The situation in Cyprus is still very fluid and very serious—perhaps more so than in Greece last year. While the country may be too small to have a meaningful direct impact on the rest of the euro area, the big issue for markets is the potential for contagion to more systemically important countries.

Cyprus is a small economy, with nominal GDP last year of just €18 billion (US$23 billion) or 0.2% of the euro-area total. So while Cyprus’s bailout may seem small in euro terms, it is huge relative to the size of its economy.

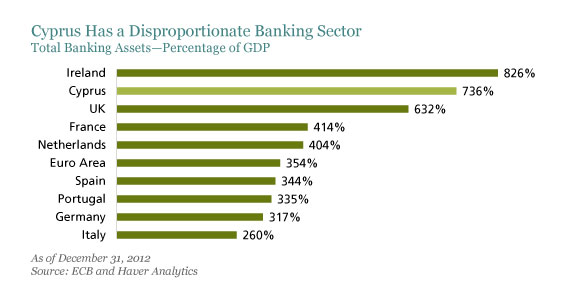

The epicenter of the problem is the country’s outsized banking sector. Total banking assets currently stand at 736% of GDP. To make matters worse, the IMF estimated in 2011 that Cypriot banks’ exposure to Greece (government bonds and loans to Greek residents) was €29 billion, or 160% of GDP.

The offshore banking business is a source of considerable controversy. In Germany—and this is crucial to understanding the German government’s hard line—Cyprus seems to be widely regarded as a haven for Russian money laundering. However, Cyprus is also an important conduit for legitimate Russian business owing to its favorable tax regime. The offshore banking business is therefore vital to Cyprus’s prosperity.

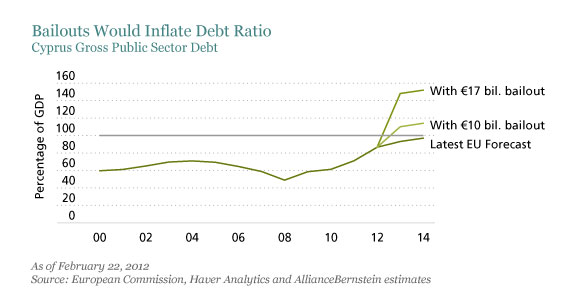

Meanwhile, Cyprus’s public finances don’t look too bad. Latest estimates show that it had a budget deficit equal to 5.5% of GDP last year, slightly higher than the euro-area average of 3.2%. Government debt, at 87% of GDP, is actually below the regional average of 93%.

The problem is that Cyprus’s banks took enormous losses on their exposure to Greece and now need to be recapitalized at an estimated cost of €10 billion, or 55% of GDP. Adding this to the sovereign balance sheet would quickly push the debt-to-GDP ratio above 150% of GDP, similar to the debt trajectory in the original Greek program which is now considered unsustainable. This is why the EU/IMF is unwilling to lend Cyprus the full €17 billion of funds required to recapitalize the banks and finance the government for the next four years.

Instead, the EU/IMF has offered to lend Cyprus €10 billion. With few other options, this means the net cost of the bank recapitalization has to be reduced to €3 billion. And this is where the levy on €68 billion of customer deposits comes in.

The furor about the deposit tax has obscured the fact that Cyprus will be required to tighten fiscal policy aggressively as part of the bailout conditions. According to press reports, the tightening will amount to 4.5% of GDP. This, it is hoped, will help Cyprus reduce its debt-to-GDP ratio to 100% in 2020.

We have major doubts about the program’s viability. First, our own analysis shows that tightening fiscal policy in a country like Cyprus, which has no exchange-rate flexibility and where domestic credit conditions are very tight, is likely to be very destructive. Second, even if the levy on insured depositors is dropped, a huge amount of damage has already been done and a very large deposit outflow looks inevitable when the banks eventually reopen. This would put another hole in the banks’ balance sheets, lead to a further contraction in credit availability and exacerbate the economic downturn.

Right now, only a few things are clear. First, Cyprus almost certainly faces a huge recession or depression. Second, it is very difficult to identify a solution that would be acceptable to all parties. Third, although Cyprus is too small to undermine the rest of the region—even if it leaves the euro—fears of contagion are big enough to send shockwaves across Europe.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.