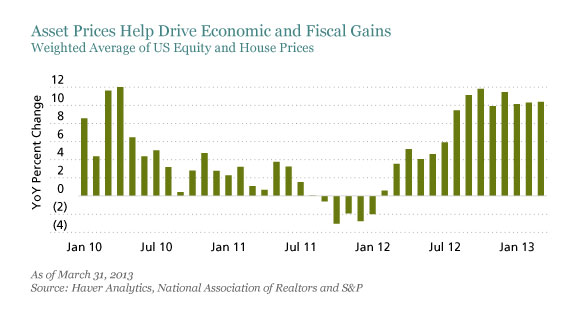

As the housing market wakes up and the stock market rallies, strong gains in asset prices are improving US household wealth and helping to reduce the federal deficit. This is a great boost for confidence, but it also sharpens the challenge facing US fiscal and monetary authorities.

Rising prices of real and financial assets (display) are a catalyst for spending because they increase household wealth and create fiscal benefits, which fuel economic growth. Indeed, private sector gross domestic product (GDP) advanced at an annualized pace of 4% in the first quarter, while private sector job growth has averaged over 200,000 for the past seven months.

Stocks and Real Estate Rebound

In early May, both the Dow Jones Industrial Average and the S&P 500 Index reached record highs, each rallying nearly 16% since the start of the year. Equity-price gains have added approximately $3 trillion to US household total net worth.

Real asset prices have also increased by more than 3% through April. With real estate values at $20 trillion, the additional increase in real asset values would add $600 to $800 billion to household net worth so far this year, pushing it far into record territory. Against this backdrop, it’s no coincidence that real consumer spending rose by 3.2% annualized in the first quarter, the biggest quarterly gain in more than two years.

Fiscal Deficits Are Narrowing

The US Treasury is also enjoying the asset-price ride. The Congressional Budget Office (CBO) has pegged the 2013 deficit at $642 billion, or $203 billion below its estimates from earlier this year. It now projects the federal deficit will decline from 4% of GDP in 2013 to 2.1% in fiscal year 2015, the smallest deficit since 2007.

Federal revenue has enjoyed a boost from an announced dividend payment of $95 billion to the US treasury by Fannie Mae and Freddie Mac, which is tied to a recovery in real estate prices. And the CBO says individual tax receipts are nearly $70 billion higher than estimated a few months ago, apparently because of rising capital gains and higher personal income growth. All told, the downward revision to the current budget deficit is one of the largest on record. State governments are also benefiting from a revenue windfall.

Of course, in the past we’ve seen that rising asset prices can also breed spending imbalances, irrational expectations and complacency. In the 1990s, the US economy was fueled by an equity-market boom, and in the 2000s, growth before the financial crisis was buoyed largely by a real estate bubble.

In a more buoyant environment, monetary policymakers may be reluctant to withdraw a loose monetary policy soon enough. The sharp reduction in budget deficits might compel fiscal policymakers to defer decisions on long-term budget imbalances.

Changes Are Easier in Solid Environment

We think that would be a mistake. In our view, growing concern about financial stability should lead the Fed to consider tapering its asset purchase program soon. We also believe that budget discussions should take place because it is always easier politically to make small changes in a positive growth environment than to make big changes during a downturn.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.