Is Your Income at Risk?

Take Our Quiz to Find Out

01

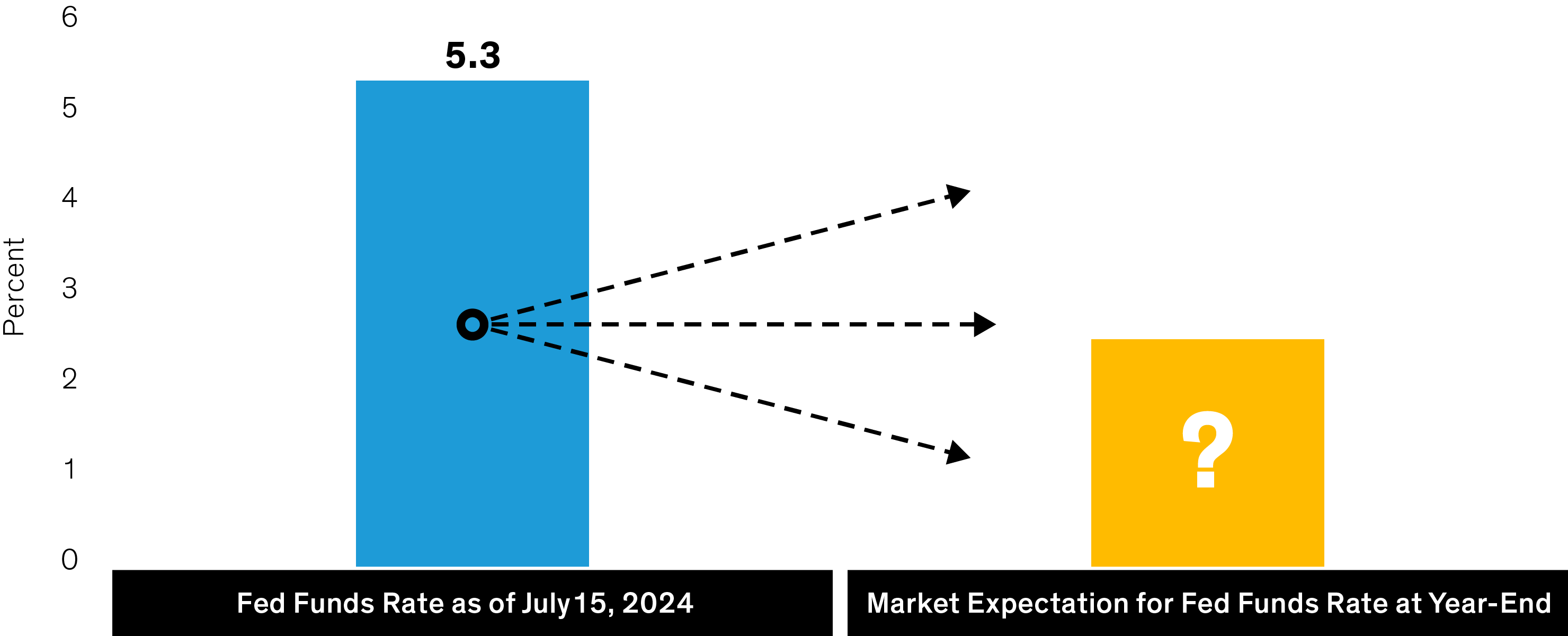

As of July 15, where did the market expect the Fed policy rate to be at the end of 2024?

Market Expectation of Fed Funds Rate by Year-End 2024

Current and historical analyses do not guarantee future results.

As of July 15, 2024

Source: Morningstar and AllianceBernstein (AB)

Correct

As of July 15, the market was pricing in roughly 60 basis points of cuts in the Fed policy rate.

