It sounds unorthodox. But for investors facing taxes, it makes sense to consider opportunities beyond the municipal bond realm. Because it’s all about what you have left after taxes.

Municipal bonds are the fixed-income strategy of choice for most taxable US investors. For investors in the top federal marginal income tax bracket of 43.4%, tax-exempt municipal bonds usually do make the most sense. They have an after-tax yield edge over Treasury bonds, corporates and other taxable bonds most of the time.

Note the wording: most of the time. That’s a reminder to municipal bond investors that flexibility is the most important tool in building a taxable portfolio. Many factors drive opportunities: supply and demand, credit quality, volatility and changes in tax laws. Sometimes, Treasuries or corporate bonds offer after-tax income that trumps that of comparable municipal bonds. When that’s the case, it makes sense to fold them into a bond strategy.

Flexibility Is Key

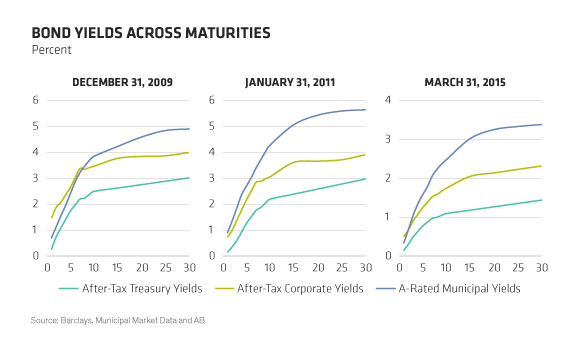

In December 2009, markets had rebounded from their 2008 lows. Both munis and taxable bonds were performing well again. Municipals were helped by a reduced supply of new issuance, partly due to the Build America Bonds program, through which municipalities issued taxable bonds (when they otherwise would have issued tax-exempt bonds). At the same time, the economic stimulus package had renewed investor confidence in state and local governments. As investors bought municipal bonds, yields were driven down, and corporates actually delivered higher after-tax returns than municipals (Display). Taxable investors willing to move outside the municipal box earned a return advantage.

Let’s look at another moment in time: On January 31, 2011, news headlines were full of a vocal analyst’s predictions of municipal disaster. As a result, demand for municipal bonds dried up, prices fell and yields rose sharply, which made municipals much more attractive—especially across intermediate and long maturities—versus Treasury bonds and even corporate bonds. Sticking with munis was the best course of action.

A look at a more recent period shows a different picture. In the above Display, on March 31, 2015, you can see that corporate and municipal bonds with shorter maturities had very similar yields. That’s because fears of future interest-rate increases have driven more municipal investors into shorter-term municipal bonds and cash, driving prices up and yields down. Today, the uncertainty surrounding future interest rates and the potential for volatility means smart investors should stay in touch with what’s happening across the full credit spectrum.

Tax Aware Can Be More Profitable than Tax Exempt

Some investors are convinced they should only pursue tax-exempt income, but this stance can be shortsighted: it’s what you keep after taxes that counts. Given the significant changes in the municipal market landscape since the Great Recession, investors should be open to the idea of adopting the flexibility to include taxable bonds in their muni bond portfolio if they provide higher after-tax yields.

So, which investments offer better after-tax potential: munis or taxable bonds? The answer is, “it depends.” As the economic cycle shifts and interest rates rise, investing flexibly using a tax-aware approach—rather than a strictly tax-exempt approach—should help portfolios looking to maximize after-tax performance.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.