2025: Lessons on the Value of Proactive Tax Management in Muni SMAs

What You Should Know

Munis are prized for their tax efficiency, but AB’s proactive tax management may unlock even more value for investors in separately managed accounts (SMAs). We believe systematic, year-round tax-loss harvesting is essential, especially in volatile markets like 2025. It’s been a case study in why waiting until year end to “rush” to market may not be enough.

2025: A Case Study in Volatility…and Missed Tax-Loss Harvesting Opportunity

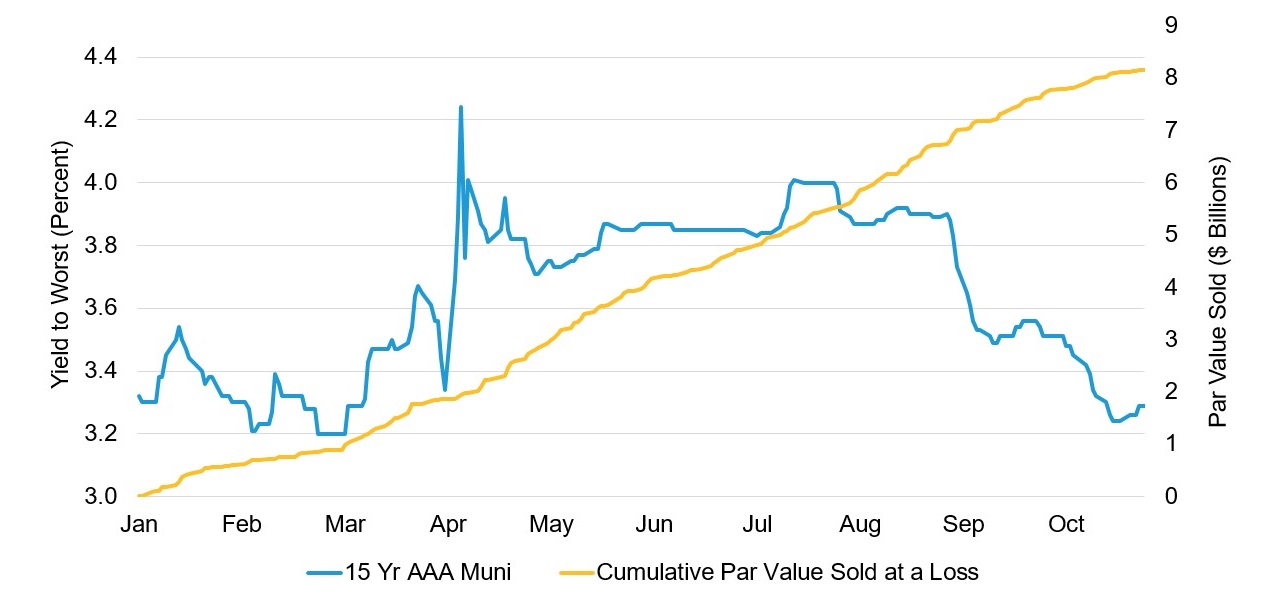

- Fifteen-year municipal bond yields started 2025 at 3.27%, soared to 4.24% by mid-April because of elevated supply and tariff-related volatility, dropped back to 3.71% in early May, then climbed once again to 4.00% in late July. These sharp moves in interest rates presented several opportunities for managers to harvest losses and create tax savings for clients.

- Since the beginning of August, muni yields have dropped by 69 basis points and were at 3.29% as of October 31. That strong rally boosted muni bond prices and erased nearly all tax-loss harvesting opportunities for the year.

- There’s a key lesson for investors. Interest rates move throughout the year, and those who wait until year end to harvest tax losses may find there’s nothing left to harvest. With portfolio losses erased, the likelihood of a bigger tax hit is looming.

Why Many SMA Managers Miss the Harvest

- Many SMA managers harvest losses only at year end, missing opportunities created by market volatility. Manual, infrequent or unsystematic approaches aren’t dynamic enough to capture opportunities when they emerge.

- Many SMA managers aren’t proactive—they put the burden on the client and financial advisor to suggest tax-loss sales. This process can be inflexible and time-consuming, and it ignores important considerations.

- Harvesting losses is easier said than done—technology, expertise and scale matter. Managers need sophisticated tools, robust processes and market experience to generate attractive tax losses across a platform of custom SMAs.

AB: The Power of Proactive Tax-Loss Optimization

- AB engages in tax-loss optimization year round, not just at year end. Our proprietary AbbieOptimizer® portfolio-management engine systematically screens portfolios for opportunities tailored to each client’s tax rates and holdings.

