The Reality Behind the Five Biggest ETF Myths

8 min read

Exchange-traded funds (ETFs) have been a presence in US capital markets since 1993, with their popularity exploding in recent years. Investors appreciate the attributes of ETFs, including their listed status on major exchanges, liquidity, nearly continuous trading, transparency and generally lower costs than those of equivalent vehicles.

While ETFs have indeed served many investors well through some very trying market cycles, misperceptions linger about what they are, how they trade and the roles they can play in investors’ portfolios. Let’s look at the five most enduring myths about ETFs and the reality behind them.

Myth One: The Average Daily Volume of an ETF Tells You How Liquid It Is

This misperception seems to stem from trading individual shares of stock. When it comes to stocks, the average daily volume provides some indication of the market’s capacity to handle large buy or sell orders in any given day. Smaller companies, for example, may not have a large base of investors, which can result in lower daily trading activity—and relatively low liquidity, meaning the price of the stock can sometimes be shifted higher or lower based on near-term demand pressure. The number of outstanding shares of a stock is generally stable, changing only with buybacks or new share issuance.

ETFs work differently. They’re essentially a “wrapper” for a basket of securities and operate similarly to mutual funds. But market makers for each ETF can create more shares based on buying interest on a given day. That means average daily volume isn’t really linked to the number of ETF shares that can be traded. A more accurate way to think about ETF liquidity: they’re at least as liquid as the aggregate liquidity of their underlying securities. That can be many, many times greater than the ETFs’ own average daily volume. The key takeaway: don't judge an ETF by its average daily volume.

Myth Two: ETFs Trading at Premiums and Discounts to NAVs Is Costly to Investors

It’s true that ETFs may trade at premiums or discounts to their reported net asset value (NAV), and investors more used to the mutual fund world might see this as a disconnect. In many ways, however, these variances are healthy for markets—and investors.

