Nigeria is Africa’s biggest economy and one of the world’s largest oil and gas producers. Resolving its electricity-generation gaps could significantly boost the country’s economic growth—and provide opportunities for equity investors.

Most global investors pay insufficient attention to Nigeria, which isn’t included in traditional emerging-market equity indices. Yet in this country of 174 million people, a policy-driven change to infrastructure could transform the economy and create new opportunities for equity investors.

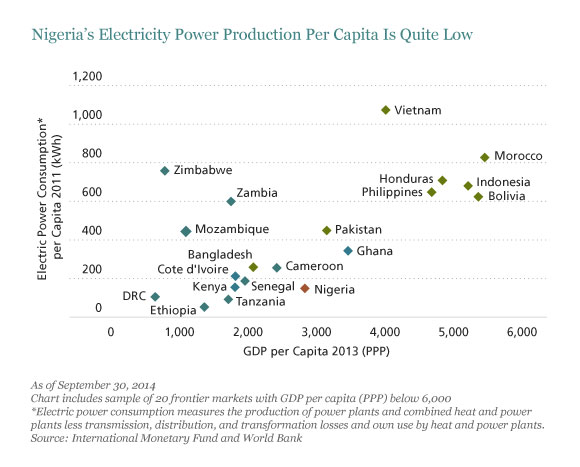

Nigerians regularly experience electrical outages, which can add up to as much as seven hours a day; the country supplies only one-third of the electricity found in countries with comparable income levels (Display). This power gap is constraining growth and hampering the potential of industries such as manufacturing, leaving Nigeria overly dependent on oil.

But progress is under way. In November 2013, most of the formerly state-owned power-generation companies and power-distribution companies came under the control of private investors. Today, the Nigerian Electricity Regulatory Commission is responsible for guiding the power sector toward becoming an open and competitive electricity market.

Transformational Economic Impact

There’s plenty of work to be done. Currently, companies and individuals frequently must rely on expensive generators. Blackouts are routine. People own multiple cell phones from different operators—not just because coverage is spotty, but because cell towers lose power so often. Perishable food products routinely go to waste due to the lack of refrigeration. This additional spending would be unnecessary if Nigeria had reliable electricity.

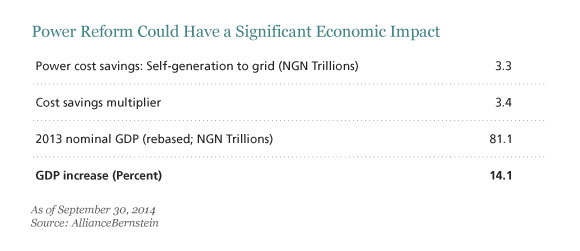

Fixing Nigeria’s power gap could transform its economy. Our analysis suggests that reliable grid power would result in a cost savings that could increase Nigerian gross domestic product (GDP) by 14% (Display). This is based on the estimated cost differential between self-generated power and access to the grid, and applies a cost-saving multiplier. Fewer power outages would also mean higher productivity, allowing companies to recover an estimated 8.9% of lost sales a year.

Nigeria aims to increase its generation capacity from 8.7 gigawatts (GW) per year to 28.3 GW per year by 2020. These ambitious targets require private-sector operating expertise and capacity, plus capital—some US$19 billion of investment over the next five years, according to our estimates. Private equity capital and private companies will help, but much of the funding will come from local banks, most of which are publicly traded.

The Path Ahead: What’s the Holdup?

Investors of all types are keeping an eye on three key measures needed to ensure the success of Nigeria’s power reform:

-

Tariffs must be increased, because current revenues won’t cover operating costs. Higher prices will be more palatable to customers if the electricity supply improves.

-

A sufficient gas supply must be guaranteed for power-generation companies. Energy companies need incentives to invest in gas infrastructure.

-

Transmission capacity, a bottleneck for power delivery, must increase.

Cooperation between the private and public sector is vital. The public sector must create clearer regulatory frameworks and smooth the path toward implementation, and the private sector must supply funding and operational expertise.

How Can Investors Capitalize on Power Reform?

If Nigeria can successfully partner with investors on power, many industries would be transformed. Although most current opportunities involving direct investment in power are available through private equity and dedicated infrastructure funds, investors can also get exposure to the upside of Nigeria’s power-sector reforms through public equity markets.

In banking, for example, privatizing power assets would spur loan growth. Many publicly traded banks have already begun lending, and power-sector exposure for some of them is expected to triple in the next five years. In fact, building out the power sector would require loan amounts equal to 25% of all current bank loans in Nigeria. Lending policies and loan structures will be key differentiators for banks, and will determine their relative performance.

Manufacturing capacity and efficiency would also benefit from reliable power. This would enable significant growth and cost savings for companies that manufacture goods domestically, such as those in consumer goods sectors. And we would see the emergence of new manufacturing sectors that require reliable power to be competitive, ranging from textiles to automobiles.

A successful power reform would prove that Nigeria is able to implement structural reforms and liberalize its economy. The expected boost in GDP would also drive employment growth and thus create greater stability, a benefit to Nigeria as well as Africa and the rest of the world. As confidence improves, we think investors will become increasingly attracted to the potential of this dynamic and important economy.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.