“Did you hear the news? We just got a new client—Jane Smith—$6.8 million, moved from XYZ Advisors.” As financial advisors working in a highly competitive space, these are words we don’t often get to say.

According to recent research from Barron’s, over one million people now have $5 million or more in wealth.1 That sounds like a lot of potential clients. So why is it hard to land a new high-net-worth client?

The answer is partly because, to coin a phrase, “there are plenty of other fish in the sea.” According to FINRA, in 2016 there were close to 636,000 registered representatives. And as you would expect, most high-net-worth individuals already have a financial advisor—even among millennials, 65% of those in the high-net-worth category work with an advisor.2 So, given this highly saturated marketplace, how can you stand out from the crowd?

Client Needs Evolve with Time and Wealth

Many advisors are good at focusing on the “bottom line”—reporting to clients on a regular basis about how their portfolio performed over a given period of time. Some advisors have even mastered the art of checking in regularly. But few have stopped to think about what their clients really require, and how that changes as they get older and wealthier.

Pain Over Pleasure

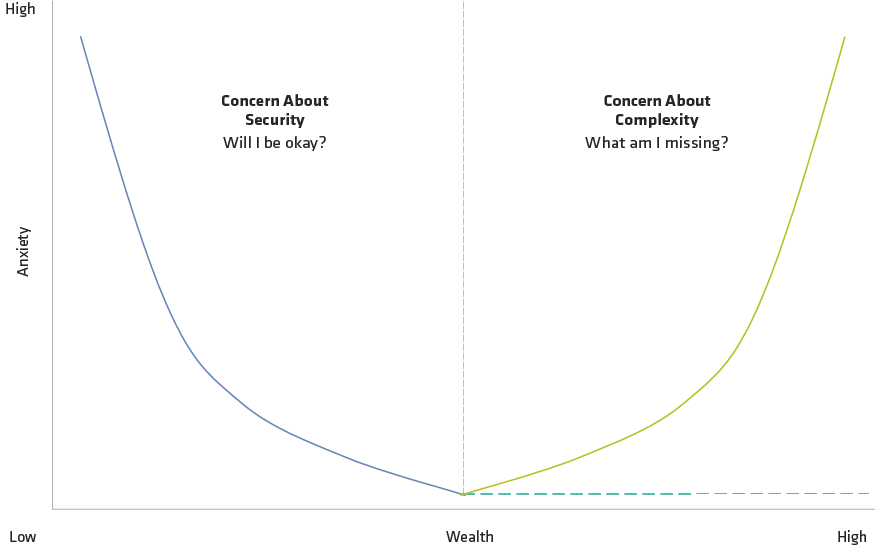

I like to think about age and wealth in relation to anxiety or distress. Research shows that pain is nearly three times more motivating than pleasure. That means people are significantly more motivated to reduce or avoid pain than they are to achieve pleasure. This insight helps us understand how to give clients what they really need: more than just helping them achieve pleasure, like making more money or increasing the value of their portfolios, the simple answers, we should consider what pain our clients are hoping to avoid.

“Will I Be Okay?” vs. “What Am I Missing?”

Figuring out what clients are trying to protect themselves from depends on where they lie on the wealth/age timeline. Before a client is financially secure, her primary pain or anxiety (Display) is focused on answering the question “Will I be okay?” She hopes that by hiring an advisor she’ll avoid the pain of running out of money during retirement. What she really needs is an advisor who can safeguard and grow her money.