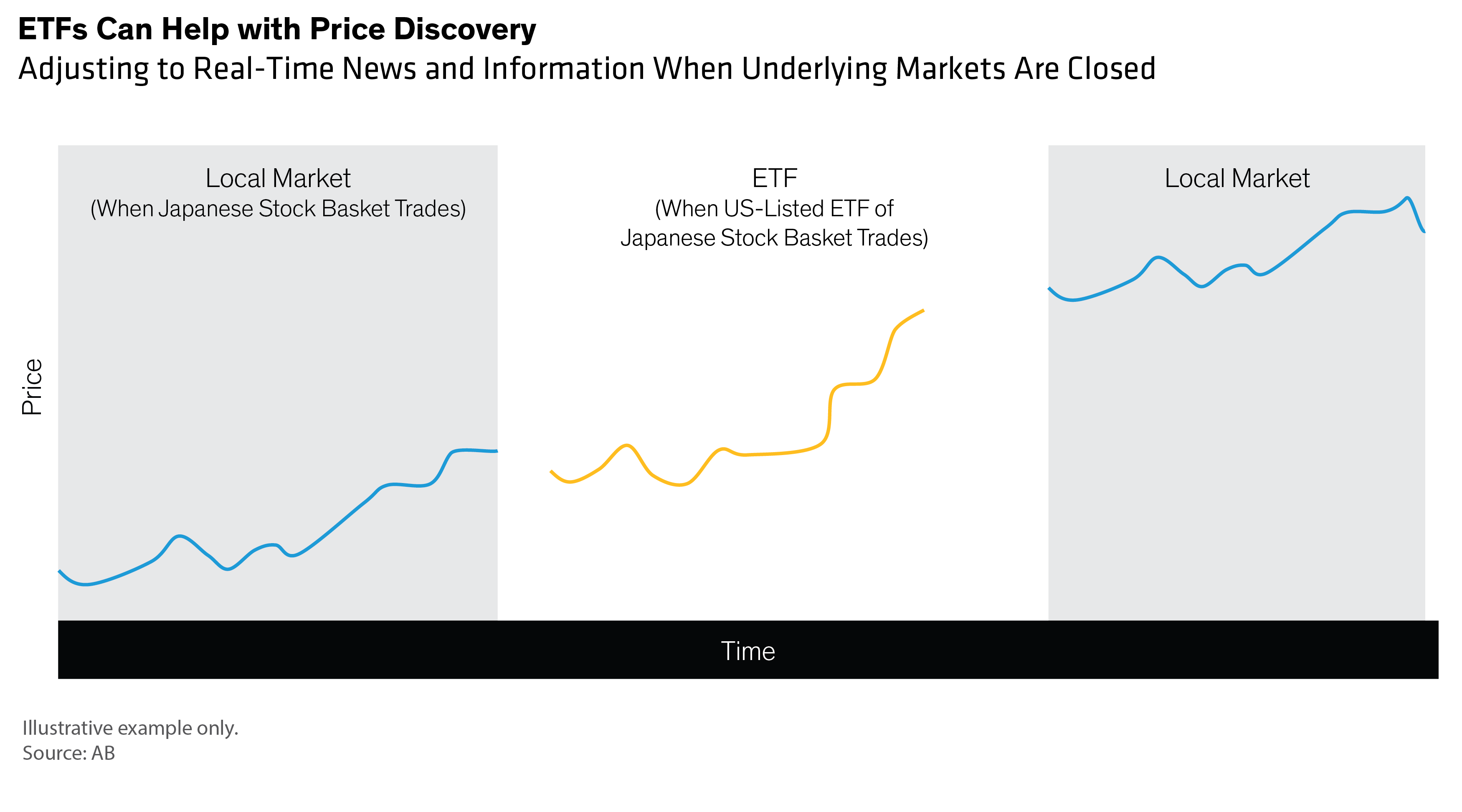

The vast majority of ETF premiums and discounts are temporary—part of the day-to-day synchronizing of markets. Take an equity ETF trading in the US when its underlying foreign market is closed. It’s natural for the ETF price to evolve to reflect new information that may affect stock valuations—even though the home market is closed (Display).

In the case of bonds, which trade over the counter, some securities—particularly in less-liquid markets—may not trade much during the day, or at all. So, reported prices of some bonds might take time to “catch up” to the constant flow of information. In both these cases, ETF premiums and discounts can provide investors with valuable information about where markets and securities actually stand at a given time.

Occasionally, markets see larger disruptions, including public health, weather or other emergencies that impair or halt trading. These can dramatically change the liquidity profile of underlying ETF assets. As ETFs continue to trade, they become a mechanism for investors to express views on underlying issuers, a valuable part of price discovery. In short, many premiums and discounts in the ETF market are a sign of price discovery: the NAV is stale, and the ETF is assumed to be the current fair value of underlying securities with stale prices. Some mutual funds even incorporate ETF price feeds in an effort to better price securities.

Myth Three: ETFs Might Break the Market in a Major Sell-Off

Since ETF trades can be executed easily and quickly, many investors assume that ETF selling would bring more people into falling markets, intensifying volatility and liquidity challenges. The high-yield bond market has often been referenced, given its lower liquidity profile than those of more broadly traded markets.

In practice, however, that worry hasn’t been realized—as we’ve seen in the global financial crisis, the taper tantrum of 2013, and even the disruptions at the onset of the COVID-19 pandemic. In those episodes, when liquidity dried up in the high-yield market, the higher trading volume of ETFs in a down market actually worked as a type of relief valve for liquidity.

It’s important to keep in mind that trading in an ETF in the secondary market (the buying and selling of ETF shares between investors over the exchange) does not translate into a one-for-one impact on the underlying portfolio. That’s because of the large institutions that manage market supply and demand on behalf of ETF sponsors. They act as a clearing mechanism at times when there may be very few individual buyers and sellers for underlying securities. Because ETFs are listed on major exchanges, often through a national order system, they may help markets weather disruption rather than breaking them, by acting as a separate venue to exchange exposures away from the actual fund.

