Dividend cuts make unsettling headline news for income-seeking investors. But we believe that focusing on which companies will cut or raise dividends is a diversion from the search for stronger returns in a diversified equity income portfolio.

It’s easy to understand why dividend reductions are disturbing. When a company reduces its payout, it’s often a symptom of a deeper malaise in profitability. Sometimes, it reflects a bigger problem in an industry, such as the oil price declines of the last year squeezing energy companies’ earnings. For many investors, it rattles the relative certainty of income streams that flow from quarter to quarter.

But in our view, recent weakness in dividends has been confined to a cluster of companies concentrated in one sector. And our research shows that attention given to dividend cuts or increases might distract investors from the fundamental analysis that really matters to performance.

Dividend Cutters Are Rare

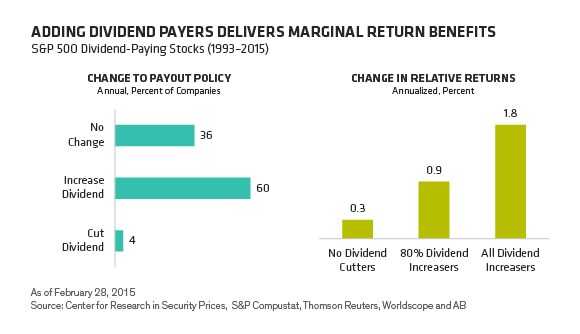

Dividend cutters are relatively rare. We looked at a universe of dividend-paying stocks in the S&P 500 from January 1993 through February 2015 and found that each year, only 4% of companies actually cut their dividends, while 60% increased their payouts (Display, left chart).

Much attention is directed toward avoiding dividend cutters or getting more exposure to companies that are likely to increase payouts. But the benefits of this strategy are marginal. Extracting the dividend cutters from the S&P dividend-paying stocks would have improved relative performance by 0.3 percentage point a year versus the broader market (Display above, right chart). A heroic investor who was capable of building a portfolio with 80% dividend increasers would be rewarded with just 0.9% more a year. And even if you could hypothetically create a portfolio that consisted of the entire set of dividend increasers—a nearly impossible feat—the added return would still be only 1.8 percentage points a year.

Sift for Equity Factors

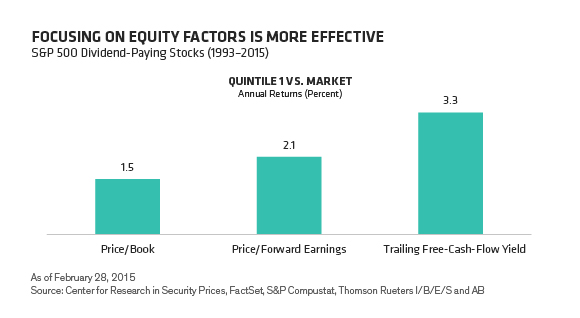

That doesn’t mean investors should be passive in equity income allocations. To improve outcomes, we believe the key is to focus on a range of equity factors that usually point to success when investing in stocks in general. In our view, the best approach is to look for dividend-paying stocks with strong cash flows and low valuations (price/book or price/earnings ratios).

Our research shows that the most attractive quintile of dividend-paying stocks in each of these groups provided a significant boost to relative returns versus the S&P 500 (Display) that exceeded the marginal benefit of avoiding the dividend cutters or increasing the dividend raisers. And since more than half of the dividend-paying companies tend to increase their payouts in a given year, an investor will benefit from this trend by definition when investing in a basket of dividend payers.

Focusing on dividends isn’t foolproof. There are always episodes of economic and market stress that trigger weaker returns for dividend-paying stocks. Short-term investors who get in and out at the wrong time might experience much less favorable performance.

But for investors with a long-term horizon, we believe focusing on dividends can be very fruitful. Over time, income streams from equities have been very stable. And you don’t really need to fret about finding companies that might raise dividends. Instead, develop conviction in companies with solid fundamental features—that also pay out to shareholders—to energize returns from dividend-paying stocks.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.