-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Volatility Is Back—And That’s a Good Thing for Active Management

Large-Cap Blend Managers Beating S&P 500, Rolling Three Years

From December 31, 1992, through December 31, 2016

Historical analysis does not guarantee future results. An investor cannot invest in an index.

Represents the percent of mutual funds in the US Large Blend Morningstar category outperforming the S&P 500 on a rolling threeyear basis with a monthly step The data include active mutual funds only.

Source: Bloomberg and Morningstar Direct

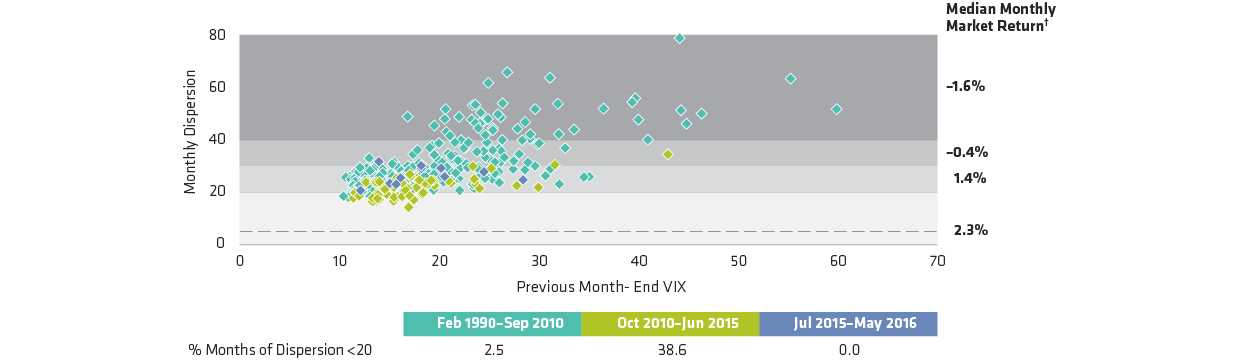

Monthly Stock Dispersion* vs. Level of VIX (Percent)

As of May 31, 2016

Historical analysis does not guarantee future results. An investor cannot invest in an index.

*Dispersion is cross-sectional standard deviation of monthly returns.

†Median monthly return of the S&P 500

Source: Bloomberg, Chicago Board Options Exchange, eVestment, MSCI, S&P and AllianceBernstein (AB)