Recoveries from past financially driven recessions have tended to be slow, and so far the current US recovery is following that pattern. But abundant liquidity and fading headwinds suggest to us that growth is likely to accelerate.

If we look at the long history of economic cycles, every period of economic growth typically has both its own unique characteristics and specific features in common with other economic cycles. However, based on recent expansions, it seems that the pace of an economic recovery has a lot to do with the nature of the preceding downturn.

One common notion is that recoveries generally mirror the recessions that came before them—so, the deeper the downturn, the stronger the rebound. Our view is that this rule of thumb only applies to recessions driven by excess inventory and high interest rates. Recoveries that follow financially driven downturns have been different: they’ve consistently started much more slowly, but over time their growth rates have often topped those of recoveries boosted by huge inventory-rebuilding cycles as well as falling interest rates.

Comparing Two Different Recoveries

We took a closer look at these patterns by comparing the 1980s US recovery, which followed a traditional inventory-driven downturn, with the 1990s rebound, which followed a recession provoked by financial factors: a commercial real estate correction, tight credit, the savings-and-loan crisis and big defense cutbacks. We focused on the private sector because there were big differences in public-sector trends and policies between the two cycles. The lengths of the cycles were in the same ballpark: 108 months for the 1980s and 128 months for the 1990s.

What did we find?

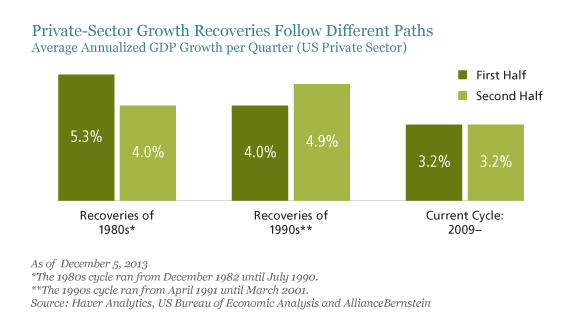

During the first half of the ‘80s recovery, real private-sector gross domestic product (GDP) grew at an average annualized rate of 5.3% (Display), with a huge boost from inventory-building by businesses. But in the second half, growth was quite a bit slower, at 4%. The ‘90s recovery offered a contrast: it grew by 4% in the first half before accelerating to 4.9% in the second half. You could say that the second half of the ‘90s looked more like the first half of the ‘80s, while the first half of the ‘90s looked more like the second half of the ‘80s.

Understanding the Current Recovery

At 54 months old, the current US recovery cycle is young by comparison to those earlier cycles. If it ended today, both halves of the recovery would be identical—each with average annualized growth of 3.2%. That would be much slower than either of the earlier recoveries. However, we think there’s a good case to be made that the current recovery looks a lot like the ‘90s rebound, when growth picked up in the second half as headwinds from tight credit and a fiscal drag faded.

If this recovery continues to track the ‘90s recovery, we would expect growth to accelerate. There’s good reason to believe it will, because the current recovery bears several similarities to that of the early ‘90s:

- The private sector has had to overcome the lingering effects of a major financial crisis

- Private-sector growth has begun to accelerate—to 4.3% annualized in the third quarter of 2013—led by cyclical industries

- Business investment has started to outpace depreciation, and aggregate household borrowing has just started turning positive after a long period of deleveraging. We think both are bullish signs

- The recovery appears to be in the early stages—there’s no visible tightness in labor or product markets that could cause a sudden tightening of financial conditions and jeopardize the rebound

History shows that broad economic trends are sequential patterns that tend to repeat from cycle to cycle, and the current US recovery seems to be following a path similar to that of the ‘90s cycle. This makes us optimistic that the economy can at least maintain its current growth pace for a while.

Of course, the speed and length of growth periods are never predetermined, but abundant liquidity and low leverage indicate that downside risks are low. And potential gains appear to be increasing, as headwinds quickly dissipate.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.