Myth Four: ETFs Are Only Useful for Passive Investors

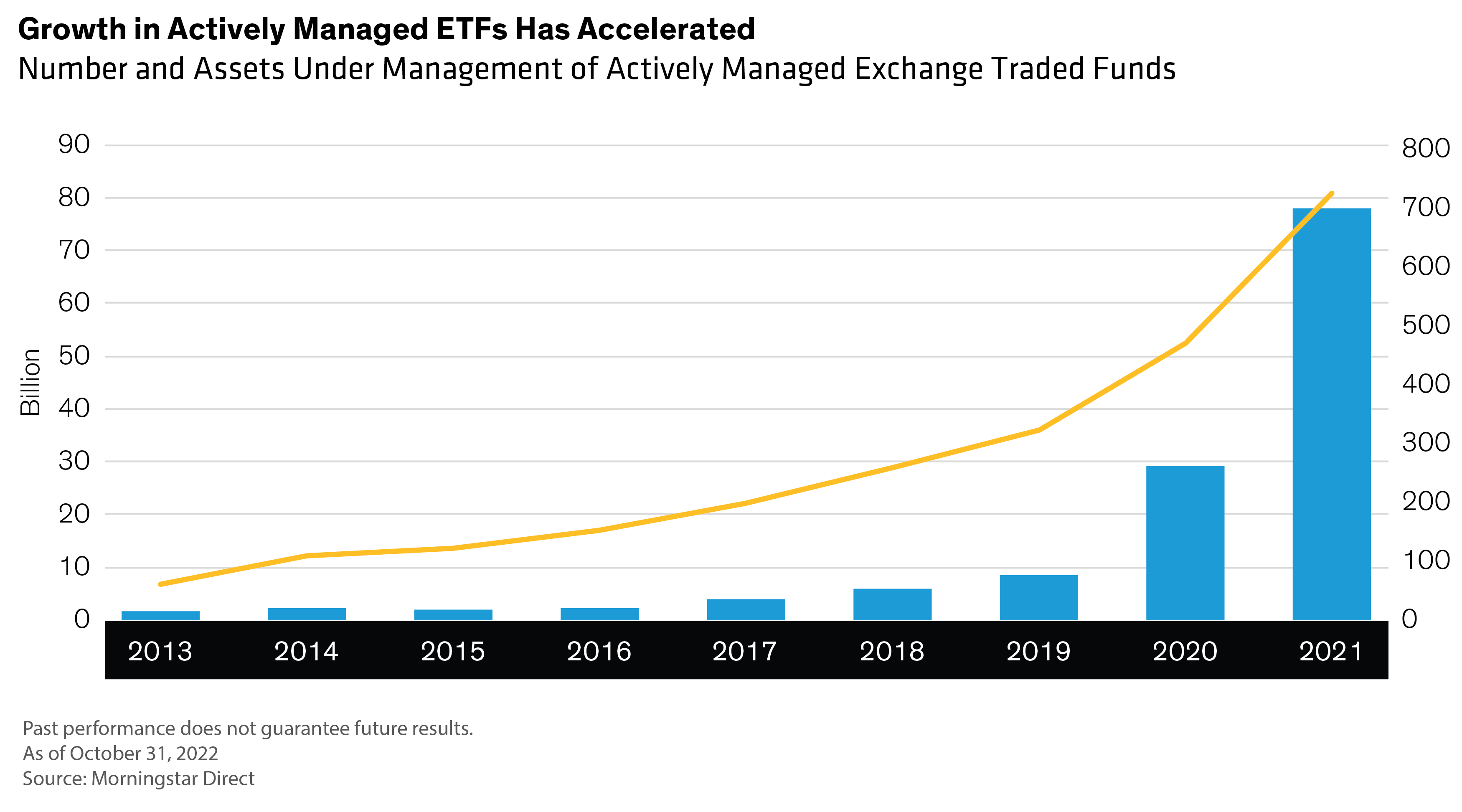

For many investors, the term “ETF” has become synonymous with passive investing. It’s actually an understandable association, given that overall assets in ETFs have been dominated by passive investing strategies for decades. But active investing is alive and well in the ETF world; in fact, some actively managed ETFs date as far back as 15 years. Several hundred actively managed ETFs have been brought to market over the past several years, and today there’s quite a broad range of strategies across asset classes, providing investors with many choices.

The recent surge in issuance was in part thanks to streamlined regulatory guidance and processes for issuing ETFs—in many ways, this leveled the playing field for actively managed ETFs. Their popularity continues to grow (Display), and the reality for most investors is that both passive and active building blocks have a place in their portfolios.

Myth Five: Long-Term Investors Don’t Really Need ETFs

Some investors who employ a long-term horizon feel that an ETF structure doesn’t have a lot of value for them. The thinking often goes something like this: “I’m investing for the long term and don’t trade in and out of allocations often, so I don’t need an active ETF that trades intraday.”

In reality, there are advantages to the ETF structure even for long-term investors who trade infrequently—perhaps just to rebalance portfolios or make the occasional manager or strategy change. As discussed earlier, there are advantages from trading on an exchange, including the potential for the ETF market to be a liquidity buffer in challenging markets, which might translate into more favorable pricing. ETFs can also be tax efficient for investors, depending on their specific individual tax situations. ETFs can also be held in any brokerage account and are often available with low or no commissions.

In terms of trading costs, ETFs can be very efficient vehicles. Trading spreads for ETFs are generally no wider than the spreads of the underlying securities, and over the life of an ETF the spread tends to decline. And even though investors may not be planning to sell at the time they buy an ETF, changes can occur in both the ETF holdings and investors’ specific situations. ETFs make the sales process relatively straightforward, fast and, most of the time, cheaper. Of course, every ETF is different, so it’s important for investors to evaluate each carefully before buying.

Sign Up

AB ETFs. On Active Duty.

Get periodic insights, tools and access to events from AB’s ETF experts.

Thank You

Thank you for contacting us. Expect a reply soon.

Investing in ETFs involves risks, including loss of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only.