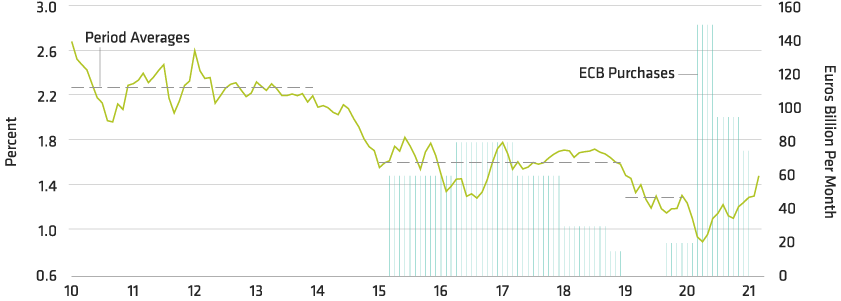

The European Central Bank’s (ECB’s) reaction function has become increasingly vague, almost deliberately so. But one thing is certain: it will continue to push back against any near-term increase in bond yields.

Last week, the ECB promised faster bond purchases to prevent a premature tightening of financial conditions. This unexpected move sent a strong signal: the central bank is determined to keep euro-area bond yields from rising at a time when US yields are under upward pressure.

Investors Need More Clarity… but Officials Aren’t Delivering

The ECB Governing Council (GC) did not, however, specify how many bonds it plans to purchase. And it continued to define financial conditions in a fuzzy and confusing way—although the GC prefers the terms “holistic” and “multifaceted.” Indeed, ECB President Lagarde muddied the water further by talking about the “upstream stage” and “downstream aspect” of the monetary-transmission process.

Fortunately, we can cut through some of this obfuscation.

The ECB may prefer a holistic approach to financial conditions, but it’s clear that the most important variable to focus on is the risk-free interest rate. In the past, this might have referred to the ECB’s refinancing rate; today, it’s the whole of the euro-area yield curve—as measured by weighted-average sovereign-bond yields or overnight-index swap rates.

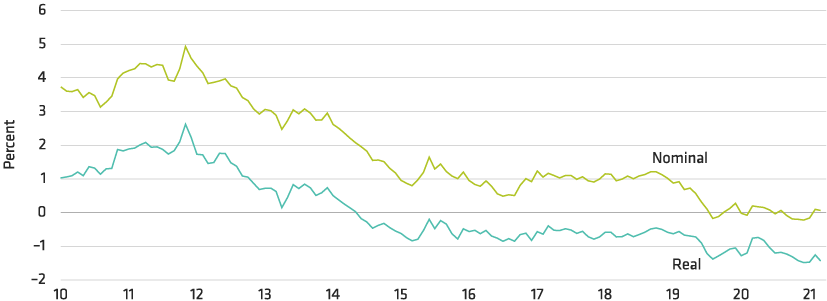

Still, it’s unclear whether the ECB thinks about the risk-free interest rate in real or nominal terms—an important distinction that has split the GC. At the heart of this divide is a difference of views over the efficacy of monetary policy.

Members of the GC who think monetary policy can still play an active role in lifting inflation believe that policy is still not loose enough. They argue that higher nominal yields should be resisted even if inflation expectations start to rise (which would lead to lower real yields and a more expansionary policy). Executive Board member Fabio Panetta recently expressed this view forcefully.

Other GC members fear that the ECB is approaching the limits of monetary-policy effectiveness and are increasingly worried about adverse side effects. This group are comfortable with rising nominal yields as long as this is preceded by higher inflation expectations (keeping real yields and the monetary-policy stance unchanged).

Monetary Policy: Intensity Versus Duration

Executive Board member Isabel Schnabel recently touched on this difference of approach when she spoke about the “intensity” and “duration” of monetary-policy stimulus. This is a useful way of thinking about the ECB’s current dilemma. Should the GC use an increase in inflation expectations as an opportunity to increase the intensity of its policy stimulus? Or should it play a more patient game and focus on the duration of extraordinary policy support?

Were Mario Draghi still president of the ECB, we might already know the answer to this question—history suggests that he’d come down in favor of the intensity camp and look to drive the rest of the GC in the same direction. But Christine Lagarde is now in charge, and she favors a more consensual approach. As a result, we may not know the answer to the real versus nominal (or intensity vs. duration) debate until later this year, when the ECB publishes its monetary-policy strategy review.

Until then, there are two routes forward. One is for the ECB to resist any increase in nominal yields. The other is to focus on real yields and adjust the appropriate level of nominal yields for changes in inflation expectations—we could call that approach dynamic yield-curve control. Philip Lane, the ECB’s Chief Economist, hinted at this approach in a recent Financial Times interview.

Dynamic Yield-Curve Control

In recent weeks, euro-area inflation expectations (as measured by the 5-year/5-year inflation swap) have risen to 1.5%, helping keep real yields within a few basis points of record lows despite higher nominal yields (Display, below). If the ECB’s current focus is on real yields, which we suspect it is, then the GC shouldn’t be unduly concerned by these developments.