-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Midyear Municipal Outlook

Stay Flexible Late in the Cycle

31 July 2019

5 min read

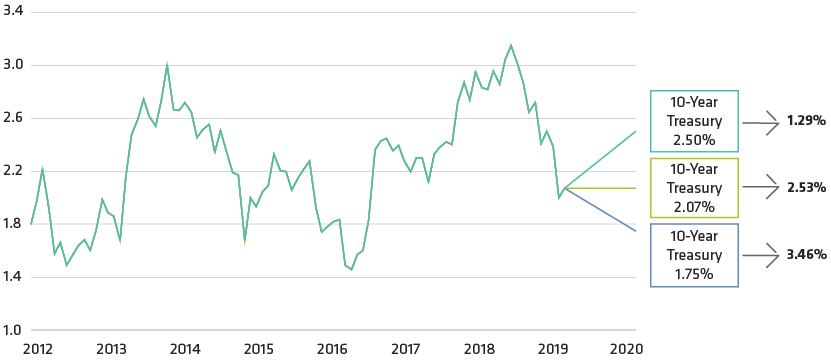

Expected 12-Month Municipal Returns Scenario Analysis

10-Year US Treasury Yield (Percent)

Historical analysis does not guarantee future results.

Display reflects expected return of a 5.4-year-duration intermediate municipal portfolio under three scenarios: 10-year Treasury yields rise to 2.50% over the next 12 months, remain the same or decline to 1.75% over the next 12 months.

As of July 26, 2019

Source: Bloomberg and AB

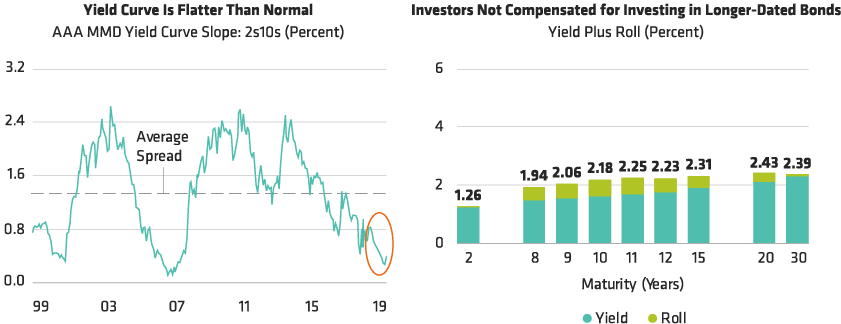

It Doesn’t Pay to Venture Out on a Flat Yield Curve

Historical analysis does not guarantee future results.

2s10s Slope can be calculated by subtracting the yield of a 2-year AAA muni from the yield of a 10-year AAA muni

As of June 30, 2019

Source: Municipal Market Data, US Treasury and AB

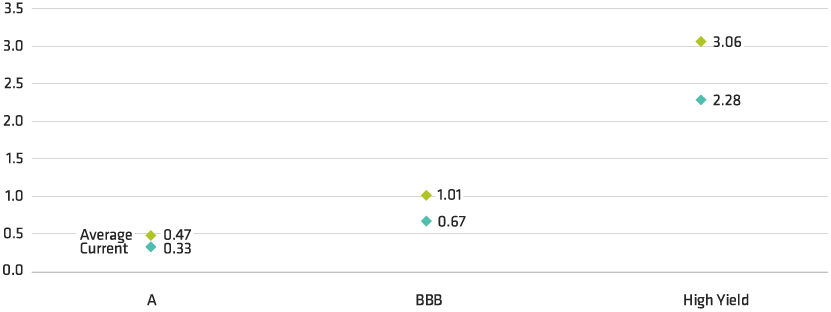

Mid-Grade Muni Credit Spreads Are Closer to Fair Value

Spread (Percent)

As of July 26, 2019

Source: Bloomberg, Municipal Market Data and AB

About the Author