As the Fed Wrestles with Inflation, Can Short-Duration ETFs Provide a Refuge?

4 min read

When the Fed slowed the pace of rate hikes, markets quickly priced in easing inflation, setting the stage for an early-2023 market rebound. However, with recent data showing continued strength in the consumer and still-present inflation pressures, both the central bank and investors remain wary of an unpredictable policy course ahead.

Given this uncertainty, many investors still find the short-term segment of the yield curve an attractive destination, enabling them to pick up potential income with less duration risk. Unlike similar past economic cycles, individual and institutional investors are expressing this view with an expanded toolkit that includes actively managed exchange-traded funds (ETFs). These funds combine a transparent, tax-efficient vehicle with the professional skill of active management.

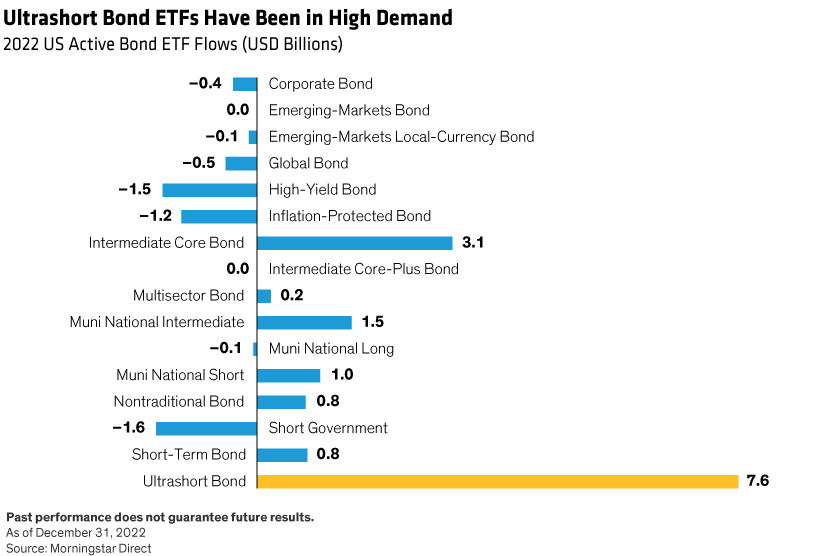

In 2022, actively managed bond ETFs in the US reached a record-breaking $138 billion in assets under management. With the inverted yield curve spurring many investors to gravitate toward low-duration bond strategies, US ultra-short bond active ETFs saw nearly $8 billion in net flows pour in over the course of the year (Display). That’s up almost 33% from 2021, according to Morningstar Direct.

Recent fund flow trends demonstrate continued strong demand for shorter-duration ETFs, as many investors seek to maximize yields and limit volatility while maintaining a higher-quality orientation.

AB’s first two actively managed ETFs, the AB Ultra Short Income ETF (YEAR) and the AB Tax-Aware Short Duration Municipal ETF (TAFI), offer liquid tools for investors to express that view. Launched in 2022, each fund combines the benefits of ETFs with the professional guidance of AB’s experienced fixed-income portfolio-management teams. Find out more about AB’s actively managed ETFs here.

Sign Up

AB ETFs. On Active Duty.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

Investing in ETFs involves risks, including loss of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

TAFI—Bond Risk: The Fund is subject to the same risks as the underlying bonds in the portfolio, such as credit, prepayment, call and interest-rate risk. As interest rates rise, the value of bond prices will decline. Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (aka “junk bonds”) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally, and may be more difficult to trade than other types of securities. Municipal Market Risk: Economic conditions, political or legislative changes, public health crises, uncertainties related to the tax status of municipal securities or the rights of investors in these securities may negatively impact the yield or value of a municipal security. Tax Risk: The US government and Congress may periodically consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income shareholders receive from the Fund by increasing taxes on that income. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

YEAR—Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear two layers of asset-based expenses, which could reduce returns. Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value. Interest-Rate Risk: As interest rates rise, bond prices fall and vice versa; long-term securities tend to rise and fall more than short-term securities. Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered, and the bond’s value may decline. Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments. Foreign (Non-US) Risk: Non-US securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets. Derivatives Risk: Investing in derivative instruments such as options, futures, forwards or swaps can be riskier than traditional investments, and may be more volatile, especially in a down market. Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations. Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage transactions such as reverser purchase agreements magnifies both gains and losses, resulting in greater volatility. New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only. Foreside is not affiliated with AllianceBernstein.