-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

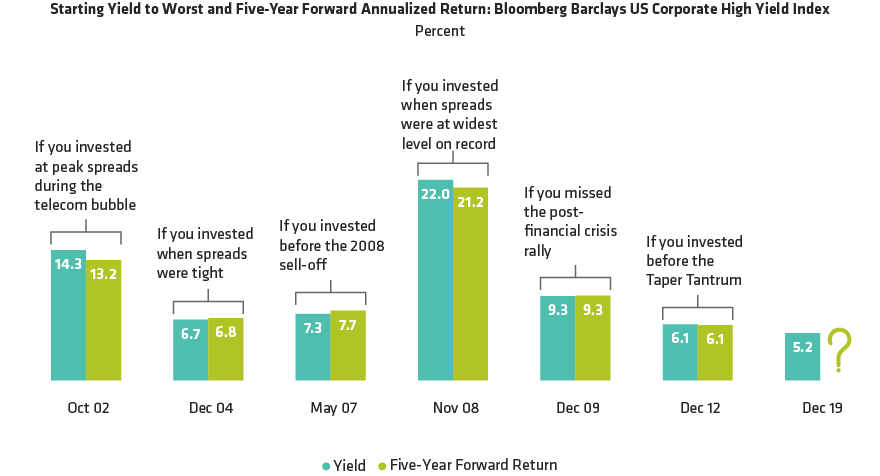

Are High-Yield Returns Predictable? Key Metric Suggests Yes

12 February 2020

1 min read

Starting Yield Has Been a Reliable Indicator of Future Returns

As of December 31, 2019

Historical and current analyses and forecasts do not guarantee future results. An Investor cannot invest directly in an index, and its performance does not reflect any fees and expenses or represent the performance of any AB fund.

Source: Bloomberg Barclays and AllianceBernstein (AB)