- In 2025, AB has delivered tax alpha for our clients on average, ranging from 25-50 basis points through October. That’s a real, quantifiable benefit that can offset gains taken elsewhere in client portfolios and help reduce their tax burden.

The Value of AB’s Tax-Loss Harvesting Approach

- Real-time tax analysis tailored to clients: AbbieOptimizer enables dynamic, year-round tax-loss harvesting opportunities.

- Impressive scale and consistency: AB has traded over 500,000 tax lots in the past four years, benefiting tens of thousands of customized SMAs.

- Proactive, research-based process: The devil is in the details when it comes to tax management. A dynamic process with intensive scrutiny of every harvesting decision can make the difference.

AB’s Proactive Tax Optimization Process: Robust Factors of Consideration

- Tax Benefit: Calculated as the tax-lot capital loss multiplied by a client’s respective tax rate. A higher tax benefit makes a security more attractive to sell.

- Relative-Value Framework to Assess Market Replacement Opportunities: Our proprietary quantitative model compares the value of a bond in a portfolio with real-time market opportunities. The goal is to increase the portfolio’s expected return by harvesting a tax loss and reinvesting in a bond with a higher expected return. The bigger the increase, the more attractive it is to sell.

- Market Liquidity/Transaction Costs: These factors are especially critical when markets are volatile. AB calculates transaction-cost matrices based on real-time liquidity and bonds’ distinct characteristics such as size, credit rating and duration profile. A higher transaction cost makes a security less attractive to sell.

Demonstrated results: Through October 31, AB has proactively harvested over $8 billion in par value in 2025, driving incremental after-tax returns in client portfolios (Display).

AB Uses Proprietary Technology That Seeks to Deliver Enhanced Tax Outcomes

AB Muni SMA Tax Optimization Results: Year to Date 2025

Past performance does not guarantee future results. For illustrative purposes only. There is no guarantee any investment objective will be achieved.

The information and performance shown are for illustrative purposes only and do not represent the outcome of a specific AB strategy or service.

As of October 31, 2025

Source: Municipal Market Data and AllianceBernstein (AB)

Takeaway—It Pays to Be Proactive: We believe investors should demand proactive tax optimization from their fixed-income managers. Systematic, tech-driven tax-loss harvesting has the potential to deliver tangible value; in contrast, waiting until year end could mean missing out entirely. AB’s approach helps ensure that clients capture opportunities as they emerge. It’s designed to maximize after-tax results in any market environment.

Source for 15 year Municipal Bond Yield: Municipal Market Data (MMD)

AbbieOptimizer (Pat. No. 11,550,824) is AB’s proprietary and patented portfolio-construction engine.

There is no assurance that a separately managed account will achieve its investment objective. Separately managed accounts are subject to market risk. The market values of securities owned will fluctuate so that your investment, when redeemed, may be worth more or less than its original cost.

Tax-Loss Harvesting (Tax Alpha) Disclosure: AB employs a tax-loss harvesting program within its separately managed accounts. This may be achieved through screening for unrealized losses within portfolios and comparing the benefit of selling (tax benefit) relative to the cost of selling (estimated market transaction cost). AB’s tax-loss harvesting algorithm considers other factors as well such as tax drag on positions, considerations around replacement bonds and step-out custodial ticket charges if applicable.

The tax-loss harvesting program is run based on Portfolio Management discretion. Whether the algorithm is run on a given day is dependent upon a number of factors including market liquidity conditions, portfolio cash levels, anticipated future active investment decisions within portfolios or strategies, among other considerations. While AB does anticipate regular tax-loss harvesting via this program, AB does not guarantee a minimum frequency of tax harvesting within the program overall or an account specifically.

Should portfolio management deem it appropriate to run the tax-loss harvesting program on a given day the algorithm recommends a list of suggested sales. These can be executed on a discretionary basis. AB has controls in place when executing trades to ensure the anticipated tax benefit evaluated by the algorithm is in-line with market executable levels; this is controlled via upper and lower limit prices on tax-loss harvest sales. Market execution of a suggested tax-loss sale is not guaranteed; intraday market movement, changes in liquidity conditions, inability to execute within limits, trader discretion, among other factors may result in non-executed tax-loss harvesting trades.

On an ongoing basis specific accounts are evaluated for eligibility to participate in the tax-loss harvesting program. Specific accounts or positions may not be eligible for the tax-loss harvesting program based on a number of factors. This includes missing cost basis data, availability of other evaluated data and decision analytics, portfolio positioning relative to portfolio-management targets, account tradeable status based on position reconciliation or client directed freeze, among other factors.

Tax alpha, or the additional return generated from active tax management after-tax, will differ among strategies, portfolios and market environments.