Given states’ and other municipal issuers’ strong financial positioning, we don’t think that the current economic downturn will result in broad bondholder impairment. However, as the crisis continues to unfold, we do anticipate disruptions and downgrades. That makes careful credit research more critical today than ever.

Challenges vary by sector:

State and Local Governments

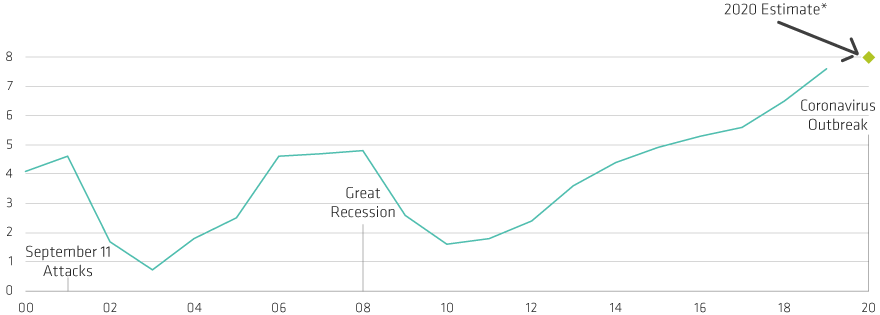

The situation: As already noted, states have repaired their balance sheets and built cash-funded reserves to historic levels. In the short run, costs associated with fighting the coronavirus will surely rise, but pending aid in the form of a higher federal share of Medicaid costs should help soften the blow.

The challenge: As we saw in 2008, broad-based revenues such as sales and income taxes decline in economic recessions. Today, a drop-off in sales tax revenues is certain, with so many tax-generating businesses—from sports venues to shopping malls—shutting down and tourism halting. As layoffs begin, income tax revenue will suffer too. Ultimately, however, states and municipalities have the authority to raise taxes, tap reserves and cut expenditures, allowing them to ride out a downturn.

Hospitals

The situation: Most major healthcare facilities have enough financial liquidity to weather tighter margins. If additional funds are needed to ensure hospitals’ ability to meet community service needs during the crisis, we believe facilities will receive federal, state or local financial support.

The challenge: Under normal conditions, higher patient volumes would help boost margins. But the significantly higher patient volumes seen in a far-reaching health emergency are likely to squeeze margins instead. Shortages of medical supplies, the potential spread of the virus among healthcare workers, and the suspension of more profitable elective procedures could add to operating pressures.

Senior Living

The situation: The elderly are among the most vulnerable to COVID-19. Elder care facilities in Washington State have been hit particularly hard by infections among residents, visitors and staff.

The challenge: Beyond the human tragedy, facilities may suffer long-term reputational damage, especially as cases rise and potential containment breaches along with them. As they fight the outbreak, they may see fixed costs, such as caregiver salaries and food, increase as supplies grow scarcer or require significant pre-ordering. Costs for increased maintenance are already rising as facilities work around the clock to meet the highest industry standards. In general, though, most senior-living facilities have sufficient cash reserves to weather a decline in occupancy for at least a year.

Utilities

The situation: As essential service providers, water & sewer and electric utilities are generally well-insulated from COVID-19’s thick economic cloud due to their diverse customer base.

The challenge: We expect reduced demand from commercial and industrial users as more people self-isolate and/or work from home. For the same reasons, residential demand is likely to rise.

Airports

The situation: Larger hubs are better positioned to deal with disruptions in service than are smaller, regional airports. Even though the airline industry is under stress, airlines will continue to make payments to airports. These payments represent just 3% of airlines’ budgets, and airports are essential to airlines’ survival.

The challenge: Between airlines voluntarily cutting flights due to lower passenger volume and federally imposed limitations on travel into the US, most airports will see revenue declines in the coming months. The decrease in travelers will also hurt ancillary revenues, such as concession fees from food courts and newsstands.

Higher Education

The situation: Most colleges and universities have physically closed to help prevent community spread of the virus; students will complete the semester online.

The challenge: We expect a modest hit to revenues, as many schools are refunding room and board for the remainder of the school year. Tuition, however, will not be refunded, as courses are being taught remotely. We believe normal operations will resume in the fall, with little drop-off in demand, even if a full-out recession develops. In fact, colleges and universities typically see enrollment in graduate programs rise during economic downturns.

Charter Schools

The situation: Younger people seem to be less affected by COVID-19, but the key concern is community spread into homes. Charter school revenues are based on average daily attendance from the prior year, so schools are in relatively good position for now. The virus also struck very close to the school year’s end, which is leading many states to waive the mandatory 180-day requirement.

The challenge: A shift toward “remote learning” alternatives could spark school closings and teacher layoffs. Schools also may be pressured if states dial down aid to students to make up for budget gaps caused by other aspects of the outbreak. However, that may not impact them until the next school year.

Preparing for the Unexpected

We have good reason to think the broad municipal bond market will hold up under the weight of an economic downturn. Municipal bonds generate more income today than three months ago, and over the long run, municipals act as a buffer against equity volatility.

But rapidly evolving conditions and heightened uncertainty demand thorough fundamental research and continuous monitoring. In our view, that makes an active and flexible strategy municipal investors’ best bet for negotiating the coronavirus crisis.