It’s in the Wrapper: Demystifying the Tax-Savings Power of ETFs

5 min read

The ETF creation and redemption process limits the impact of capital gains on investors. Some investment vehicles may require the fund manager to sell securities in order to meet shareholder redemptions, a process that could lead to capital gains distributions. ETFs work differently—they can use an “in-kind” redemption process that enables them to exchange securities for ETF shares without triggering a taxable event. This mechanism can reduce capital gains distributions that might create a tax hit for investors.

Just like stocks, ETFs trade on an exchange, which enhances their tax-efficiency profile. Investors can buy and sell ETF shares on the secondary market, just as they would buy or sell stocks. That on-exchange volume doesn’t necessarily translate into buying or selling within the ETF itself, which shields it from creating capital gains. So the tax implications of buying and selling ETFs are generally limited to the individual investor’s activity, and are not influenced by the actions of other investors in the fund.

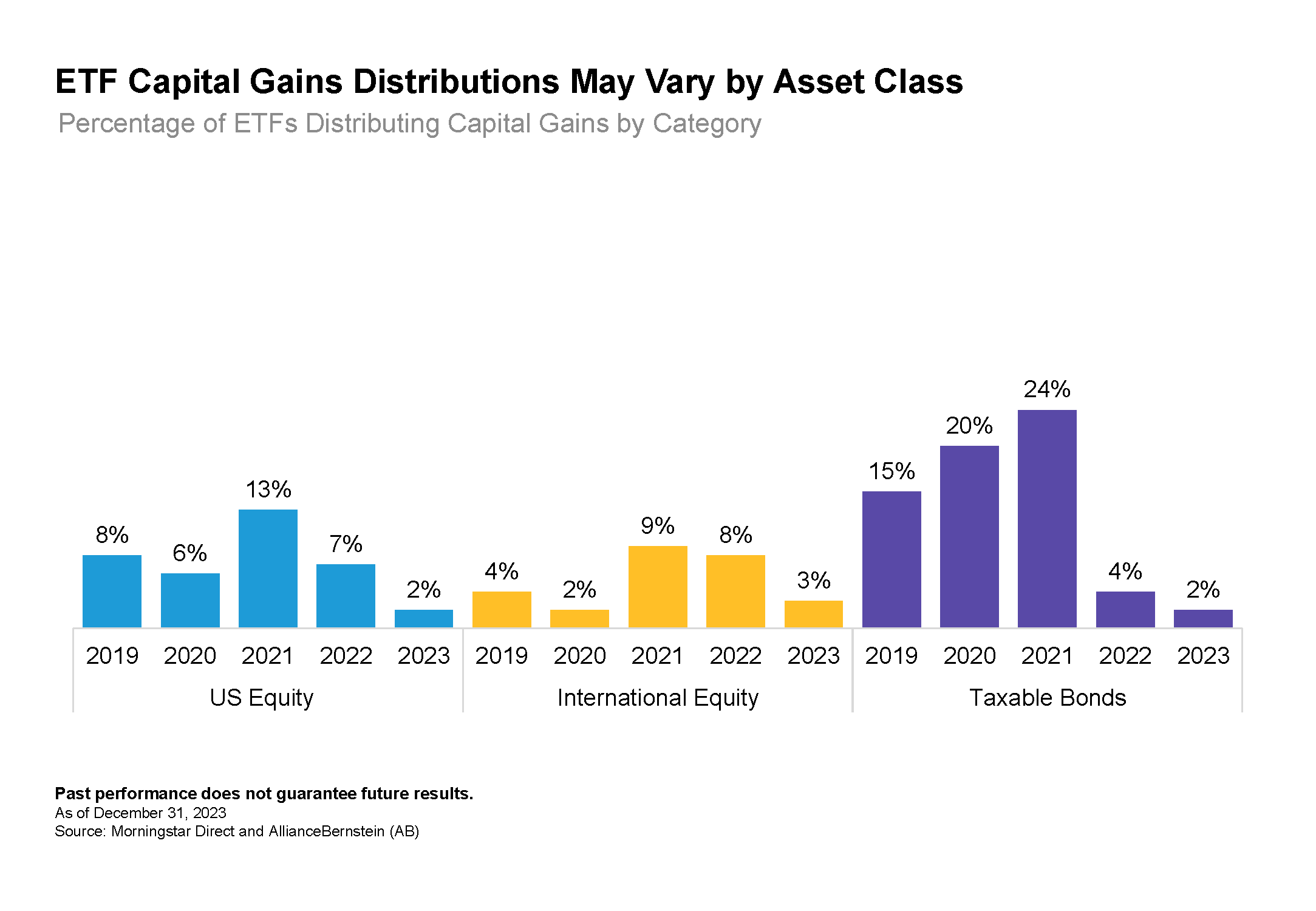

Different asset classes and investment types can result in different ETF capital gains distributions (Display). Due to the nature of fixed income, bond ETFs can sometimes distribute more capital gains than equity ETFs do. In some cases, portfolio managers will allow bonds to fully mature, and some types of bonds can’t be delivered via an in-kind redemption process.

Certain derivatives, emerging-market securities and other asset classes such as commodities are subject to tax rules that prevent in-kind transfers. While there’s a mechanism for ETFs to keep all gains within the fund, there are still instances when an ETF won’t be able to take advantage of in-kind transfers and will distribute a capital gain.

Not all ETF issuers are equally adept at managing tax liabilities. Some ETF issuers have been more effective than others at leveraging the in-kind redemption process to manage tax liabilities. AllianceBernstein’s ETFs (both equity and fixed income) have paid zero capital gains since they were first launched in 2022. We think it makes sense for investors to conduct due diligence not only on individual investment strategies, but also on each ETF sponsor’s capital-market infrastructure before making a decision to invest.

Investing in ETFs involves risks, including loss of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

© 2024 AllianceBernstein L.P., 501 Commerce Street, Nashville, TN 37203