High-yield default rates have been unusually low over the past couple of years and now look as though they are on the cusp of a reversal. But default rates in themselves could be less damaging to high-yield bond returns than rising government bond yields.

Defaults Set to Rise

Yields in the high-yield (HY) market have fallen considerably—offering less compensation for risk—so concern is growing about what happens when default rates start to rise.

There are indications that HY credit quality is deteriorating. Under normal monetary conditions, with low economic growth, you’d expect to see weaker firms forced into bankruptcy, but we are in an aggressively supported economy. Fixed-income markets have received a massive boost as central banks pumped trillions of dollars of new liquidity into the global financial system, keeping interest rates at rock bottom.

Quantitative easing may be masking some deteriorating fundamentals, potentially creating an increasing number of zombie companies that in a “free” economy wouldn’t be able to fund themselves. For example, latest data on the UK showed that the percentage of loss-making UK companies had risen to roughly 30%—the highest since 1990. But liquidations are around 15%, compared with highs of well over 20% in the early 1990s. In Europe, credit quality has declined over the past two years. For example, the upgrade/downgrade ratio for euro HY has fallen from around 1.0 in 2011 to well under 0.5 in 2013, yet we have seen default rates reach their lowest levels since the market started. So it’s safe to assume that, as monetary conditions normalize, we will see more “normal” levels of defaults (that said, we are coming from very low levels).

The Impact of Rising Yields

The interesting thing to note is that expected defaults don’t have nearly as much impact on returns as rising yields. This is illustrated by some recent studies, by Deutsche Bank for example, on the potential impact of changes in default rates and yields.

In the developed markets, annual defaults on single-B rated bonds have averaged about 5% since 1983, and a much lower 1.6% over the past decade. They rose to 7.4% in 2009 at the height of the global financial crisis. In the US single B market, a 5% default rate would be consistent with a total return of about 2.8%. To wipe out the return on those bonds, yields would have to rise by about 80 basis points. If interest rates remained unchanged, the default rate would have to rise to 9.5% (in other words higher than 2009 levels) to wipe out the total expected return.

In the euro single B market, an average annual default rate of 5% would be consistent with a total return of 3.6%. Given the higher return, it would take a bigger move in yields—about 180 basis points—to erase the total return. Assuming government bond yields stayed the same, the return would still be marginally positive if the default rate went to 10%.

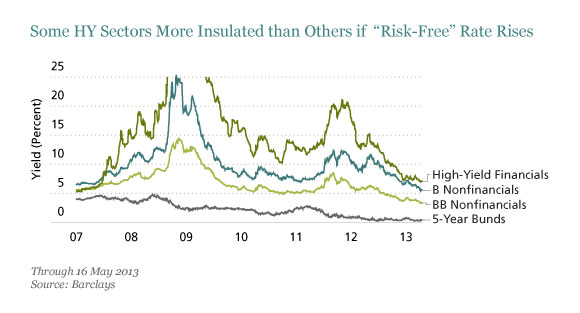

The chart below shows euro HY bond yields, together with the interest-rate yield—the “risk-free” rate—for which we use the yield on the five-year German Bund as a proxy (the highest point reached by the HY financials in 2007, which isn’t shown, was about 47%). Low government bond rates mean that investors today are being paid much less—in fact almost nothing—for taking interest-rate risk. As abnormally low central bank interest rates and government bond yields eventually start to rise, investors face capital losses on their (low spread) longer-duration bonds. So the investment case for owning bonds rests on the question of whether capital losses are likely to be outweighed by the bonds’ credit premium. In this example, high-yield financials offer the best cushion.

Investment Implications

One implication of all this is that we need to worry about both rising interest-rate yields and rising default rates, but that yields are more of an issue at present. The key catalyst for rising yields will be withdrawal of liquidity as central banks start signaling an end to quantitative easing. The good news is that we think interest-rate yields will take longer to rise in Europe than in the US, where the authorities have already started to send signals about a return to normal.

We believe a well-diversified, carefully selected portfolio of euro-area HY bonds offers the most attractive return. Our research suggests that a good balance would be about 55% in BB names, 25% in B, 10% in CCC and the rest in higher-yielding investment-grade bonds.

The 55% weighting in BB reflects our view that a lot of that segment is currently overpriced (BB actually accounts for about 70% of the high-yield market). We think the B category in Europe offers more value than BB at the moment. We are selecting a number of attractive single-B credits that have shorter duration than the average BB, making them less sensitive to interest-rate changes.

At the security level, our top picks include opportunities we’ve discussed in detail in the past year, including some nonfinancial peripheral bonds. We believe there’s still value in some of the subordinated financials.Spreads have tightened considerably since we identified the opportunity, but, as shown in the chart, they are still yielding more than the nonfinancials.

This combination of names would have an average credit rating of BB-, and we estimate that it should be able to yield about 5.2% in the coming 12 months. With default rates in the current range, it would take a rise of about 1.6% in interest rates to erase that return. Given the still fragile state of the euro-area economy and the stated willingness of the euro authorities to keep the liquidity flowing, we’re comfortable with that risk-return trade-off for now.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. Past performance of the asset classes discussed in this article does not guarantee future results.

© 2012 AllianceBernstein