The US manufacturing sector has repeatedly figured out how to reinvent itself when faced with competitive threats. In recent years, American companies have become much leaner, regaining an edge in global markets that should lead to a bigger role in economic growth.

Since the recovery began in mid-2009, US manufacturing production has increased by 5.5%, nearly 2.5 times the overall gain in gross domestic product (GDP). It was the strongest manufacturing performance since the 1990s, while the three percentage point spread over real GDP growth was the largest in over three decades.

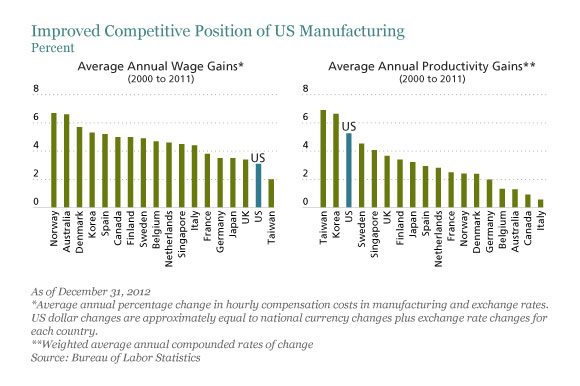

This achievement was reached by controlling costs and improving productivity. For example, wage costs (hourly compensation) have risen on average by 3.1% per year since 2000, according to the Bureau of Labor Statistics (BLS). That’s much slower rate than the average of 5.0% for 17 other large countries (Display). US manufacturers have also curbed wage growth much more effectively than the rest of the domestic private sector.

The international comparison isn’t perfectly clean. For non-US companies, the data include wage changes as well as the added increase to a country’s wage bill from currency fluctuations relative to the US dollar. Yet, even if we exclude the exchange rate effect, non-US wages in these countries rose by 3.4% per year—still marginally higher than the US rate.

Productivity has also been impressive. According to the BLS, the US manufacturing sector has averaged annual productivity gains of 5.2% since 2000. That’s near the top of the global rankings, with only Taiwan and Korea ahead of the US. Wage restraint and productivity improvements have combined to reduce US unit labor costs over a decade.

By sharpening its competitive edge, the US manufacturing sector has removed a serious handicap in the international marketplace. Indeed, in 2000, only 18% of overall US manufacturing shipments were destined for overseas markets. But in 2012, a record 28% of total US manufacturing shipments were directed overseas, with nearly 58%—a record share—going to emerging economies. In 2000, the emerging-market share stood at 43%.

Most of the incremental gains in the manufacturing sector have been concentrated in durable goods industries, such as motor vehicles, commercial aircraft, machinery and select areas of technology. Growth in these sectors tends to have positive spillover effects on many other industries that supply nondurable goods, such as chemicals, plastics and textiles. Manufacturers may also benefit from lower energy costs, driven by the discovery of shale gas in the US in recent years. In some industries that are more energy-intensive—such as paper, chemicals and metals—these benefits could be pronounced.

In light of these trends, we expect US manufacturers to increase their share of GDP, from a low of 13% in the past decade, to about 20% within 10 years. For this to happen, manufacturers must continue to invest in new products and innovative technology. In January, nondefense capital goods orders—a proxy for manufacturing investment—surged by 6.3%. This is a good sign that US manufacturers know what needs to be done to stay ahead in a tough global marketplace.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.