Investors in Australia have piled into defensive stocks since 2010, amid a global flight to safety. As a result, many cyclical companies are now unusually cheap, despite strong balance sheets and cash flows, and this has created a compelling opportunity.

Fear and greed are commonly cited as motives for human behaviour, particularly when they lead to extreme movements in financial markets. Few would disagree that investor behaviour since 2010 has been characterized largely by fear, and that the effects of this powerful and (during this period) unusually sustained emotion remain deeply ingrained in markets, despite the rally in global equities during 2012. In our view, this fear has helped to create a once-in-a-generation value opportunity in the Australian equities market.

A feature common to both greed and fear episodes is that they result in crowded trades—that is, a largely one-way traffic of investment flows that reflects the consensus thinking about which stocks or types of stocks are the most or least attractive to own at the time. During the greed-driven tech boom of the early 2000s, for example, the crowded trade was in Internet and other tech-related stocks. Many of these were start-ups with little or no business track record, low cash flows and weak balance sheets. In hindsight, the winning investment strategy during this period would have been to buy traditional businesses with strong cash flows.

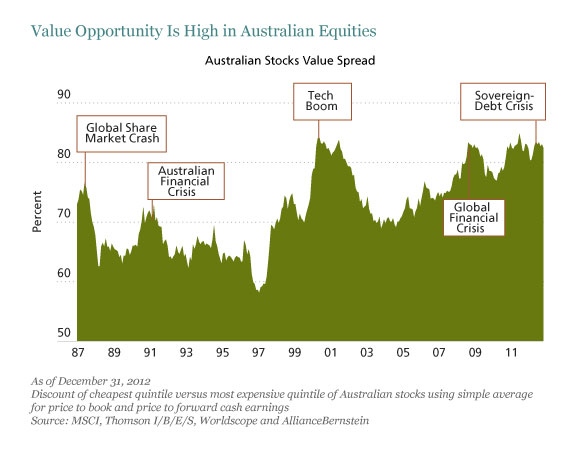

In Australia, the crowded equities trade since 2010, driven by fear of the global economic outlook and the sovereign debt crisis in Europe, has been in defensive stocks such as consumer staples, healthcare and property. As investors drove up valuations of these stocks, a lot of Australian cyclical companies—many of which have very strong balance sheets and cash flows—have become unusually cheap. Consequently, the value opportunity in Australian equities, expressed as the “value spread” or discount of the cheapest 20% of stocks to the most expensive 20% of stocks, is close to record highs (Display).

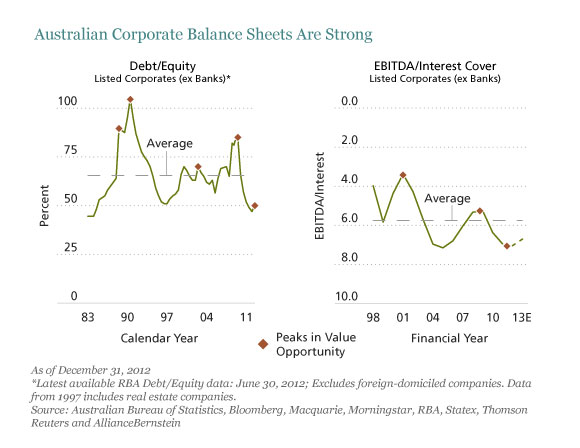

There’s something different about this value opportunity. Today, many Australian cyclical stocks boast strong balance-sheets and, in our view, they’re trading well below fair value. Listed corporates’ debt-to-equity ratios and earnings before interest, tax, depreciation and amortization to interest cover, are extremely robust (Display). These key measures of balance sheet strength are much stronger than during the value opportunities created by the global financial crisis in 2008/2009 (when most cheap companies had weak balance sheets), the tech boom and the Australian financial crisis of 1991.

In other words, we think this is the first time in 25 years, or in a generation, that such cheap stocks with such strong balance sheets have been available to investors in Australia. One reason this opportunity is so unusual is that, historically, the value spread between cheap and expensive stocks has typically been driven by relative balance-sheet strength. The difference now is that the spread is being driven by whether a stock is exposed to the business cycle or not, which has created a valuation fault line between defensive and cyclical stocks.

What are the risks in Australian cyclicals? This is a good question, given the relative weakness of the non-mining sectors of the Australian economy. Key cyclical sectors such as housing and retail, however, are already close to cyclical lows. While they may have further to fall, we believe that any downside risks will be limited by a recovery of demand in these sectors as economic fundamentals reassert themselves. In our view, this provides contrarian-thinking, value-driven investors with an attractive return as the crowded trade in defensive stocks begins to unwind.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.