US-only bond investors are affected by one business cycle, one yield curve, one monetary policy. As long as interest rates were falling, that was good. But it doesn’t sound so good now.

Going global diversifies an investor’s interest-rate risk and brings other potential benefits as well. Although countries’ economic cycles, business cycles, monetary cycles and yield curves may briefly align, over long periods, they’ve not been highly correlated.

Countries’ sovereign-bond returns differ greatly year by year. And so do opportunities. And so do risks. If that sounds worrisome, think again: your own country is part of this mix, and if you’ve got a home-centric portfolio, it’s riding rough seas without ballast.

The Benefits of a Bigger Pond

The most obvious benefit to going global comes from a far greater opportunity set. At year-end, the Barclays US Aggregate Bond Index comprised nearly $18 trillion in outstanding debt and about 9,000 issues. Its global counterpart, the Barclays Global Aggregate? $43 trillion and more than 16,000 issues.

For the active manager, that’s a much bigger pond to fish in.

And the dispersion of hedged returns among developed countries has been striking. For example, in 2011, hedged sovereign UK bonds outperformed those of Japan and the euro area by 13.5%. The following year, the euro area outperformed Australia by 9.8%.

In contrast, in most years, the return gap between the best- and worst-performing sectors of the US core is a couple of percentage points. So having such a large gap between country returns provides a lot more potential for an active manager to add value.

A Potential Risk Reducer

But that’s not the only advantage to globalizing. We sorted quarterly returns from 1990 through 2014 into periods when the US Aggregate was positive and periods when it was negative. We found that when it was positive, it returned, on average, 2.3%. The hedged Global Aggregate performed almost as well during those same quarters, capturing 95% of that performance. We call that “up capture.”

When the US Aggregate was negative, it returned, on average, –0.9%. While the hedged Global Aggregate was also negative on average during those periods, it was less negative; its “down capture” was just 67%.

That’s a notable skew, with investors preserving more of their capital during down periods by allocating assets away from the US into other countries—countries where rates weren’t rising as much, or where rates were stable or even falling. (We also looked at this from the perspective of risk mitigation and saw a significant diversification benefit during extreme down months for US Treasuries. In other words, investors got the most benefit from being global when they needed it most.)

Anchor to Windward

Adding global is not just a tactical strategy for periods of market drama. Global bonds can meet investors’ core objective by serving as a low-volatility anchor to windward.

While an unhedged global bond approach would not fulfill this objective, the overall risk of a global bond portfolio declines sharply once the currency risk is hedged out. When we compared the three-year rolling standard deviation of the hedged and unhedged global bond approaches and US core bonds over the past 20 years, the unhedged global strategy (represented by the Barclays Global Aggregate unhedged) was the most volatile, and the US core strategy (represented by the US Aggregate) was less volatile.

But—significantly—the hedged global strategy (represented by the Global Aggregate hedged to the US dollar) had the lowest volatility of the three.

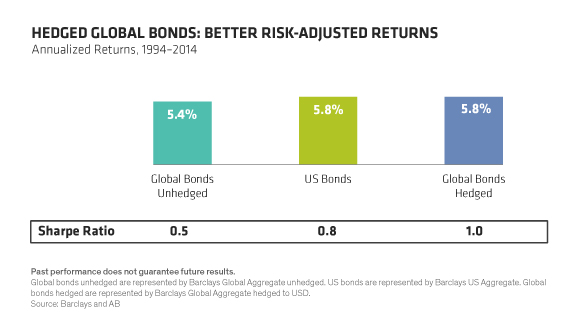

Also significantly, that lower volatility did not translate into lower returns, as shown in the Display below, where the global hedged strategy delivered the same annualized returns over the past 20 years as the US core strategy.

The risk-adjusted return tells the full picture. The Sharpe ratio, which measures return per unit of risk, climbed from global unhedged at 0.5 to US at 0.8 to global hedged at 1.0.

In short, hedged global bonds are simply a better way to meet the core objective. And with rates likely to head higher soon, there’s no time like the present to make the move.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.