The common wisdom about retirement planning is to fund tax-deferred vehicles such as 401(k) plans and IRAs to the max—and we agree. But how to put these accounts to best use is more complicated.

15%+ More After-Tax WealthFew dispute the virtues of compounding funds on a tax-deferred basis. We estimate that after two decades of growth, in the median case a tax-deferred portfolio will generate 15% more proceeds after federal taxes than a taxable counterpart, assuming that today’s tax regime remains in effect.

In fact, many investors are likely to gain more than an extra 15% from a tax-deterred account, since their tax rate in retirement will probably be lower than it was during their working years. They'll do better still if, like many retirees, they move from a high-tax to a low-tax state.

Spend First from Taxable AccountsBut there are ways to maximize the virtues of tax deferral. For example, investors approaching or already in retirement frequently want to know which account to spend from first—taxable or tax-exempt.

For investors who intend to leave tax-deferred assets to beneficiaries, this decision is complicated and must be coordinated with their estate plans. But for other investors, it almost always makes sense to extend tax-deferred growth for as long as possible. The general principle is to spend down your taxable portfolio first.

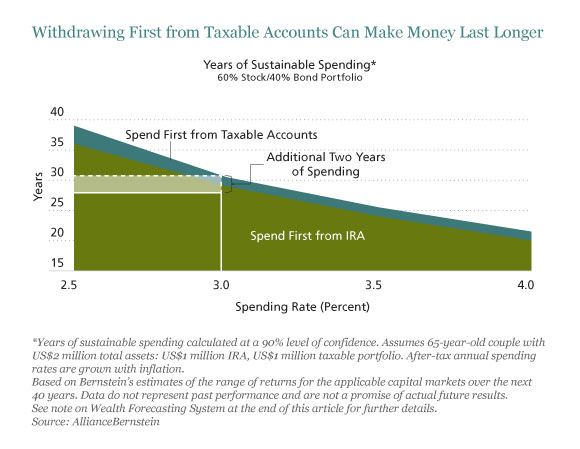

The display below shows the case of a 65-year-old couple with $1 million in an individual retirement account (IRA) and another $1 million in a taxable account. They have a moderate-risk asset allocation and spend 3% of their initial portfolio value each year, grown with inflation.

If they withdraw first from their taxable account and take only the required minimum distributions from their IRA starting at age 70½, we project that the couple's assets will last 31 years in poor markets, rather than 29 if they spend from their tax-deferred account first. Two more years of spending will be very welcome if one or both spouses are lucky enough to reach age 94.

A Question of Asset Location Those who own both a taxable and a tax-deferred account often wonder which assets to hold in each. Our research indicates that location doesn’t matter much with respect to stocks and bonds. It would seem logical to fill your tax-deferred account with bonds, since the top marginal tax rate on bond income (including the 3.8% Medicare surtax) is 43.4%, versus 23.8% for long-term capital gains and qualified dividends. However, but the bulk of returns in a balanced account is likely to come from stocks. The benefits of sheltering these assets tend to cancel each other out. This issue is best explored on a case-by-case basis by each investor and his or her advisors.

But some diversifying asset classes are better housed in a tax-deferred portfolio. REITs, for example, pay out large dividends that are taxed as ordinary income. Hedge funds, which tend to trade frequently, may take short-term capital gains, which are taxed at the same rate as ordinary income.

It’s wise for all investors in retirement to review the performance of their assets in their taxable and tax-deferred accounts, as well as their spending patterns and tax brackets. Any changes or concerns warrant a discussion with investment and tax professionals.

Next in this retirement investing series: Spend less? Work more?

Bernstein does not offer tax, legal, or accounting advice. In considering this material, you should discuss your individual circumstances with professionals in those areas before making any decisions.

The Bernstein Wealth Forecasting SystemSM uses a Monte Carlo model to simulate 10,000 plausible paths of return for each asset class and inflation, producing a probability distribution of outcomes. It projects forward-looking market scenarios, integrated with an investor’s unique circumstances and taking the prevailing market conditions at the beginning of the analysis into account. The forecasts are based on the building blocks of asset returns, such as yield spreads, stock earnings and price multiples. These incorporate the linkages that exist among the returns of the various asset classes and factor in a reasonable degree of randomness and unpredictability.