Q1 2024

Capital Markets Outlook

Highlights

- Macro

- Rates

- Credit

- EMD

- Equity

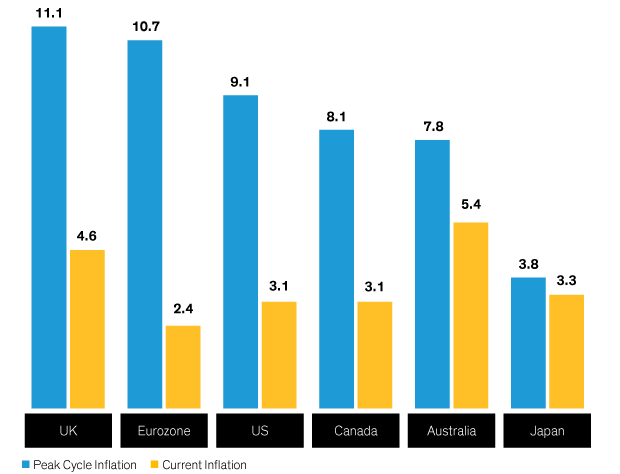

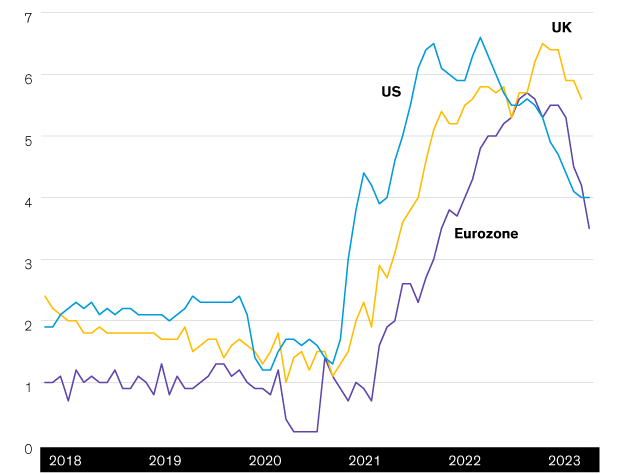

As of November 30, 2023 (except Australia headline inflation, which is as of September 30, 2023)

Source: Bloomberg, Federal Reserve Bank of Atlanta, Office for National Statistics and AB

As of November 30, 2023 (except Australia headline inflation, which is as of September 30, 2023)

Source: Bloomberg, Federal Reserve Bank of Atlanta, Office for National Statistics and AB

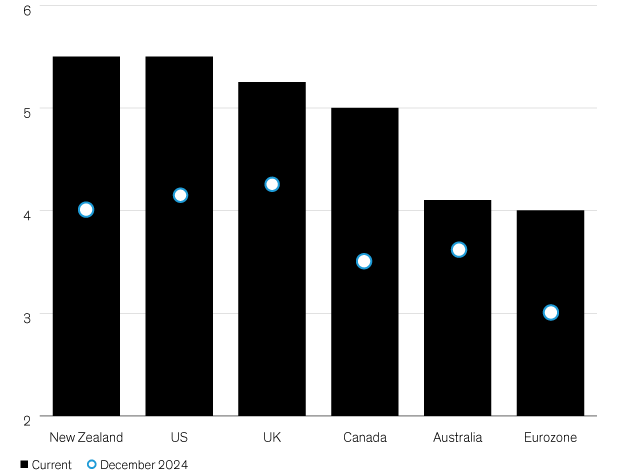

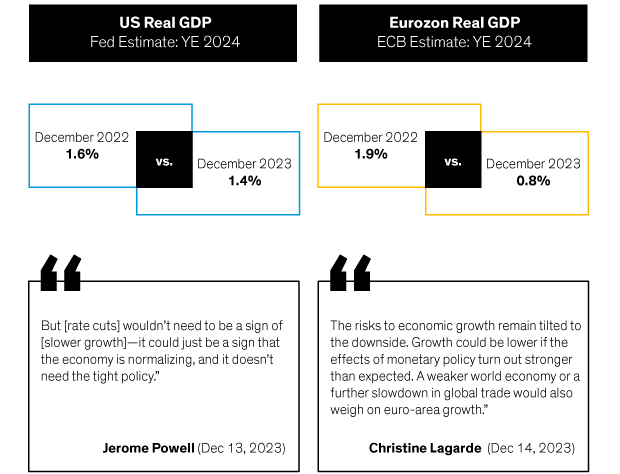

As of December 31, 2023

Source: Bloomberg, European Central Bank, Goldman Sachs, US Federal Reserve and AB

As of December 31, 2023

Source: Bloomberg, European Central Bank, Goldman Sachs, US Federal Reserve and AB