02

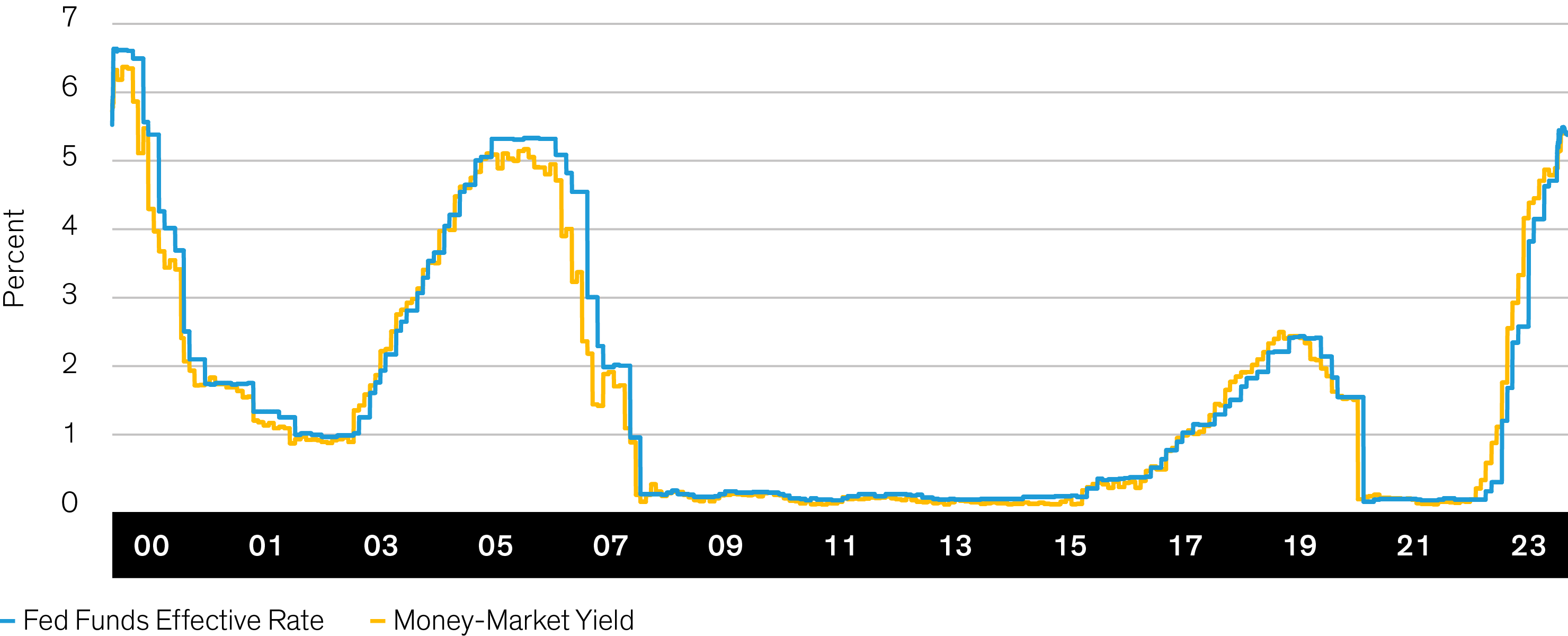

What is the relationship between the federal funds effective rate and money-market yields?

Money-Market Yields Are Almost Perfectly Correlated with the Fed Funds Rate (Percent)

Past performance does not guarantee future results.

Money-market yield: US Treasury 3 Month Bill Money Market Yield

As of December 31, 2023

Source: Bloomberg

Correct

The fed funds rate and money-market yields are almost perfectly correlated. When the Fed cuts rates, money-market yields tend to follow suit—nearly instantaneously.

