-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Can Investors Make Money in a US - China Trade War?

Mar 22, 2018

4 min read

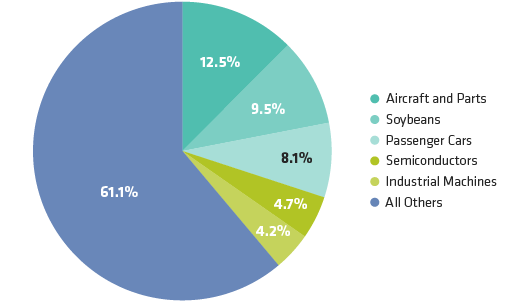

What Does China Import from the US?

As of December 31, 2017

Source: US Census Bureau and AllianceBernstein (AB)

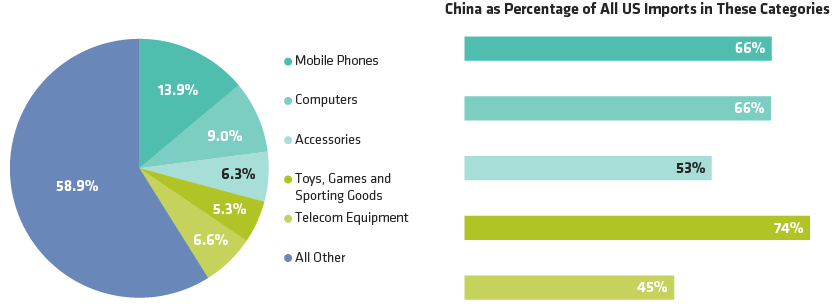

What Does US Import from the China?

As of December 31, 2017

Source: US Census Bureau and AllianceBernstein (AB)

-

Identify the most vulnerable products, industries and companies

-

Find companies that could actually benefit from trade war fallout

-

Look for specific targeted areas in which one country may have leverage over another

About the Authors