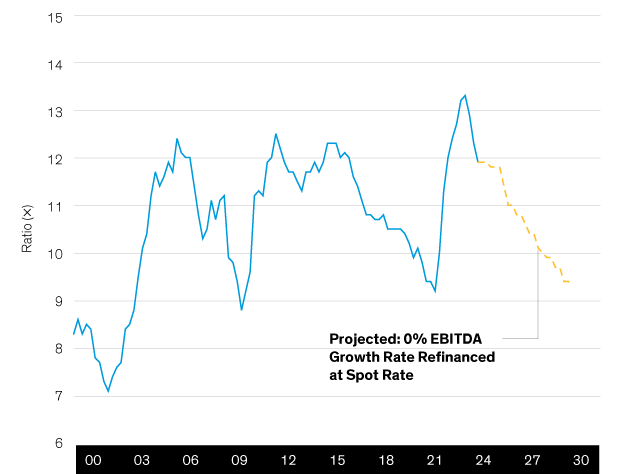

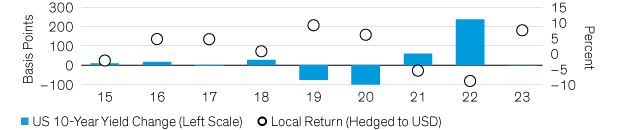

As of September 30, 2023

Source: Bloomberg, Morgan Stanley and AB

Through December 31, 2023

Source: Bloomberg, Morgan Stanley and AB

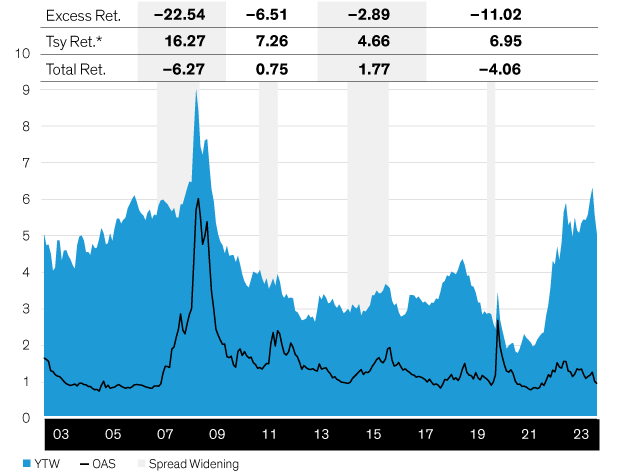

As of December 31, 2023

Source: Bank of America, Bloomberg, J.P. Morgan and AB

As of June 30, 2023

Source: Bank of America, Bloomberg, J.P. Morgan and AB

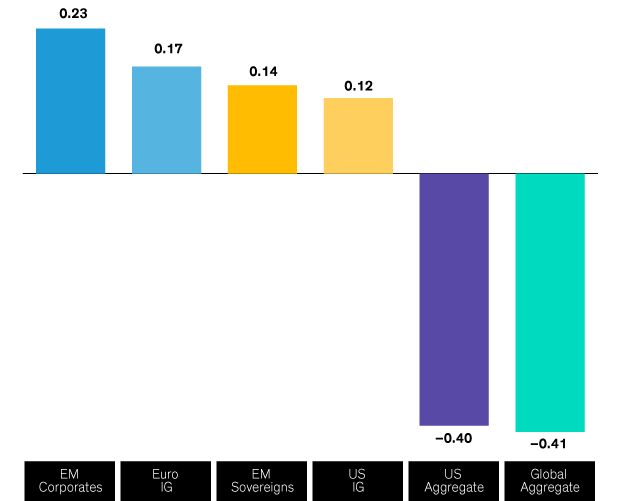

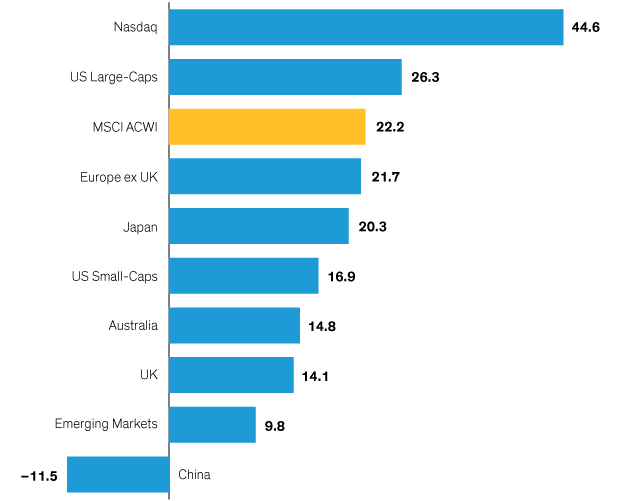

As of December 31, 2023

Source: Bank of America, Bloomberg, J.P. Morgan and AB

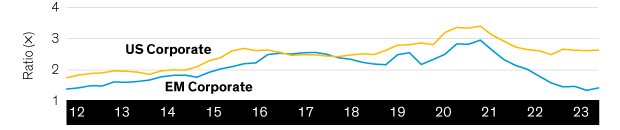

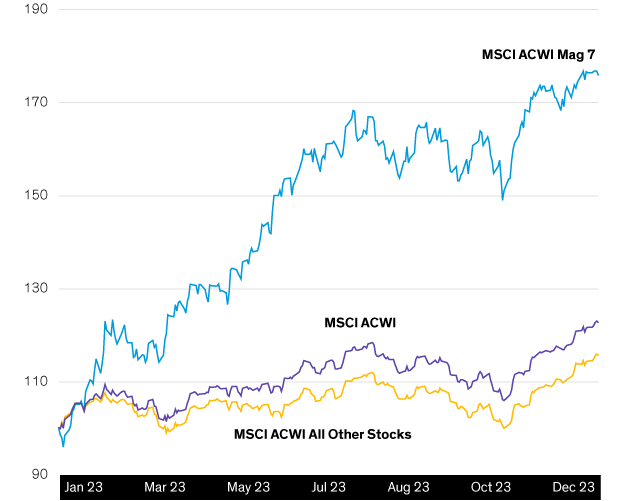

As of December 31, 2023

Source: FactSet, FTSE Russell, International Data Corporation, MSCI, S&P and AB

As of December 31, 2023

Source: FactSet, FTSE Russell, International Data Corporation, MSCI, S&P and AB