Investors can’t usually see the sales mix effect. Few companies provide enough detail on how sales are generated to evaluate the mix. For instance, even when Apple reported smartphone unit volumes in the past, it did not disclose sales volumes by phone model. With good (or bad) mix trends potentially lasting for years, both investors and companies may lose perspective on what a normal sales mix is. It’s also difficult to disaggregate productivity gains (which theoretically are structural) from mix improvements (which can have limited life-spans).

Since the Great Recession, the sales mix of many companies has benefited from monetary policy, in our view. Central banks’ low interest rates have driven a consumer-lending boom. This has enabled consumers to buy products and services that they might not be able to afford without financing. As a result, we think excessive monetary liquidity has likely inflated demand volumes across many industries. This possibility implies that if conditions normalize the risk to many companies’ financial performance is greater than many realize.

Will Car Buyers Downshift from CUVs?

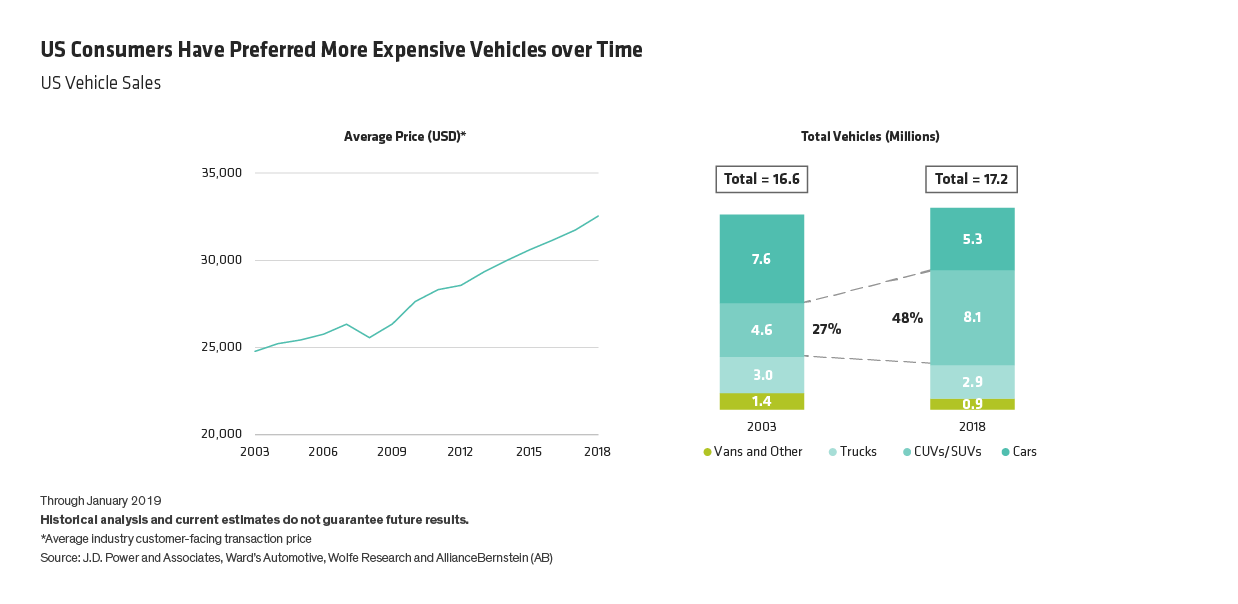

For example, look at the automotive sector. Cheap financing has helped US automakers persistently increase the combined share of trucks, crossover utility vehicles (CUVs) and sport utility vehicles (SUVs) (Display, right). Driven by surging CUV demand, the share of cars has never been lower.

It’s easy to understand why automakers prefer to sell larger vehicles. In 2018, US consumers paid more than $32,000 on average for vehicles (Display, left). For large pickup trucks, the average was $44,000—about 75% of the median annual household income. Midsized SUVs sold for an average of about $35,000, while midsized cars and compact cars sold for $23,300 and $19,000, respectively. As a result, some automakers are significantly scaling back their exposure to the lower-margin compact car/sedan segments of the passenger vehicle market. This shift implies returns are better on larger vehicles and that companies believe the current vehicle production mix is sustainable. If it isn’t sustainable, they’ll need to scramble to adjust their product mix and production footprint to produce more lower-return vehicles.