03

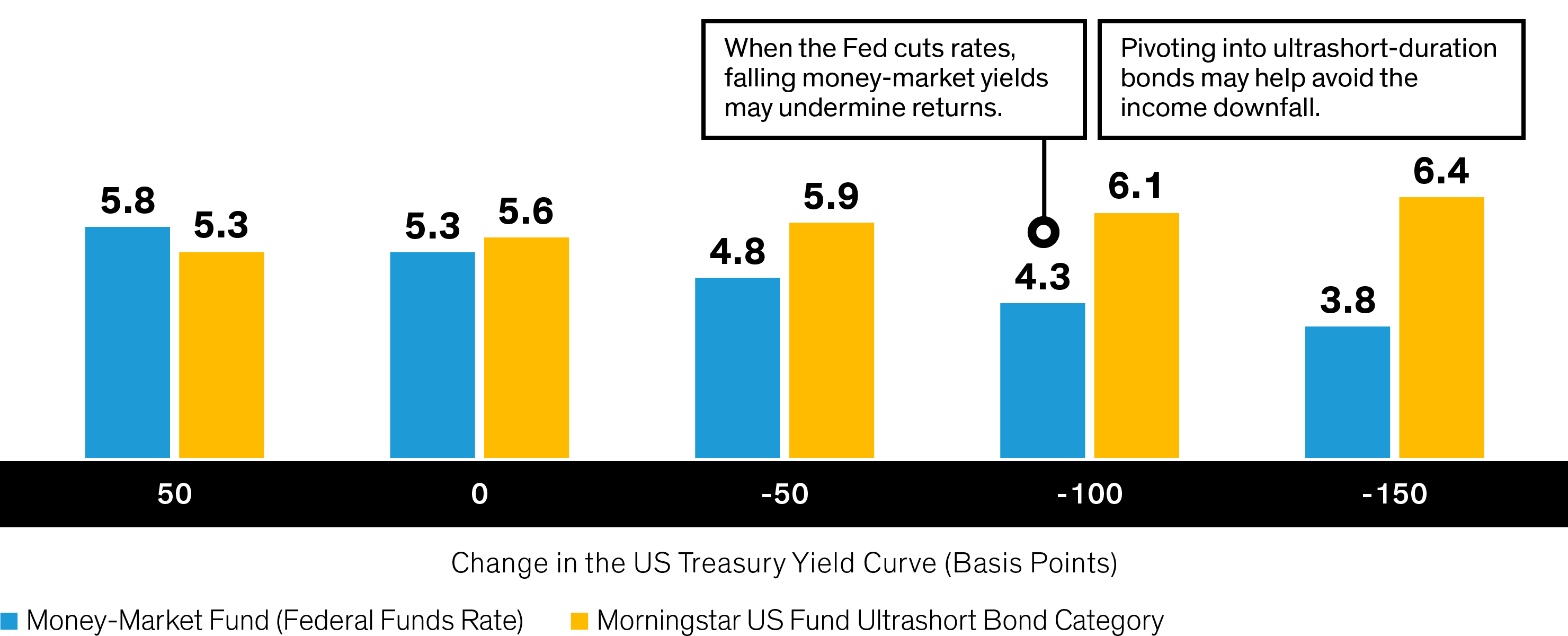

If rates fall, what are the expected returns for money-market and ultrashort bonds?

Expected 12-Month Returns of Ultrashort and Money-Market Funds When Rates Change (Percent)*

Current and historical analyses do not guarantee future results.

*Shock analysis assumes the potential impact of an instantaneous parallel shift (across the whole curve) in US Treasury yields and the resultant yield over the next 12 months. Utilizes the Effective Federal Funds Rate for Money-Market Fund yield: 5.33 and the Morningstar US Fund Ultrashort Bond category average yield and duration: 5.60% and 0.54 years, respectively. Duration is a measurement of the sensitivity of a security to changes in interest rates. Analysis ignores correlations between Treasuries and other sectors that the portfolio invests in. The actual moves in spreads and Treasury yields may differ meaningfully from the sample moves shown.

As of December 31, 2023

Source: Morningstar and AB

Correct

When the Fed cuts rates, money-market yields have tended to follow quickly, forcing reinvestment at lower yields.

