The passion for gym-to-street fashion has gone global, and shows no sign of losing vitality. It’s also keeping business humming for a network of yarn spinners, fabric mills and sneaker makers across emerging Asia.

Stylish running shoes and yoga pants have become wardrobe mainstays around the world, worn for workouts and in the workplace and anywhere in between. According to a recent NPD Group survey, roughly half of American women buy stretchy tees and leggings for every activity but exercising. “Athleisure” is the industry’s buzzword for this new category of sports-inspired clothing and footwear for people who like to work out—or just want to look like they do.

High-Tech Textiles

The athleisure phenomenon is rooted in two trends: the advent of high-tech, high-performance textiles and manufacturing processes enabling a wide range of useful new properties (e.g., odor absorption, moisture wicking and antibacterial protection) and the healthy lifestyle movement. The popularity of the post-workout look reflects a fundamental shift in social attitudes that has, for example, made hardcore Flywheel spin classes and $10 kale juices an integral part of everyday life for many American urbanites. Retailers, leading sportswear brands and luxury designers such as Stella McCartney and Alexander Wang have jumped into the arena, allocating more store space to activewear, introducing high-end sporty streetwear collections and featuring athletes as sponsors of their brands.

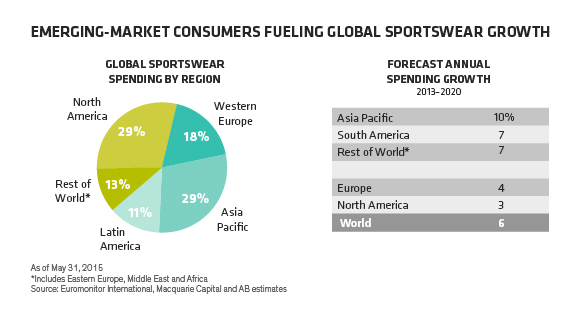

Athleisure is the bright spot in the otherwise lackluster apparel and footwear business. We expect the global sportswear market to advance 6% annually to nearly $400 billion by 2020, spurred by the rapid rise of the emerging-market consumer class and its growing demand for Western activewear brands. Category spending should grow most vigorously in Asia Pacific countries (Display), where the middle-class populations are expanding the fastest.

Go for the Big Brands…

For investors, there are several ways to access this growth potential—and most paths lead to the developing world. The top-tier global brands are Nike, Adidas, Under Armour and Lululemon Athletica, which have averaged sales growth of 10% over the past decade. Nike is the category champ, commanding 36% of the global athletic footwear market, while second-place Adidas has another 20%. And Nike’s emerging-market business has been sprinting at a 10.5% annual pace for the past five years, accounting for about 30% of revenues and even more of its operating profits in 2014.

…or Go Behind the Scenes

Another way to tap into athleisure growth is via the Asian powerhouses at the heart of the “sneakernomics” supply chain. This highly concentrated business is dominated by Taiwan-based Feng Tay Enterprises, the third-largest athletic shoemaker, and Yue Yuen Industrial, the world’s largest sports shoemaker. Nike accounts for 80% and 28% of these companies’ business, respectively. Other major players include San Fang Chemical Industry, the largest global producer of synthetic leather for athletic footwear, and Li Cheng Enterprise, the largest global high-end spacer fabric producer. We expect the Taiwanese footwear supply chain to register above-industry-average sales growth as these players continue to capitalize on their reputations as technological innovators and on their focus in the premium market, where the barriers to entry are higher and competition relative to the mass market isn’t as fierce.

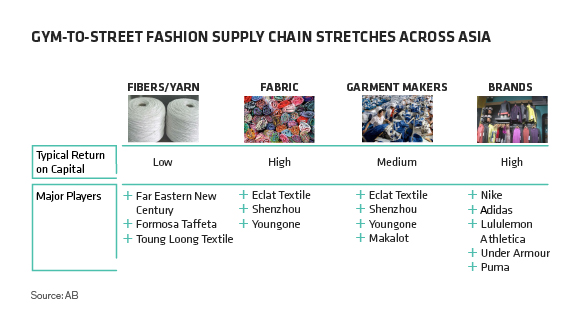

On the apparel side, there are the companies that produce the yarn, fabrics or garments in partnership with the leading global brands (Display). Shenzhou International is China’s largest knitwear manufacturer. Roughly 75% of its 2014 revenues came from Uniqlo (Fast Retailing), Nike, Adidas and Puma. With its fully integrated business model, Shenzhou is one of the few suppliers that can offer customers full services across yarn selection, fabric customization, dyeing, cutting and sewing.

Eclat Textile is one of the Taiwanese textile manufacturers to emerge as leaders in the field of innovative, high-performance fabrics and fibers, putting the industry at the forefront of the athleisure boom. The company’s products are being snatched up by the giant brands, including Nike, Under Armour and Lululemon. Toung Loong Textile supplies high-end yarn to fabric makers, including Eclat.

Many of these textile companies are also reaping first-mover advantages from shifting production to low-cost South and Southeast Asian countries and from plans to further expand this capacity, particularly in Vietnam. Declines in petroleum-based synthetic-material costs are also bolstering profitability.

The gym-to-street fashion phenomenon may have originated in the developed world, but in our view, a large part of its future growth and many attractive investment opportunities can be found in the developing world. The rising tide of global demand will likely lift many supply-chain boats, though finding the right investment on this theme will still require careful research and a discerning eye.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.