Can, Should, Must

Are You Ready for Client Reactions to New MSRB Rules?

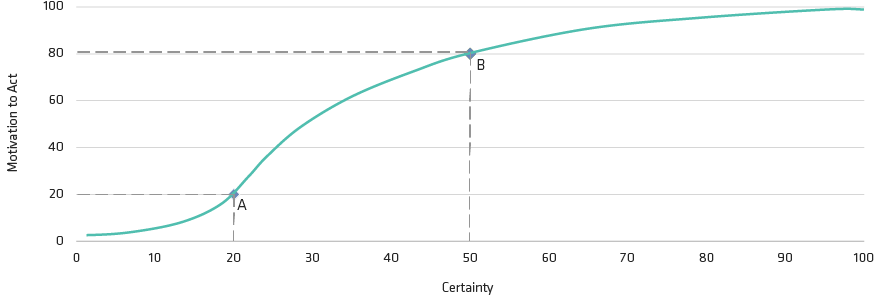

For illustrative purposes only

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Kenneth Haman is the Managing Director of the AB Advisor Institute (AB AI). AB AI provides insights from the behavioral sciences, including behavioral finance, to client-facing financial advisors to improve their marketing outreach and relationship-building efforts with investors. Haman began his current role at AB in 2005. Prior to this, he managed a psychotherapy practice in the Washington, DC market for 20 years. Haman holds a BA in business administration from Lebanon Valley College; an MDiv from Princeton Theological Seminary; an MAPC from Moravian College; and certifications in clinical hypnosis and neuro-linguistic programing from the American Hypnosis Training Academy. Location: Nashville