In a World of Opportunities, Why Choose AllianceBernstein?

AB and LPL | A Strong Bond

AB’s mutual funds, exchange-traded funds (ETFs), Models and Separately Managed Accounts are available across the LPL SAM/SWM, MWP and Manager Select platforms.

available on your LPL platform of choice

Research Recommended available on LPL platforms

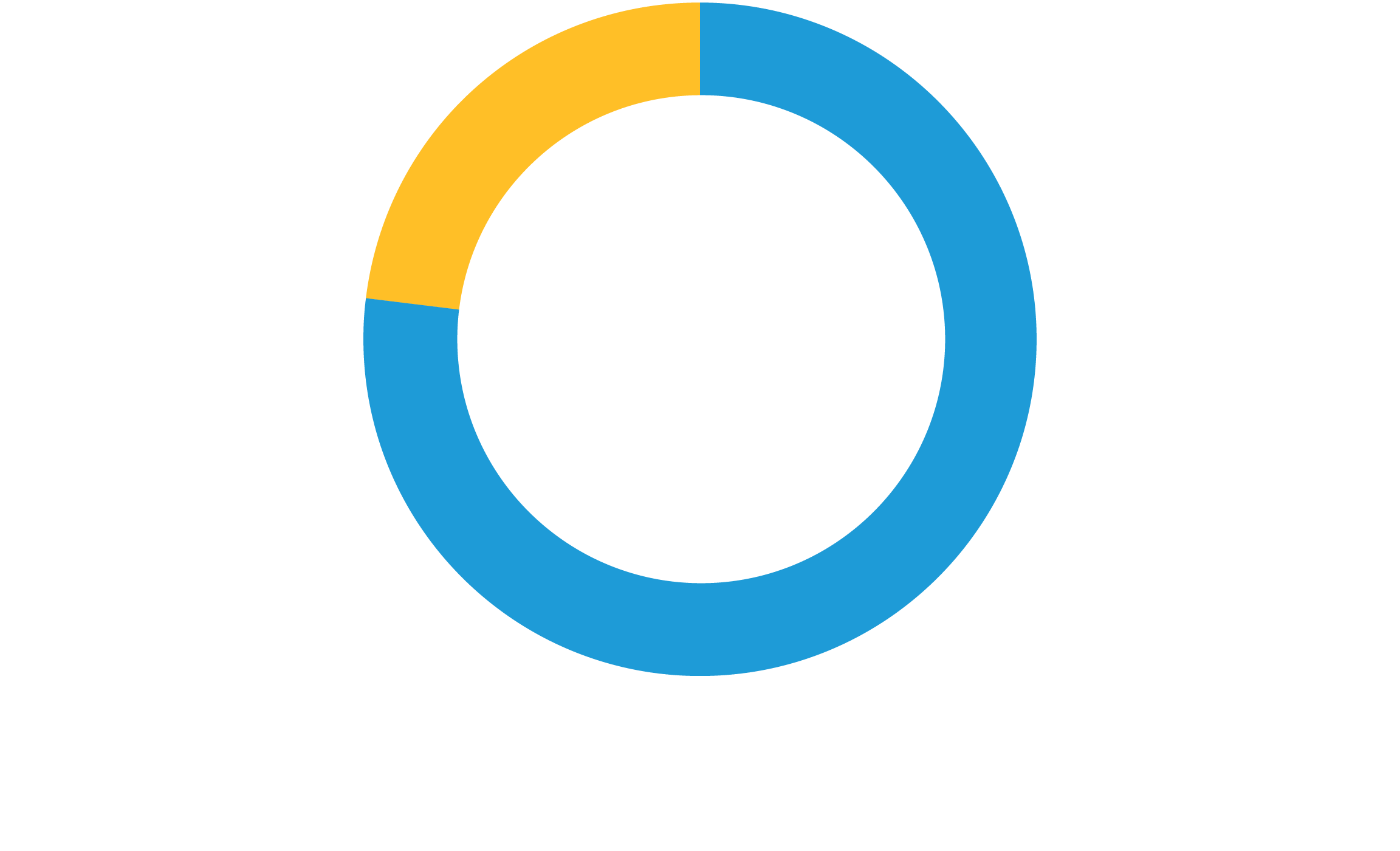

based on overall SMA assets with LPL

As of January 31, 2024 | Source: AllianceBernstein and LPL Research

…With a potential directional change in interest rates coming in 2024, we believe bonds offer compelling value.

—LPL Research 2024 Outlook: A Turning Point

1Percentage of active fixed-income assets in institutional services that outperformed their benchmark gross of fees and percentage of active fixed income assets in retail Advisor and Class I share funds ranked in the top half of their Morningstar category. Where no Advisor class exists, Class A share is used. Performance for private client services included as available. As of December 31, 2023.

Featured ETFs Available at LPL

With more than $2 billion in assets under management in active ETFs, we offer solutions that align with investor goals in the current environment. These popular fixed income ETFs are available with no transaction fees on the LPL SAM/SWM platform and on MWP.

Ready to Get Active?

For more information on how to invest in AB funds on one of the LPL platforms, connect with our ETF Specialist team.

[[fa-icon-envelope]] ETFSpecialist@alliancebernstein.com

For the most current SEC standardized performance, click here for YEAR and click here for HYFI.

Investing in ETFs involves risks, including loss of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (aka junk bonds) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally and may be more difficult to trade than other types of securities. Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered, and the bond’s value may decline. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. Foreign (Non-US) Risk: Non-US securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets. Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments. Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear two layers of asset-based expenses, which could reduce returns. Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage tools magnify both gains and losses, resulting in greater volatility. Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only.