike will kick in from January, adding 5% to the average household tax bill. Yet consumer confidence remains buoyant, according to November surveys (Display). New vehicle sales soared to 15.5 million units in November—the highest rate since 2008. Sales were firm even if we exclude a boost related to replacements of cars that were damaged or destroyed by Hurricane Sandy.

While consumer spending in other areas is less robust, the willingness to purchase big-ticket items like cars shows that consumers are not yet spooked by the fiscal cliff. We think US consumers are focusing more on modest improvements in labor and housing markets. They may also have been reassured by President Obama’s pledge to avoid raising taxes on middle income taxpayers.

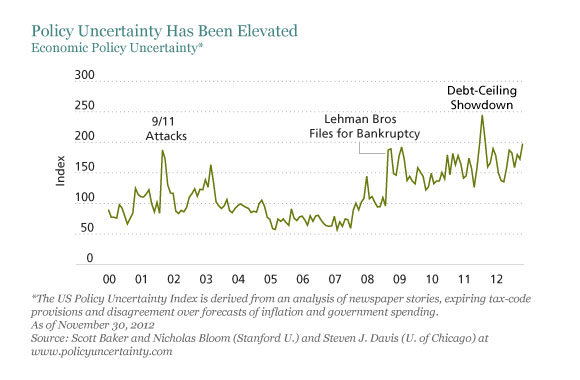

Meanwhile, business confidence has plunged, even though corporate tax rates won’t change at year-end. Companies seem to be rethinking spending and investment plans. Many have adopted active risk-management strategies since the financial crisis to guard against adverse outcomes, especially those that are hard to predict. According to a new US Economic Policy Uncertainty Index, created by Professors Scott Baker and Nicholas Bloom of Stanford University and Professor Steven Davis of the University of Chicago, policy uncertainty is slightly higher than it was during the Lehman Brothers crisis (Display).

We still think that the fiscal cliff is likely to be avoided. But companies are clearly afraid of it anyway and it will take some time for managements to regain confidence. Yet this also means that a fiscal deal may prompt a revival of corporate spending and investment, which could produce a positive surprise in US economic growth next year. Conversely, if policymakers fail to avoid the fiscal cliff, rising taxes would force consumers to tighten their belts, which could undermine the economic growth outlook.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.