Momentum is finally building to do something with Fannie Mae and Freddie Mac. The bipartisan Corker-Warner proposal, now making the rounds on Capitol Hill, aims to dissolve the GSEs and start fresh. Meanwhile, Fannie and Freddie are testing innovative mortgage-security structures that transfer the risk of borrower defaults to the private sector.

It’s the start of what is sure to be a difficult winding down of the GSEs—but we think efforts are heading in a good direction.

What’s Needed for Mortgage-Market Reform?

In our white paper, Increasing the Role of Private Capital in the Mortgage Market

, we outlined the crucial elements we believe are needed in a post Fannie/Freddie world: the government should keep a role in the housing market to ensure standardization in loan underwriting and mortgage-backed security (MBS) issuance, and the risk of homeowner defaults should be kept in private hands to insulate taxpayers from another meltdown—though it needs to be done the right way.

Corker-Warner Is a Good Starting Point

The bill being hashed out in Washington now has these components. The proposal would shut down Fannie and Freddie and replace them with a new government agency plus a new system of privately formed insurance companies. The private insurers would assume at least the first 10% of losses from defaulting borrowers, while the government entity would reinsure the risk of loss above that amount.

So, in its favor, Corker-Warner attempts to maintain a standardized, government-sponsored MBS market. This would enable lenders to sell their loans, keeping mortgage rates low and promoting plentiful credit for homebuyers. Transferring the first 10% of losses to the private sector would also provide a new buffer of protection for taxpayers.

But relying on private guarantors to insure first losses wouldn’t be our first choice. Essentially, the bill seeks to create a new line of business. It would take time to develop a sufficient number of firms to absorb the first losses on the enormous volume of agency MBS.

And even then, we don’t think that a few private firms can be expected to withstand a dramatic downturn in real estate. That idea clearly didn’t work in the last housing crisis, when bond insurers, the primary mortgage insurers and the GSEs nearly all went bust or came close to it.

This problem could be solved, however, by engaging the fixed-income market.

Freddie’s New Mortgage Structure May Be More Efficient

The Federal Housing Finance Agency sees this potential problem too and isn’t waiting for legislation to find innovative ways to transfer loss risk.

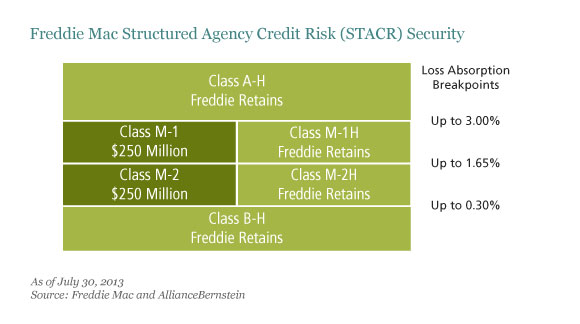

In July, Freddie Mac issued a new deal, called STACR, which takes a recent pool of standard Freddie mortgages and divides the risk of borrower default into senior and junior classes (M-1 and M-2 in the display).

The junior classes will absorb the risk of losses between 0.3% and 3.0%. In this deal, Freddie retained many of the classes, shown in light green.

The junior classes will absorb the risk of losses between 0.3% and 3.0%. In this deal, Freddie retained many of the classes, shown in light green.

We like this senior/subordinated structure, as it transfers loss risk away from the GSEs more efficiently than mortgage insurance does. Selling the loss-bearing security into the capital markets distributes risk much more widely than mortgage insurance. And, we think that there would be ges going forward.

Is STACR perfect? No. As Fannie and Freddie issue more test deals this fall, we’d like to see them try out structures with a thicker layer of loss protection for taxpayers.

But as investors, we think that current legislative proposals and the recent STACR deal are promising. Closing down Fannie arobust demand for these securities among institutional investors.

It’s also valuable that, with this structure, mortgage loss risk is bought and sold in the open market with a visible price; this information could guide pricing for the guarantee fee on mortgand Freddie is sure to be contentious, but consensus is building for reforms that support homeownership and keep the MBS sector thriving. And that would be a win-win for taxpayers and the capital markets.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.