04

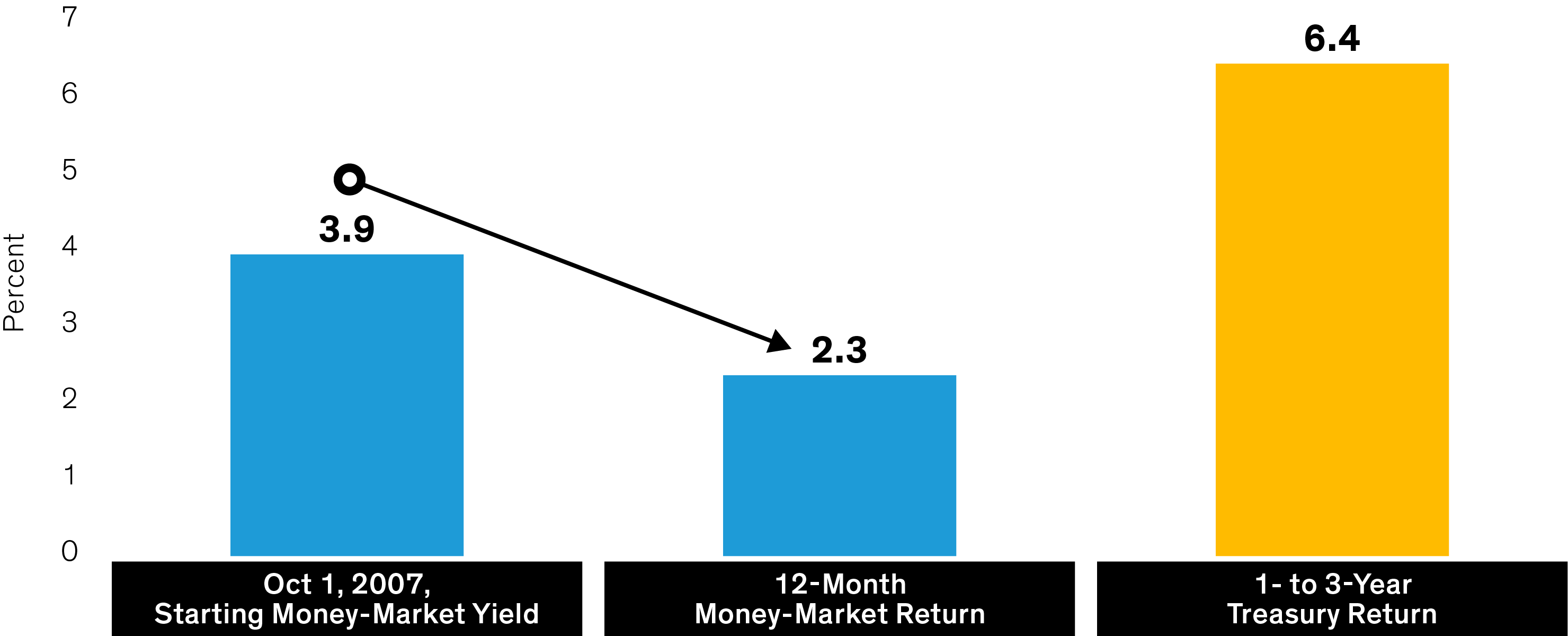

On October 1, 2007, the money-market yield of the US Treasury three-month bill was 3.9%. As the Fed began cutting interest rates, what was the actual return money-market investors realized over the next 12 months?

Realized Returns on Money Markets Declining Significantly After the Fed Began Cutting Rates in 2007

Past performance does not guarantee future results.

Money market is represented by US Treasury three-month bill. One-year period is from October 2007 through October 2008.

Source Bloomberg

Correct

From October 2007 to October 2008, money-market yields plummeted from 3.9% to 1.1% as the Fed began cutting interest rates. Over that period, money-market investors earned only 2.3%, while short-term Treasuries returned 6.4%.

05

When compared with three-month Treasury bills, how have longer-duration bond categories performed after pauses in the last seven rate-hike cycles?

