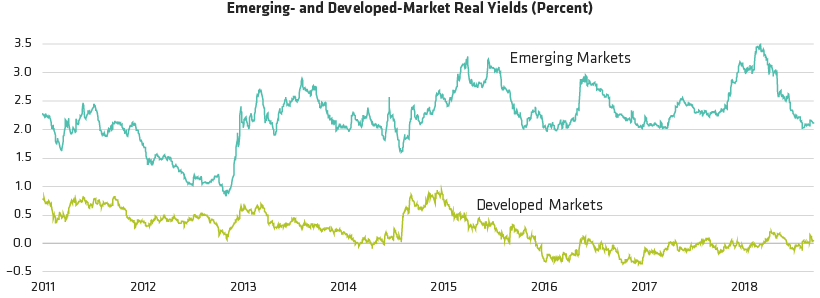

Meanwhile, investors can earn substantially higher yields on dollar-denominated EM investment-grade bonds—both sovereign and corporate—than they can on US debt of comparable credit quality. And anyone with high income needs should note that EM high-yield sovereign bonds have rarely traded at a higher premium to US high-yield corporate bonds.

Many EM currencies are still attractively priced, too. And they could benefit if the US dollar, which has been overvalued on a long-term basis, starts to weaken now that the Fed has said it won’t raise rates again this year.

Finally, the supply/demand dynamics still favor investors. Net issuance of EM sovereign and corporate debt has been light this year, while demand from investors eager to get in on the EM rally has increased. That is likely to be supportive of asset price performance.

An Active Approach Is Essential

Of course, with assets having come so far so fast this year, finding significant alpha opportunities means investors will have to be selective. There’s still variation in macroeconomic stability, governance and fiscal policy among countries.

For example, we worry about Mexico’s ability to balance its dual aims of maintaining fiscal conservatism and increasing social spending programs. This is a concern because PEMEX, the state-owned oil company, suffers from weak fundamentals and will likely require government support.

We’re more optimistic about Brazil, where a new government is pushing an ambitious agenda of privatization and pension reform and is trying to reduce bloated public-sector debt. But political infighting illustrates how challenging it will be to make these plans a reality. While we expect Congress to pass some reforms, they may get watered down.

Earlier this year, we thought investors in Argentina were too complacent about political risk. Now we think the recent sharp widening in spreads on dollar-denominated bonds has been exaggerated, creating opportunities for investors. While economic data has disappointed so far this year, we still expect President Mauricio Macri or another centrist candidate to win the presidential election this fall, an outcome that would keep market-friendly policies and a major IMF financing deal in place.

In Turkey, last year’s stark currency depreciation helped turn a current account deficit into a surplus. But there are still concerns about the central bank’s commitment to tackling inflation and the government’s vague economic plan. A recent decision to cancel the results of a local election in Istanbul have added to the uncertainty. We think the authorities still have work to do to regain the market’s confidence.

Other potential hurdles for investors this year include a full calendar of important national elections with the potential to move asset prices (India, South Africa, Argentina) and geopolitical risk, including the possibility of additional sanctions on Venezuela and Russia.

The bottom line: investors must do their homework, even when it comes to countries with solid fundamentals and the right policy priorities. But the global macroeconomic conditions—decent growth, accommodative monetary policies—are good for EMD, and the a renewed bout of trade-induced volatility should provide opportunities for discerning investors to add risk at attractive prices.