Just as importantly, many energy companies are adapting for the future. The United States is becoming a net exporter of natural gas, which should help alleviate the domestic overabundance that has weighed on prices. Energy companies are also investing in pipelines that will lower costs in the long term. Finally, the industry is consolidating, which could create even stronger companies going forward.

How Troubling Are These Oil Prices?

It’s unsettling to be invested in energy bonds when oil prices drop. But the important thing to consider is whether the decline represents a long-term shift in the global energy regime or a spate of volatility. Today, we believe it’s the latter.

After a long run-up in 2018, global oil prices hit a four-year high on October 3. They began falling amid general market jitters over the direction of global growth, US dollar strength and stock market weakness. Tensions among Europe, the United States and Saudi Arabia over the murder of a journalist at the Saudi Embassy in Turkey deepened the downward pressure.

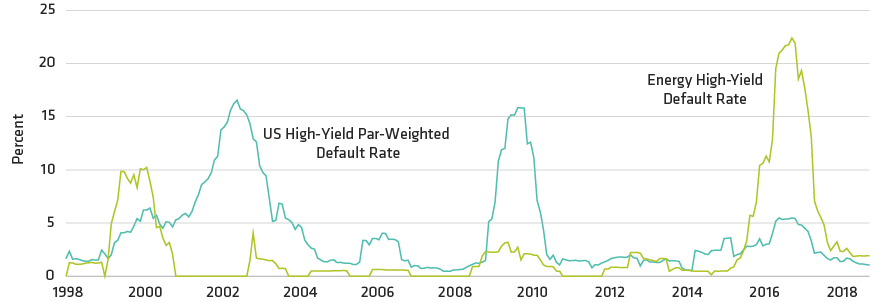

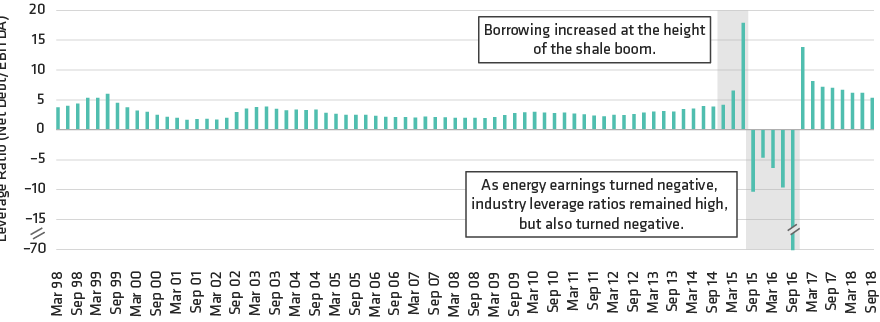

Geopolitical trouble and complex economic concerns are everyday fodder for oil markets, unlike what happened in 2014. In October of that year, it became clear that Saudi Arabia was no longer willing to act as the world’s swing producer.

While there have been murmurs about a potential surplus in 2019, price declines are unlikely to be as severe or prolonged as when Saudi Arabia dug in its heels four years ago. And having cut costs, most high-yield energy issuers can remain profitable even if prices dip a bit lower. Besides, supply is only one half of the price equation. Global demand should rise over the next few decades as the middle-class expands in India and China.

The fact is, energy is one of the most attractive sectors for high-income investors, as spreads don’t yet reflect the industry’s progress in fixing the problems that had brought it to its knees. The spread on energy bonds on November 8 was 432 basis points, compared to 336 basis points for the rest of the high-yield market.

Speaking of the rest of the high-yield market, however, most issuers in other sectors would welcome lower oil and gas prices. It’s true that energy comprises a relatively large part of the high-yield universe at some 15%, but high-yield investors must consider that the effects of commodity price movements on their portfolios are likely to be complex in nature.

Even for investors with significant energy exposure, today’s volatility will likely prove to be little more than noise–provided they take the time to research which issuers are financially sound, have high-quality assets and are making smart investments for the future.