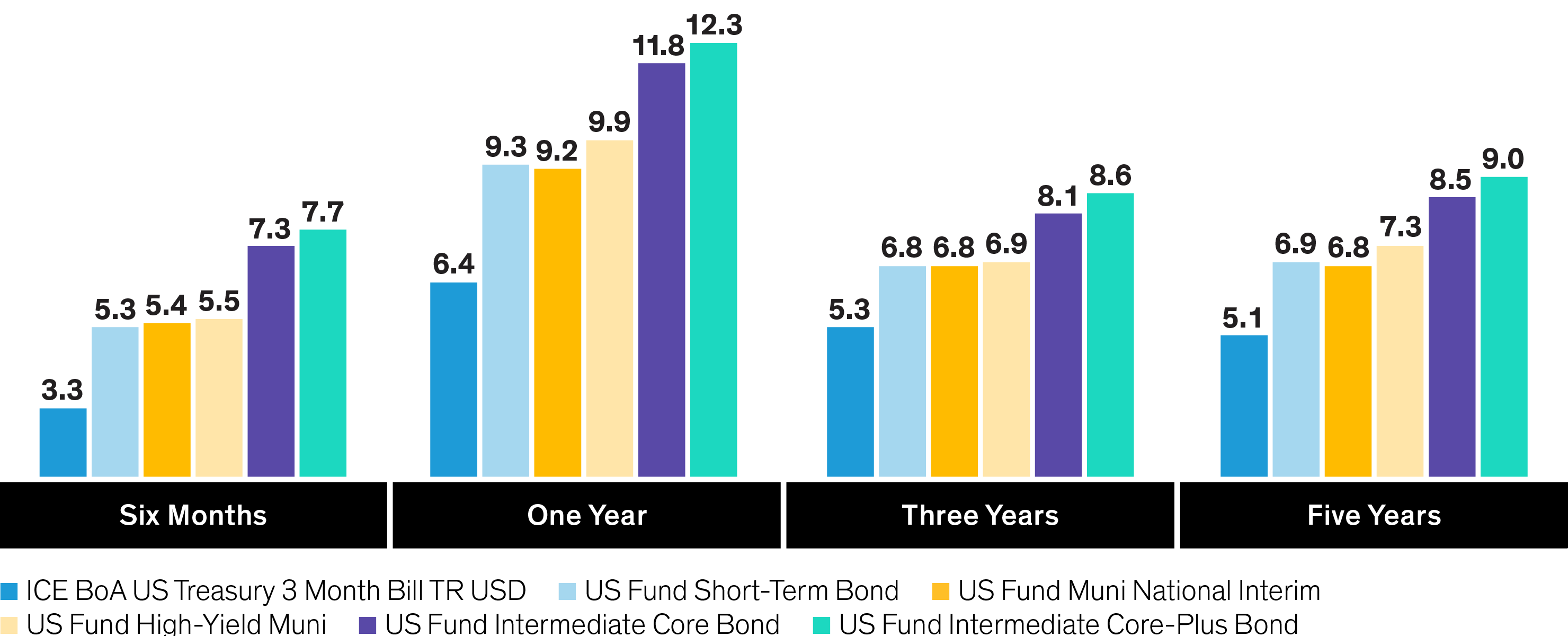

Average Annual Bond Returns Following Seven Rate-Hike Cycles (Percent)

Past performance does not guarantee future results.

Data represents category average returns for the six-month, one-year, three-year, and five-year periods following Fed rate-hike pauses on the following dates: September 1, 1984, October 1, 1987, March 1, 1989, March 1, 1995, June 1, 2000, July 1, 2006, and January 1, 2019. Bond categories are represented by Morningstar Mutual Fund category averages.

Source: Morningstar Direct

Correct

Rule of thumb—For every 1% change in interest rates, a bond’s price is expected to rise or fall in the opposite direction by an amount equal to its duration. If the Fed cuts rates, adding duration to bond portfolios may help performance as bond prices increase.

You got 3 of 5

Better luck next time.

AllianceBernstein and LPL | A Strong Bond

We understand you have options. At AllianceBernstein, we strive to be your partner of choice by offering 70+ investment solutions across LPL platforms, empowering you with choices to align with your clients’ goals.

Basis Point is a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting.

Duration can measure the sensitivity of a bond’s or fixed-income portfolio’s price to changes in interest rates.

The federal funds rate refers to the target interest rate range set by the Federal Open Market Committee.

Investing in ETFs involves risks, including loss of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of a Fund’s prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (aka junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities. Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered, and the bond’s value may decline. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. Foreign (Non-US) Risk: Non-US securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets. Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments. Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear two layers of asset-based expenses, which could reduce returns. Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage tools magnify both gains and losses, resulting in greater volatility. Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only. Foreside is not affiliated with AllianceBernstein.