-

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams and are subject to change over time.

Don't Shun Global Bonds

-

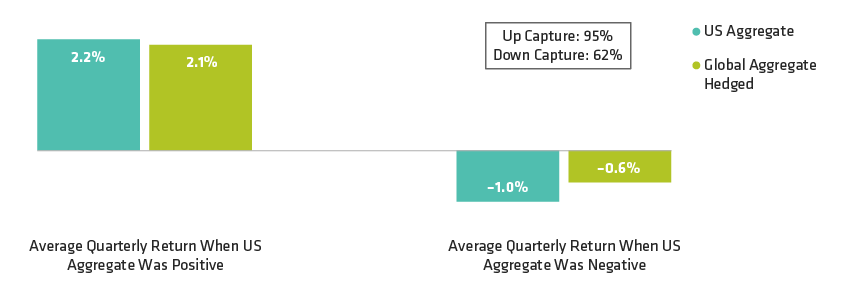

The global bond market is less volatile and supplies bigger diversification benefits than the US bond market.

Global Bonds Diversify US Bond RisksJanuary 1992–June 2020

Current analysis does not guarantee future results.

As of June 30, 2020

US bonds are represented by the Bloomberg Barclays US Aggregate Index. Hedged global bonds are represented by the Bloomberg Barclays Global Aggregate Hedged to USD. An investor cannot invest directly in an index, and its performance does not reflect the performance of any AB portfolio. The unmanaged index does not reflect fees and expenses associated with the active management of a portfolio.

Source: Bloomberg Barclays and AllianceBernstein (AB) -

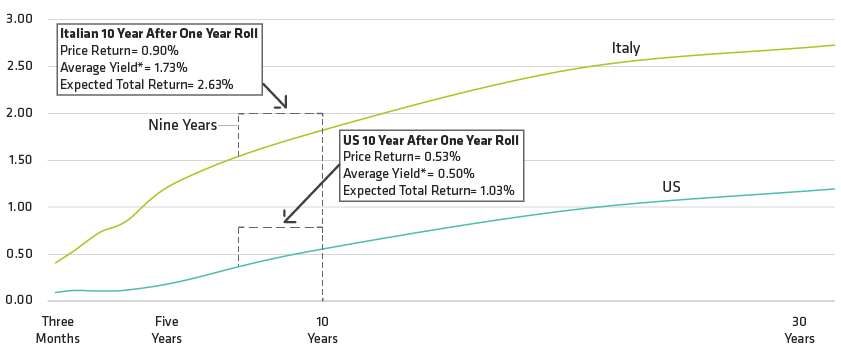

The global bond market provides unique ways to generate alpha.

Steeper Yield Curves Offer Bigger Roll Down EffectYield (Percent)

For illustrative purposes only. Assumes rates remain unchanged throughout the period.

*As of July 31, 2020, average yield is the average between the current 10-year and 9-year yield. In the case of the Italian curve, the yield is adjusted for hedging currency using three month EUR/USD per Bloomberg.

Source: Bloomberg and AllianceBernstein (AB) -

Hedging into US dollars can boost low and negative yields.

Currency Hedging Can Make Low-Yielding Bonds More Attractive

Current analysis does not guarantee future results.

As of August 10, 2020

Credit rating is represented by the Bloomberg Barclays methodology. Hedged yields are hedged to US dollars.

Source: Bloomberg Barclays and AllianceBernstein (AB)