Despite a slow start following its launch in November, the Shanghai-Hong Kong Stock Connect share trading scheme has significantly increased foreign access to China equities and created new investment opportunities. Two subsectors are particularly noteworthy for global investors.

Volumes Are Low, But Potential Is High

A key trend to watch in 2015 will be the likely increasing usage of Shanghai-Hong Kong Stock Connect. This important capital market reform was launched by the Chinese government last November to help increase the inflow of foreign capital to the Shanghai equity market, while also facilitating greater participation by mainland investors in Hong Kong-listed equities.

Initial trading within the new system has been sluggish. For various operational reasons, trading has been well below the quota levels set by the government (the system had nothing to do with recent volatility in Chinese equity markets). We see this as a transitory phase, however. Once these issues have been resolved, we expect offshore institutional participation in the scheme to increase significantly. The government is confident of success: Premier Li Keqiang recently indicated that plans are in train for a similar program linking the Hong Kong and Shenzhen stock exchanges.

This is good news for investors. In fact, we think the short-term focus on trading volumes between the Shanghai and Hong Kong exchanges may have diverted attention away from the very real structural improvements and new investment opportunities that have already been created by the new system.

Six-Fold Increase in Stocks

Global investors can now access more Chinese stocks than ever before. Prior to the launch, offshore investors’ access to domestic China equities was limited to those “A” shares (shares of companies incorporated in mainland China, priced in renminbi and traded on mainland equity markets) which were dual-listed on the Hong Kong equity market. These numbered 80 or so. Under the Shanghai-Hong Kong Stock Connect, foreign investors have access to around 500 “A” shares—a roughly six-fold increase.

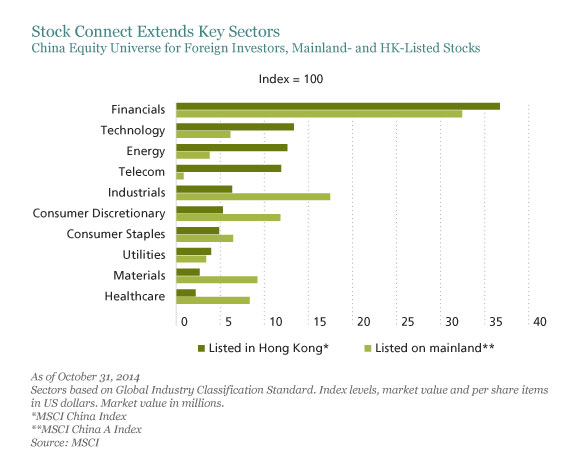

This has created a dramatic change in the sectors available to global investors (Display). The dark bars show the sector breakdown for the MSCI China Index, which consists of China stocks listed in Hong Kong—that is, the limited universe of China stocks hitherto available to foreign investors. The light bars show a comparable breakdown for the MSCI China A Index, or the universe of mainland China stocks to which foreign investors are beginning to gain access. A comparison between the Industrials, Consumer, Materials and Health Care sectors for each column shows how MSCI China A/Stock Connect is opening up these “domestic” sectors to offshore investment.

MSCI China/Hong Kong appears to offer more energy, telecom and technology stocks. However, these sectors are actually dominated by a small number of large companies, making them relatively unattractive from a stock-picking perspective. Financials are well represented in both indices.

Two Attractive Subsectors

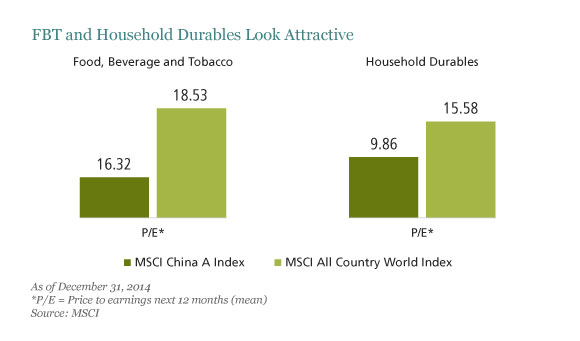

But some subsectors do look very attractive, in our view. In particular, the MSCI China A/Stock Connect has opened opportunities in the food, beverage and tobacco (FBT) and household durables subsectors (Display). China’s FBT sector is very cheap by global standards, despite its highly attractive growth and profitability. Within the sector, manufacturers of white liquor (such as the traditional grain-based baijiu) look especially appealing because China’s anti-corruption drive has had a big impact and made the stocks, which once were premium-priced, look attractively valued, in our view. Prices for the product itself have also fallen sharply but much of this has been borne by the distributors rather than the manufacturers. And the lower price is bringing new consumers into the market, so demand is stabilizing.

The household durables sector—which includes makers of air conditioners, refrigerators and other appliances—is also priced more favorably than its global counterpart. This discount partly reflects concerns about China’s real-estate market. We don’t share the most pessimistic of these views, however, and the appliances sector continues to grow. Manufacturers of air conditioners are worth watching, as households typically buy more than one such product over time. Recent consolidation in the sector means that the top companies offer the advantage of scale; also, their stock in most cases is not yet available to investors outside China.

It’s only a matter of time, in our view, before global investors will be able to take fuller advantage of these and other opportunities as the Stock Connect program finds its feet. Those looking to get into the Chinese equities market today will find that many new doors have already opened.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio managers.